[ad_1]

Dive briefs:

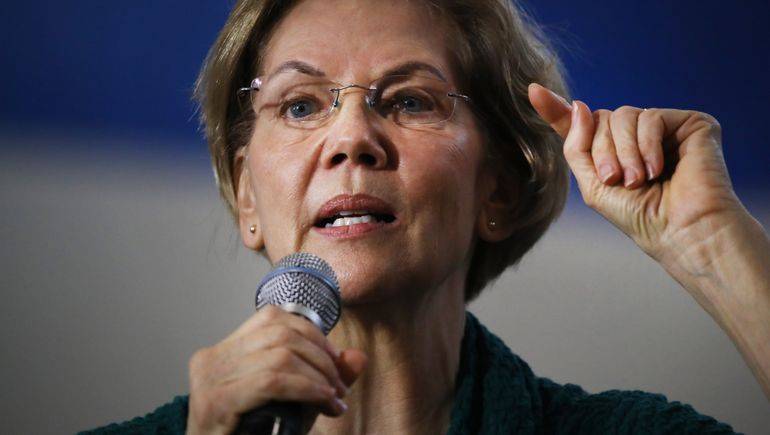

- Senator Elizabeth Warren (D-Massachusetts) on Wednesday lauded Securities and Exchange Commission Chairman Gary Gensler for trying to curb the cryptocurrency market, but regulators scrutinized the industry to combat fraud. said more needs to be done to strengthen

- in a speech at virtual event Warren, who is sponsored by the American Economic Liberties Project and Americans for Financial Reform, said the SEC also needed more help from Congress and called on other regulators to tighten enforcement in the digital assets sector.

- Warren, a vocal critic of the cryptocurrency industry, has previously called for the SEC to exercise more power over the sector. Here’s what she said: November editorial in the Wall Street Journalshe encouraged agencies to “suit up” in the fight against crypto fraud.

Dive Insight:

“The Commission is loud and clear that cryptocurrencies will not pass years of security laws that protect investors and ensure the integrity of financial markets,” Warren said Wednesday. “This is the right approach. The SEC has the right rules, the right experience, and Gary Gensler has proven to be the right leader to get the job done.”

Still, Warren added that regulators will need to “maximize their regulatory powers across crypto markets.”

The remark echoed Warren’s November op-ed in which she said the regulator failed to exercise its authority over the growing crypto industry.

“[P]”Water has no value if Beat cops don’t use it,” she wrote. However, it has fallen far behind as the crypto industry attracts millions of new investors.”

Warren said Wednesday that the SEC shouldn’t be solely responsible for combating crypto-related fraud, adding that the sector has been allowed unchecked growth under Trump-era regulators.

“Gensler faced the significant task of putting the genie back in the bottle and returning the crypto ecosystem to regulatory compliance after Trump regulators allowed it to explode,” Warren said. “The results of Trump’s regulatory weakness were not surprising. [were] scam. Over the next year, investors lost around $9 million to cryptocurrency scams every day. “

Warren called on banking regulators to step up their oversight in this area. Crypto-rich bank Silvergatewas forced to sell assets at a loss to cover about $8.1 billion in withdrawals this month after the collapse of crypto exchange FTX sparked a bank run.

“Our banking regulators are also part of this battle,” she said. .”

Warren also called on Congress to provide the necessary resources to ensure the SEC can regulate the cryptocurrency market.

“In this pocket of the market where regulators may not have the necessary powers, Congress needs to provide the tools to get the job done,” she said. Clearly, there are growing threats to national security in the dark recesses of the cryptoworld.”

[ad_2]

Source link