[ad_1]

Wells Fargo & Co. is exiting its longtime industry-leading mortgage business, the bank announced earlier this week.

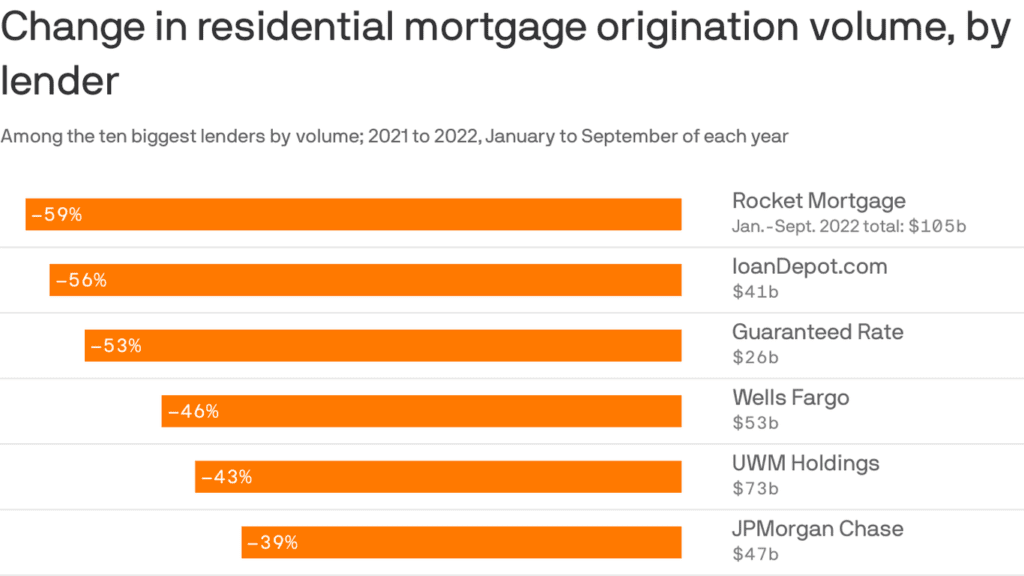

Important reasons: High mortgage rates have squashed demand for loans, and the biggest mortgage companies saw their business slump by eye-popping percentages last year.

State of play: Wells said it will continue its efforts to increase lending to black and Hispanic homebuyers, with a focus on providing mortgages to existing customers.

- “Mortgage is an important relationship product,” Consumer Lending CEO Clever Santos said in a statement. We have decided to continue to reduce

- The bank has scaled back its mortgage services portfolio and moved away entirely from “correspondent lending,” where it buys loans from smaller lenders.

Big picture: Banks have been out of the mortgage business for some time. The majority of mortgages today come from non-bank lenders such as Rocket Mortgage and LoanDepot.com.

- In 2010, only 10% of mortgages were originated by non-banks. By 2022, these companies accounted for 65% of the business, according to data from Inside Mortgage Finance.

- United Wholesale Mortgage, a Michigan-based public company that deals directly with mortgage brokers, has become the nation’s largest mortgage lender as of the third quarter of 2022, according to Inside Mortgage Finance.

- Fun fact: UWM CEO Matt Ishbia agreed to buy a majority stake in the Phoenix Suns last year.

[ad_2]

Source link