[ad_1]

The DollarsAndSense editorial team sees more and more personal loan articles and advertisements. On the surface, don’t be too surprised. The current market conditions are ripe for more people to take out personal loans.

Persistent high inflation is driving up prices for food, utilities and healthcare. Rising interest rates to combat inflation have led to an increase in monthly mortgages and car loans. As a result, the global economy is also on the brink of recession, further increasing financial uncertainty and pressure. Already, many companies are cutting staff in the name of cutting costs.

With the cost of living rising and economic uncertainty increasing, some people are finding themselves short on cash and potentially needing to resort to personal loans.

Read also: 4 reasons why Singapore is the most expensive city in the world

Should personal loans be marketed so aggressively?

The point of marketing a product or service is to create awareness so that consumers understand it and ultimately purchase it. In this regard, all businesses, including personal loan payments, should be able to sell their products and/or services.

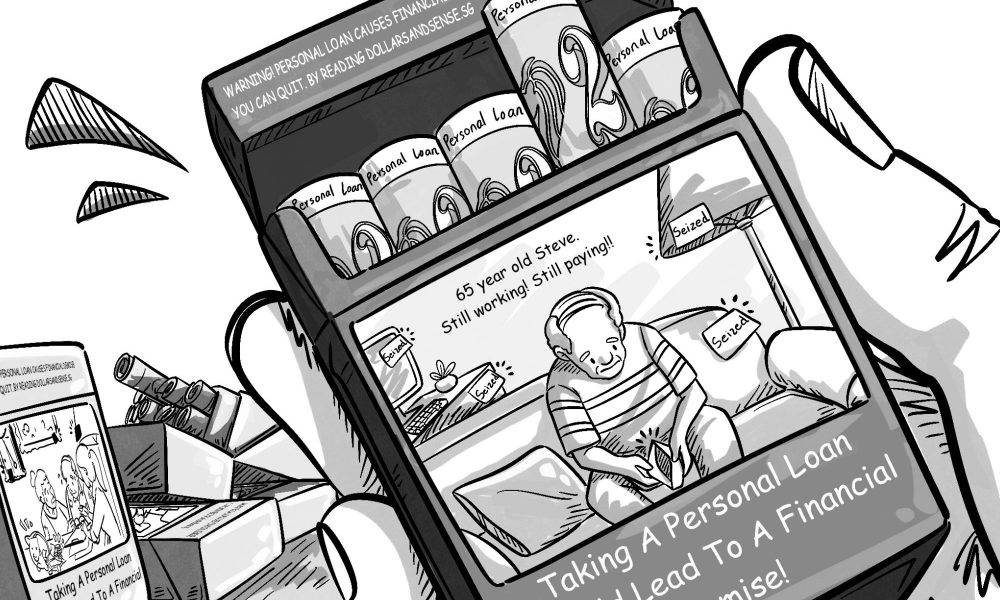

This is reinforced by the fact that there are no laws in Singapore that explicitly regulate the advertising industry. However, frameworks already exist to restrict or limit the promotion of certain types of products and services, such that tobacco promotion is not seen today.

Specifically, tobacco and other types of tobacco products are regulated under the Tobacco (Advertising and Sale Control) Act. Among other restrictions, the law restricts packaging of tobacco products, requires warning notices, prohibits on-site display of products, and prohibits offering other products as giveaways during sales. .

Also read: Price Transparency Guidelines: 4 “Strategies” Businesses Should Avoid When Violating the Consumer Protection (Fair Trade) Act (“CPFTA”)

Tobacco products are not the only type of product with restrictions. A quick Google search reveals the wide variety of restrictions placed on various types of products in Singapore, including alcohol, gambling, casinos, gambling dens, medicines, sugary drinks, and even politics, divination, and feng shui. increase. .

After reading this list, it’s easy to understand why certain categories of products and services have advertising restrictions. Similarly, it’s clear why we can’t look at products like personal loans in the same way we see shoes, food delivery services, cell phones, or even credit cards.

The difference between encouraging people to apply for credit cards and personal loans

Most of us can appreciate the idea that offering an incentive to individuals to buy jeans or a car is very different from offering an incentive to take out a personal loan. Buying a pair of jeans won’t lead to financial ruin. At best, you may regret buying clothes. For those who buy a car, there will be financial means to pay the down payment for such a luxury purchase in the first place.

Taking out a personal loan can lead to a much greater financial impact. Our finances can be affected in the long run if we are unable to repay our personal loans. For example, amounts that cannot be repaid can result in higher interest rates and additional charges. You may be left with a much larger debt than your original personal loan, and you may never be able to repay the loan.

People who are already so desperate that they might be tempted to take out a personal loan should not be given more incentives. Simply put, unverified marketing of personal loans can significantly degrade a person’s financial performance.

The concept of offering an upfront cash incentive to take advantage of financial instruments is also very common with credit cards. However, getting a credit card is not the same as getting a personal loan. Credit cards are a popular payment method that many people already use to make purchases online, in stores, or to pay for public transportation.

Personal loans are not something many of us use or think about on a daily basis. Given an upfront payment to apply for a credit card, many people think of optimizing their credit card usage. However, even with the same personal loan advance, the product will not be considered by anyone but the most vulnerable individuals. It would potentially push them into a poorer economic situation.

That said, personal loans are a useful product when used properly. When an individual needs a personal loan, they should seek out a solution or be advised to consider a solution instead of being offered a solution every day.

Practical reasons to take a personal loan (and why you shouldn’t think otherwise)

There are several reasons why personal loans are convenient for consumers.

if we You have existing debt, such as a credit card balance that charges exorbitant interest ratio. Currently, the interest rate on our unpaid amounts may exceed 25% per annum. Our research online shows that promotional interest rates for personal loans can still be significantly lower.

Still, you don’t have to resort to personal loans as your default option. In many cases, he can combine all his hard-to-pay debts into one financial institution and look for debt consolidation plans that offer similar interest rates to personal loans. Taking out a personal loan just adds another unsecured loan that we have to incur, possibly a loan with yet another financial institution that we have to deal with now.

Also Read: Struggling With Debt In Singapore? Here’s The Roadmap To Clearing Out Your Debt

A personal loan could come in handy if we favor business chance Short-term availability Personal loans can be repaid quickly in a short period of time, so business owners can benefit from such loans.

First, business owners who take out personal loans must be more adept at understanding the implications of such loans than consumers. Even so, he might be better off with a business-related loan, such as a working capital loan, trade finance, or even a P2P business loan. You can also talk to your business bank account representative about how long-term solutions can be advanced.

Also Read: The Complete Guide to Business Loans for Small Businesses in Singapore

Finally, regardless of what you read or sell online, personal loans should not be used for the following reasons.

– Home renovation or wedding costs (because these are known costs and should be saved to fit the budget or scaled back on repairs and travel plans)

– Emergency expenses (because you need to build an emergency savings fund for 3-12 months of expenses)

– Pay for vacations or buy a car (because you should live a lifestyle you can afford, not take out unnecessary loans to live a more luxurious and stressful life!)

– Invest (no need to say more as you can easily lose money)

As you can see, there are some practical reasons for using a personal loan. In most other scenarios, personal loans should not be considered.

Even in scenarios where a personal loan makes sense, it doesn’t necessarily have to be the default or best option. You should shop around to ensure you get the best deals. Most of the time the best deals are the lowest interest rates.

Also Read: Personal Loan VS Pawnshop: The Pros and Cons of Using Which Option

Listen to our podcast. Here you will find detailed discussions on financial topics that are important to you.

[ad_2]

Source link