[ad_1]

Introduction: UK house prices fell 0.1% in December

Good morning. Welcome to our rolling coverage of business, financial markets and the global economy.

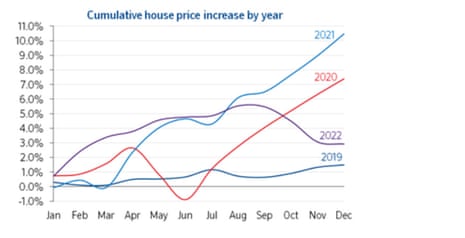

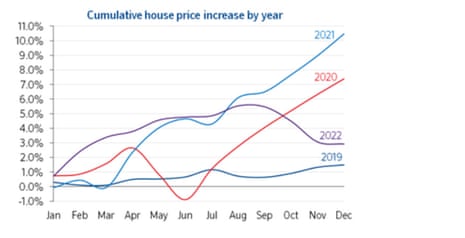

UK house price growth slowed sharply again this month, and a sharp rise in mortgage rates in the fall cooled the market, according to new data.

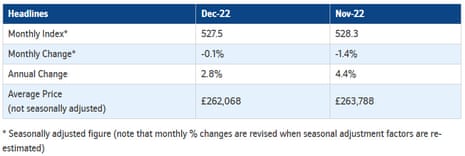

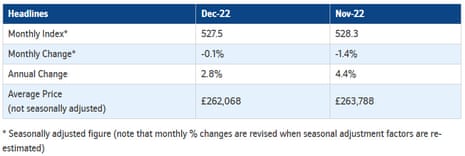

create a society Whole country reported a 0.1% drop in prices in December. This is his fourth straight month of decline and his worst drop since 2008. This follows his 1.4% drop in November.

Prices are 2.5% lower than the peak in August (after accounting for seasonal effects), and the current average price is £262,068, according to Nationwide.

This slowed annual house price growth to 2.8% from 4.4% in November.

Mortgage rates soared after a devastating mini-budget in late September, deterring some borrowers, before slowly declining.

Robert Gardner, Nationwide The chief economist said the recent weakness in mortgage applications may represent an early seasonal slowdown.

“Financial market conditions have calmed down, but it will take time for mortgage rates to normalize and housing market activity shows little signs of recovery.

“It will be difficult for the market to regain momentum in the near term as economic headwinds intensify, real incomes fall further and the labor market is widely expected to weaken as the economy contracts.

Nationwide’s housing report also found prices slowing across the UK. The key points are:

-

All regions slowed annual price growth in the final quarter of the year

-

East Anglia was the best performing region in 2022, while Scotland was the weakest.

-

The gap between the weakest and strongest regions is the smallest since the Society’s Regional Index began in 1974

-

Since Q1 2020, single-family home prices have risen nearly twice as much as flats

After a turbulent 2022, housing experts expect the property market to cool sharply next year due to rising mortgage rates and a possible recession.

Also appeared

It’s the last trading day of 2022 in the city and the market closes early for lunch.

It has been a very volatile year, with global stocks losing about a fifth of their value as the Ukraine war rocked markets, accelerating inflation and prompting central banks to sharply raise interest rates.

British FTSE 100 However, the index outperforms most international rivals. It has risen about 1.7% since the beginning of January, supported by oil companies. blood pressure When shell (both up 40% or more in 2022), and defense companies BAEMore system (up 56% this year).

agenda

important event

filter beta

Higher mortgage costs, along with rising costs of living, are having an inevitable impact on housing affordability, it said. Mark HarrisChief Executive Officer of Mortgage Broker SPF private client.

“The volatility in swap rates caused by the mini-budget has largely dissipated and mortgage rates have calmed against this backdrop. Still, there are still plenty of people leaving the fix facing payment shock. I look forward to participating in

“We could see interest rates rise further next year as the Bank of England continues its efforts to keep inflation under control. It might make your life easier.”

Scotland was the UK’s worst-performing region, with annual house price growth of 3.3%.

wales It slowed to 4.5% in Q4 2022 from 12.1% in Q3 2022.

North Ireland The price increase was 5.5% in 2022 compared to a 12.1% increase in 2021.

UK house prices fell 0.1% in December less than economists expected Victoria Scholar, investment directors of interactive investor:

“UK December Nationwide home prices fell 0.1% month-on-month, 0.7% lower than expected but an improvement from November’s 1.4% decline. House prices rose 2.8% y/y, above forecasts of 2.3% but down from +4.4% in Nov.

Decline in home prices in December marked the fourth consecutive month of negative growth and the worst since 2008, with annual figures well below November and a slowdown across all regions. East Anglia was the best performing region and Scotland the worst. The housing market is struggling under pressure from the impact of the mini-budget, Bank of England interest rate hikes, cost of living crisis and looming recession. Many potential buyers are holding back on their property hunts for now in hopes that home prices will continue to soften and mortgage rates will drop next year.

Housebuilders had a tough year, with stocks down over 40% for Taylor Wimpy, over 45% for Barratt Developments and over 55% for Persimmon. “

Given the “chaotic backdrop” of recent months and rising mortgage rates, potential homebuyers are asking themselves how mortgage rates will change before deciding to enter the market. It suggests that they may have chosen to wait until the New Year. nationwide chief economist Robert Gardner.

A recovery in activity in the new year is likely to “remain lukewarm until the broader economic outlook improves.” Gardner predict.

However, he expects a “soft landing” to be achieved next year, suggesting that prices could fall by 5% in 2023 (other forecasters suggest a 10% drop). suggesting that it is possible).

Gardner say:

“Long-term interest rates, which underpin mortgage pricing, have returned to pre-mini-budget levels. It should help. Weak or negative home price growth.

“But the main factor that will help us achieve a relatively soft landing (especially in terms of house prices) is whether we can avoid forced sales, and good reason to be optimistic on that front. Most forecasters expect the unemployment rate to rise toward 5% over the next few years, a significant increase, but still low by historical standards.

Introduction: UK house prices fell 0.1% in December

Good morning. Welcome to our rolling coverage of business, financial markets and the global economy.

UK house price growth slowed sharply again this month, and a sharp rise in mortgage rates in the fall cooled the market, according to new data.

create a society Whole country reported a 0.1% drop in prices in December. This is his fourth straight month of decline and his worst drop since 2008. This follows his 1.4% drop in November.

Prices are 2.5% lower than the peak in August (after accounting for seasonal effects), and the current average price is £262,068, according to Nationwide.

This slowed annual house price growth to 2.8% from 4.4% in November.

Mortgage rates soared after a devastating mini-budget in late September, deterring some borrowers, before slowly declining.

Robert Gardner, Nationwide The chief economist said the recent weakness in mortgage applications may represent an early seasonal slowdown.

“Financial market conditions have calmed down, but it will take time for mortgage rates to normalize and housing market activity shows little signs of recovery.

“It will be difficult for the market to regain momentum in the near term as economic headwinds intensify, real incomes fall further and the labor market is widely expected to weaken as the economy contracts.

Nationwide’s housing report also found prices slowing across the UK. The key points are:

-

All regions slowed annual price growth in the final quarter of the year

-

East Anglia was the best performing region in 2022, while Scotland was the weakest.

-

The gap between the weakest and strongest regions is the smallest since the Society’s Regional Index began in 1974

-

Since Q1 2020, single-family home prices have risen nearly twice as much as flats

After a turbulent 2022, housing experts expect the property market to cool sharply next year due to rising mortgage rates and a possible recession.

Also appeared

It’s the last trading day of 2022 in the city and the market closes early for lunch.

It has been a very volatile year, with global stocks losing about a fifth of their value as the Ukraine war rocked markets, accelerating inflation and prompting central banks to sharply raise interest rates.

British FTSE 100 However, the index outperforms most international rivals. It has risen about 1.7% since the beginning of January, supported by oil companies. blood pressure When shell (both up 40% or more in 2022), and defense companies BAEMore system (up 56% this year).

agenda

[ad_2]

Source link