[ad_1]

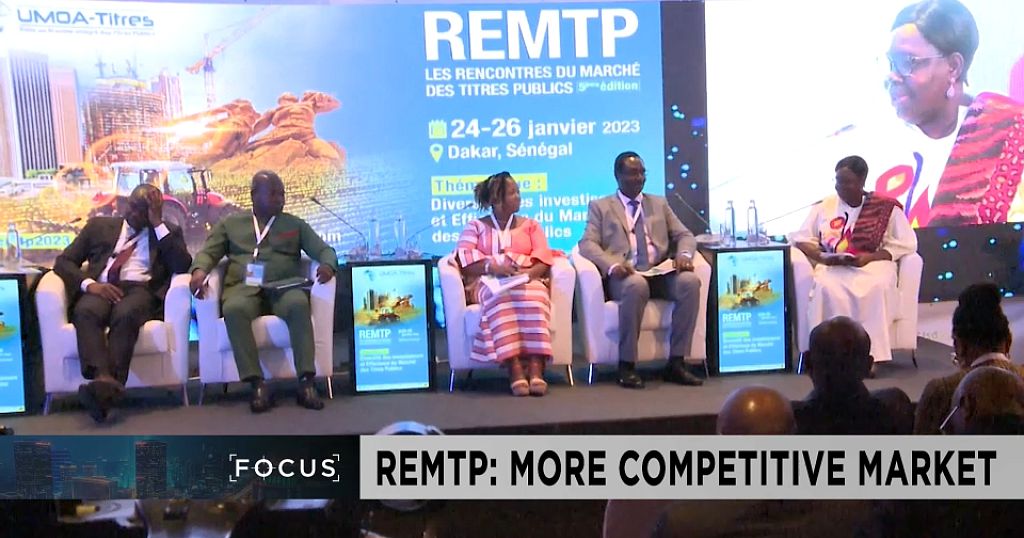

Dakar is a city in the midst of change. The capital hosted the second edition of its public securities market conference, which took place from January 24th to January 26th.

The forum focused on issues and challenges in the region’s sovereign debt markets with the aim of positioning the market as a true investment option.

To this end, WAMU-Securities and other financial market players advocate expanding public securities to new investors.

“We need to rely more on the market, especially since the external market is mostly closed,” Banassi Ouattara, Waemu’s acting vice president, quickly began.

“The Eurobond market is closed due to central bank policies that have been forced into effect. The expansion of also contributes to efficiency, as it provides a different strategy expression. I think that means a lot of trading in the market.”

Facilitating local economy financing

The forum consisted of three days of interaction under the theme of “Investor Diversity and Public Securities Market Efficiency”. Fundamentally, what major players say about how to boost local economy financing requires a paradigm shift, especially for financial inclusion.

“Unfortunately, despite being created in 1998, the financial market is still unexplained and no longer scares certain investors from different segments of the population,” said Societe Generale Senegal’s financial The service company’s general director, Harold Coffey, analyzed.

“I think everyone has a role to play – professionals, SGIs, SGOs. It’s also an aspect: inclusion, a much lower income, an unbanked population.

“I think it’s the combination of all these strong partnerships that allows us to have a broader base to more effectively collect the savings that exist in Africa,” Coffi concluded.

Financial markets remain essential in this quest to boost the economy. For example, WAMU-Securities facilitates communication between governments and investors.

Additionally, one of the highlights of the Public Securities Market Conference is the country focus. This is a forum for sharing experiences, but also for presenting progress and development projects to attract investors. It is a golden opportunity for a country like Burkina Fasoa, according to her Aminata Ouedraogo, Deputy Director General of the National Treasury of Burkina Fasoa.

“For us, this is very important because we started the program in question in 2023. First, we reassure investors to accompany us and share our issuance program. It was an opportunity, so for us this is a framework and we will be back to normal very soon.

WAEMU, a zone full of possibilities

Today WAEMU Zone offers a warranty. Huge economic potential, reassuring growth prospects, despite global and domestic crises. This is encouraging for investors like his FSD Africa, an institutional partner of WAMU-Securities. Funded by the UK government, this specialized development agency is committed to building and strengthening financial markets in Sub-Saharan Africa.

“Our presence here in Dakar will help us expand our network. It will also increase the number of institutional partnerships we can have. We will invest directly in companies. We have the opportunity to also provide technical assistance to businesses and governments across the continent, and we believe our presence will allow us to demonstrate all the financial products we offer.”

The crisis, which makes it increasingly difficult to access international markets, is forcing governments to adapt. Financial market players understand that economic sovereignty requires a broader investor base. For WAMU-Securities, the domestic market remains a credible alternative to making the economies of countries and communities more attractive.

[ad_2]

Source link