[ad_1]

(Bloomberg) — Vedanta Resources’ dollar-denominated bonds rallied as liquidity prospects improved. Vedanta announces plans to sell its international zinc business to Hindustan Zinc for $2.98 billion, benefiting from dividend run-off by Anil Agarwal’s cash cow. .

Bloomberg’s most read articles

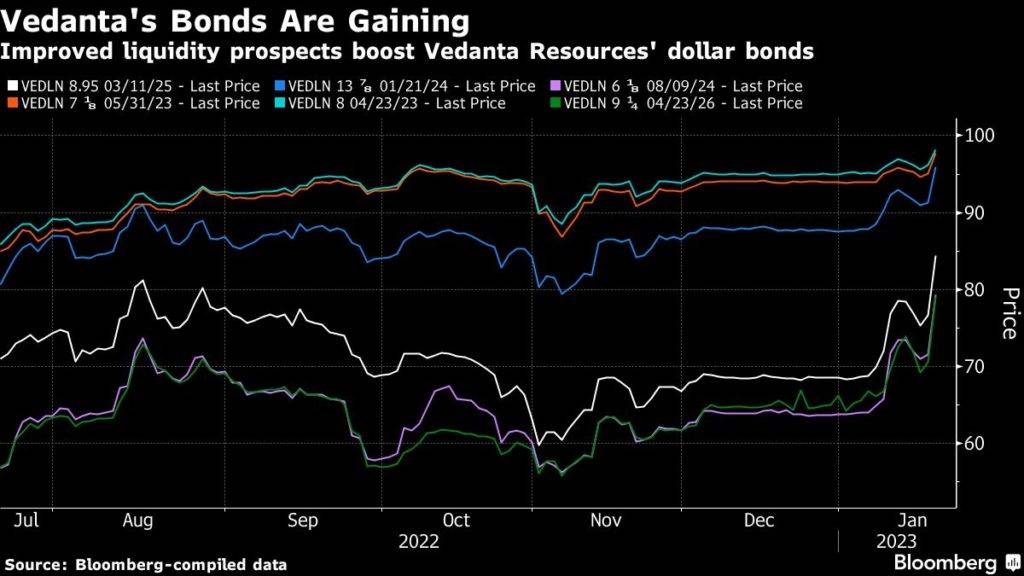

Prices of all outstanding bonds of Vedanta Resources increased on Friday. The company’s April 2026 bonds rose 7.8 cents to 77.6 cents to the dollar on Friday, according to data compiled by Bloomberg. This is the biggest rise since June 2020.

India’s Rajasthan state-based Hindustan Zinc plans to acquire the assets of THL Zinc Ltd. Mauritius from its parent company in phases over approximately 18 months, subject to regulatory approval, an Indian mine said. The company filed with the exchange on Thursday. THL’s operations include Black Mountain Mining (Pty) Ltd. in South Africa and Skorpion Zinc (Pty) Ltd. in Namibia.

The deal is significant for Vedanta billionaire owner Agarwal, who is looking to simplify the corporate structure of his commodities empire and reduce Vedanta Resources’ debt after an unsuccessful attempt to delist Vedanta Ltd. in 2020. .

London-based Vedanta Resources has $4.7 billion in bonds maturing over the next four years, with $900 million in bonds maturing in the first half of 2023, according to data compiled by Bloomberg.

The move is a “master stroke” for minority shareholders of Vedanta Resources and Vedanta Ltd. The transaction will help cash upstream from the unit, yield a return at a higher valuation, and provide long-term capital gains through structuring. Because it avoids the gains tax. Reported by Investec Capital Services Ltd. analysts including Ritesh Shah. Assuming upstream cash is used for payment, it will provide necessary relief to Vedanta Resources’ cash flow stream, the company said.

Vedanta Ltd. shares in Mumbai on Friday rose as much as 3% while Hindustan Zinc fell as much as 9.9%.

A costly acquisition of international zinc assets would deplete Hindustan Zinc’s cash reserves ($1 billion as of the end of December), according to broker Antique Stock Broking. It was indicated by the filing documents to the exchange.

Dividend flow

One of the ways Agarwal generated cash was by receiving dividends from Hindustan Zinc. The company on Thursday announced its third interim dividend of Rs 13 crore per share, totaling around Rs 55 billion. This is in addition to his Rs 154 billion already paid in this financial year.

Paying 2% of Hindustan Zinc’s consolidated revenue to Vedanta for use of its brand and strategic management services will also increase the parent company’s liquidity.

Hindustan Zinc, which has appointed Agarwal’s daughter Priya Agarwal Hebbar as chairman, said its third quarter net profit was below analyst expectations. Vedanta owns about 65% of the miner and the Indian government owns about 30%.

(updated from time to time)

Bloomberg Businessweek’s Most Read Articles

©2023 Bloomberg LP

[ad_2]

Source link