[ad_1]

Attracting and retaining Gen Z and women is a top priority for Match’s new CEO Bernard Kim, who ousted Tinder’s management after taking over in June. However, his efforts to revitalize the brand may not succeed amid increasing competition.

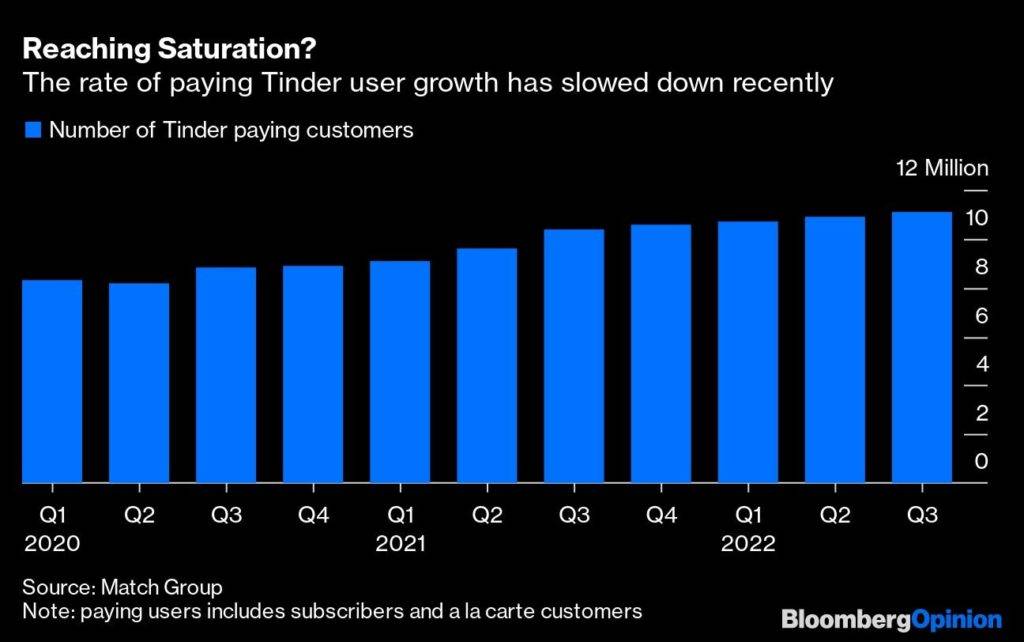

Young people are increasingly turning to apps that offer a more progressive dating experience and emphasize more serious relationships. Including the Match-owned Hinge, whose tagline “designed to be removed” resonated with those sick of swipes and ghosting. According to UBS Group AG, Tinder has about 11.1 million paying users, compared to 2.1 million for him on Bumble and about 1 million for Hinge.

While it’s common for daters to use multiple apps, Sensor Tower data shows that while Tinder’s global monthly active users have remained flat since the end of 2019, users of Bumble and Hinge have grown over the same period. increased by 87% and 140%, respectively. (Tinder has previously said monthly users are “not particularly relevant” to its paid subscription business.)

A stronger dollar won’t help at the moment, but earnings are expected to stagnate in the October-December quarter and grow by 5% to 10% next year.

In theory, Tinder still has a lot of room to grow. Even in more mature markets such as the US, only 16% of unmarried users aged 18 to her 24 are using the app. About 85% of Tinder’s nearly 70 million users don’t even pay him a dime, so they have the chance to convert to paying subscribers, or at least see more ads. Currently, Match only gets about 2% of its advertising revenue.

And in contrast to many tech stocks that have fallen, Match continues to turn a profit comfortably. Adjusted earnings before interest, taxes, depreciation, and amortization are about 35%, compared to Bumble’s 27% (although these measures aren’t exactly comparable). With governments and regulators pushing against the fees charged by his Apple and Google app stores, this online dating giant might one day even be able to keep more revenue for his customers.

Tinder’s profit margins are also much higher than the Match group’s average, partly because it didn’t need much publicity before. Millions of users have come together through word of mouth and network effects. The more people who join the platform, the more likely they will find a date.

But that silence has come at a price as Tinder has been classified as a dating app. Gary Swidler, Match’s chief financial officer, had to remind investors at the November meeting that many of its users met and got married on the app. “People don’t focus on that kind of talk,” he said. “We want to get out there and change that narrative.”

Just as the recession is looming, comes Tinder’s impending ad blitz. Some Tinder customers have already started cutting back on purchases of Boosts and Super Likes (which promote a user’s profile and let others know they swiped). These so-called ‘a la carte’ services account for about a quarter of customer revenue. (In the dating world, Bumble customers don’t renew their subscriptions that often.)

However, financial storm clouds aren’t Tinder’s biggest immediate concern. Tinder boss Renate Nyborg left the company in August after less than a year on the job after her new product initiative failed to excite customers. Match has yet to replace her, delaying her early plans to launch virtual goods and currencies.

“There has been a demographic shift between the ages of 18 and 28, with early Tinder adopters millennials being phased out of this cohort by Gen Z… payer growth slowed significantly. The facts are very likely, a UBS analyst told a client last month.

It’s not easy to pinpoint what Gen Z wants on dating apps. Gender identity, sexuality, and relationships have all become more fluid in recent years. But it’s clear that Tinder needs to do a better job of attracting them, especially young women. (Tinder believes there are significantly more male users than female users, but does not disclose the percentage.)

“Making them feel safer and more comfortable is part of that, right? Reducing the amount of bad behavior on the platform is part of it… [and] Match CFO Swidler said at an investor event in December:

Tinder has changed the online dating game with a swipe, but competitors are gaining traction by emphasizing qualities like kindness, authenticity, sex positivity, and real-world connection. For example, Hinge polls, video his prompts, and voice memos allow users to reveal more about their personality. The app also requires users to like or comment on certain parts of their profile to drive engagement. On Bumble, women have to send an initial message to start a conversation, and the company is lobbying the government to ban cyber flashing (sending unwanted indecent photos) of her.

LGBTQ-focused Grindr Inc. rose to prominence when it went public via SPAC in November. Feeld, meanwhile, was featured in The New Yorker as a “connection app for the emotionally mature.” (Feeld was known as 3nder until Tinder sued him in 2016. infringement). A new app called “Thursday”, as the name suggests, is only available to him one day a week to reduce the amount of time users spend staring at a screen.

Tinder’s brand improvement efforts seem to be heading in the right direction. A new “Relationship Goal” feature allows users to describe the type of match they are looking for. Subtle responses such as “long-term but open in the short-term” are possible. Last month, Tinder published a “healthy dating” guide on topics like consent and how to spot red flags in your profile. The company also plans to offer more curated services to women to improve the quality of matches.

In other words, Tinder has created a more attractive profile. Now it takes a cautious Gen Z dater to swipe right.

Bloomberg Opinion Details:

• Who’s Nepo’s Baby?: Adrian Wooldridge

• It’s time for the French to work longer and retire later: Lionel Laurent

• When heirs and heirs don’t care about each other: Martin Ivens

This column does not necessarily reflect the opinions of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a Bloomberg Opinion columnist covering European industrial companies. Previously, he was a reporter for the Financial Times.

More articles like this can be found at bloomberg.com/opinion.

[ad_2]

Source link