[ad_1]

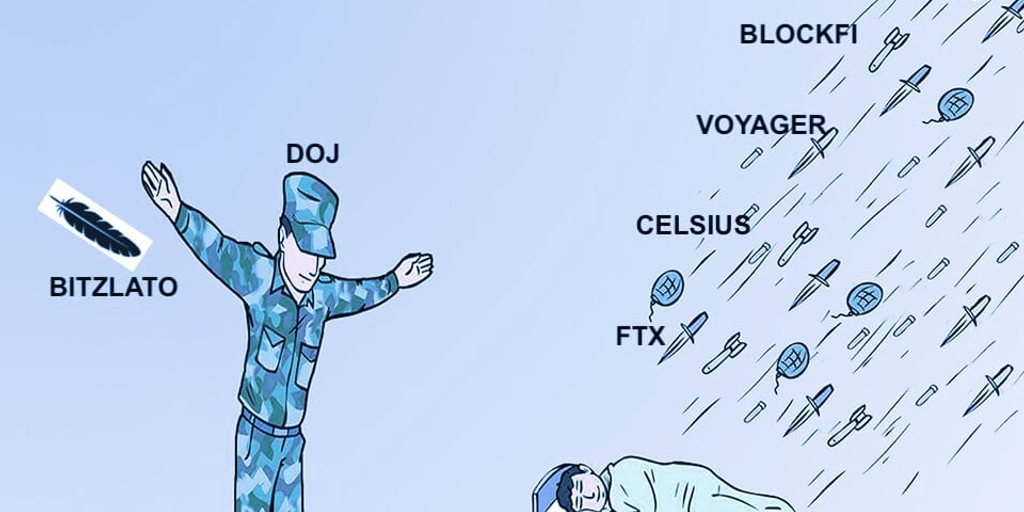

Joke wrote himself.

On Wednesday, the U.S. Department of Justice Declared Ominous to hold a live press conference at noon to announce “international cryptocurrency enforcement actions.”

Crypto Twitter panicked, and so did crypto prices. Bitcoin and Ethereum each fell nearly 5% in just a few minutes, equivalent to a flash crash. A big shot in DOJ’s crosshairs? Binance was a popular bet and CZ didn’t solve the problem. Tweet Just “4”, he announced On January 2nd, it’s his new signal that “FUD, fake news, attacks, etc.”

After that, a press conference was held. It wasn’t Binance. Not Celsius, not Voyager, not Blockfi, not the bankrupt crypto lender who ruined its customers. It was a Hong Kong-based, Russian-owned cryptocurrency exchange called Bitzlato.

Bits what? Bits latte? I’ve been writing about crypto since his 2011, never heard of it.

According to DOJ, Bitzlato has processed more than $700 million in illicit funds, including millions of dollars in proceeds from ransomware.

have understood. But as of Jan. 18, Bitzlato had $11,000 in his customer’s wallet. According to Coinbase Operations DirectorAt Bitzlato’s peak, customers had a measly $6 million in their wallets.

Still, DOJ Deputy Attorney General Lisa Monaco touted the enforcement action as “a significant blow to the cryptocrime ecosystem.”

The crypto market recovered quickly.

We could embed a lot more of the best memes into this, but let’s move on to why and what this all means.

DOJ is about to give in.

The crypto people laughed at it, but the crypto people probably didn’t. The US government wants to make it clear that it is aware, especially after her heavily scrutinized FTX collapse. crypto crime (!) We are taking decisive action.

The DOJ has reportedly been investigating Binance since 2018. Reuters Opinions are divided on whether to charge or not. DOJ is also rumored to be investigating her Digital Currency Group, owner of crypto lender Genesis, which filed for bankruptcy this week.

DOJ is not alone. The SEC last week indicted both Genesis and Gemini for securities law violations.

SEC Commissioner Hester Peirce did not explicitly say the FTX meltdown would directly lead to more crypto regulation in an interview on the gm podcast last month. But it’s clear that at least it’s already led to more attitudes.

“I think we should keep an eye out for regulatory frameworks that have been developed in the context of enforcement actions, because it is very attractive for regulators to do so,” Peirce said. . “And it just cuts everyone else out of the process.”

I often say that people in the crypto industry have an irrational fear of the word “regulation” itself. They speculate that regulation means a complete shutdown, but regulation only means creating new safeguards for retail investors in an ideal scenario for everyone.

That said, Sam Bankman-Fried has brought regulators and politicians under more pressure than ever to show they are serious about keeping the bad guys out of cryptocurrencies. It’s a new environment that I feel. And that can lead to overreach. Already seen at last year’s Tornado Cash.

The next big crackdown may not be for smaller players.

Stay on top of crypto news and get daily updates in your inbox.

[ad_2]

Source link