[ad_1]

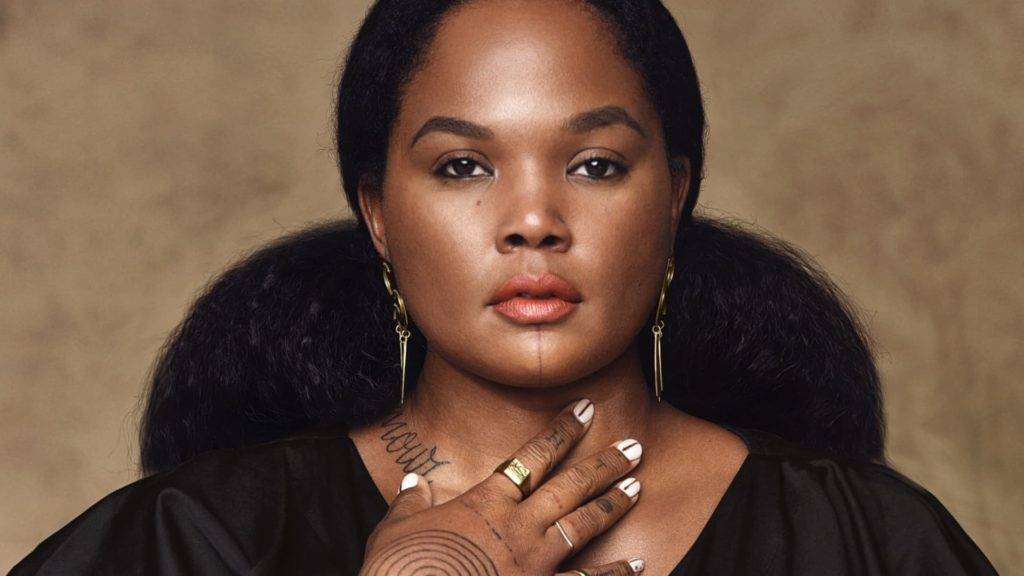

Bee Dixon, CEO and Co-Founder of The Honey Pot Company

Provided by: Honeypot Company

In 2016, Beatrice Dixon finally signed a deal the goal to carry her line of feminine care products. But she had her one problem. She was still making them in her home kitchen in Atlanta, so she had to scale up.

The CEO and co-founder of vaginal wellness brand Honey Pot Company, she faced the “impossible” task of launching in 1,100 stores and didn’t have the funds to hire manufacturers to fill retailer orders. I needed it.

She managed to secure critical funding from a foundation to support women entrepreneurs of color, and by 2017 she could quit her job, move operations out of the kitchen, and launch in Target stores nationwide. I made it.

Nearly six years later, Dixon’s products have become staples in retail stores nationwide.

“It was really hard. “I don’t know what would have happened without that money.”

Dixon is one of many black entrepreneurs who have struggled to secure funding for their businesses and have turned to venture capital funding allocated to diverse founders. While Dixon and many others ultimately found success, Black-led companies and Black founders have historically faced disparities in securing his VC funding.

Overall, according to Crunchbase data, Black entrepreneurs typically receive less than 2% of all VC dollars each year, while companies led by Black women receive less than 1%.

In the wake of the police killing of George Floyd and the ensuing racial justice calculus, black founders and black-led startups have made historic gains by securing VC funding in 2021. Of these gains, they will be gone by the end of 2022.

Crunchbase data shows that overall VC fundraising fell 36% in 2022 as inflation and interest rates surged, but funding to Black companies fell another 45%. This decline is the largest year-over-year drop black entrepreneurs have seen in the last decade.

“In 2020 and early 2021, there was a lot of political and cultural strife, and the focus was on black and diverse founders,” said Kyle Stanford, senior analyst at Pitchbook. Nobody wants it to be a reason to focus on investing in , but it has focused a lot on the issues VCs have invested in people other than straight white men.”

Marlon Nichols, co-founder and managing general partner of Mac Venture Capital, said a range of companies tend to bear the brunt of the VC slowdown, as they typically rely on the status quo during times of economic uncertainty. said.

“We’ve always invested in white men, and that’s what we’re going to do now. That’s where we’re comfortable. We believe we will get it,” says Nichols, who is Black, explaining the decisions some companies have made. “This diversity is great. If we survive this storm, we may be able to put it back together.”

So-called “risky bets”

In 2014, Dixon was working at Whole Foods and was suffering from an ongoing case of bacterial vaginosis she couldn’t shake. came to her, she said.

“She walked with me and said she had seen me in pain and knew how to fix it. He handed me a piece of paper and told me to remember what was written on the paper,” Dixon said, recalling his grandmother’s dream. And basically, this formula actually healed me.

A mixture containing ingredients such as lavender, apple cider vinegar, grapefruit seed extract, and rose has worked for her family and friends as well. and started exhibiting at the Expo.

Products of the Honeypot Company

Provided by: Honeypot Company

Using her connections at Whole Foods, she got her product on the shelves, but couldn’t really scale up and attract outside investors until she secured a deal with Target.

“It was hard. We were the founders of a black-owned business. Was it hard? Sure, it probably was,” Dixon said. “I think every time we raise money, we struggled to do it, but I think the key context to put there is that it’s not easy for anyone raising money.”

Nichols doesn’t exclusively invest in diverse businesses, but unlike other companies typically run by white men, Mac Venture Capital is led by a diverse team, which makes it one-size-fits-all. more likely than venture capitalists in the department.

“The investors are predominantly white men, and they are usually from wealthy communities. We are used to it,” said Nicholls of the newest company, which opened in 2019.

For many companies, investing in founders from diverse backgrounds is seen as a riskier bet because it differs from the norm entrepreneurs are accustomed to, says a systemic bias within venture capital. said Rudy Greenstreet, CEO of a diversity VC working to address

After Floyd’s murder in May 2020, many major banks, corporations and investment firms pledged to change that, making diversity a top priority moving forward.

But the sharp drop in fundraising seen by black founders in 2022 was that some of these promises were short-lived philanthropic efforts rather than investments that companies believed would actually yield big returns. indicates a possibility.

“When you get venture capital funding, the expectation is that you have a partner now. They’ll help us raise funds, right?” Nichols said.

For white-led teams, there’s no expectation that recipients have to be “special” in the first two years of operation to get additional funding, but the bar for black entrepreneurs is much higher, Nichols says. says Mr. His net worth is $450 million.

“For most of these black founders, it’s exactly as expected, they have to be very good to get additional capital,” he said. “And if you’re truly treating this the same way you treat all investments, then you shouldn’t.”

“Big Blue Sea”

Pocket Sun is co-founder and managing partner of SoGal Ventures, a VC focused on empowering women and diverse entrepreneurs. Since her founding in 2016, the company has seeded multiple unicorns, or startups valued above her $1 billion. Businesses include Function of Beauty and Everly Health.

“From a financial investment perspective, this remains a huge blue ocean for people to dive into,” Sun said.

“Venture capital is, and always has been, a highly privileged and proprietary industry. have… the sun.

Investing in diverse teams is often viewed as a moral imperative and something that is done because it is the right thing to do, but research shows it can lead to higher returns for investors. said John Roussel, executive director of Colorwave.

Products of the Honeypot Company

Provided by: Honeypot Company

“And somehow we are still stuck in this situation trying to convince people of that,” said Roussel, an organization that connects early-stage founders to mentors and capital. “For strong players to take the lead and show people that there are opportunities everywhere, they generally need the same success rate regardless of skin color.”

Dixon, founder of The Honey Pot, gave his own example of success. “Obviously, it’s safe to bet on black businesses,” she said.

The company’s products now reach 4.6 million households, almost double what it was two years ago. It is also sold nationwide at retailers such as Walmart, CVS, and Walgreens. Honeypot has not disclosed its current valuation or annual revenue.

Dixon called on investors to put their prejudices aside and look not at the team’s skin color, but at the company’s fundamentals: its balance sheet, innovation strategy and business goals.

“My skin color shouldn’t be part of the conversation,” she said.

[ad_2]

Source link