[ad_1]

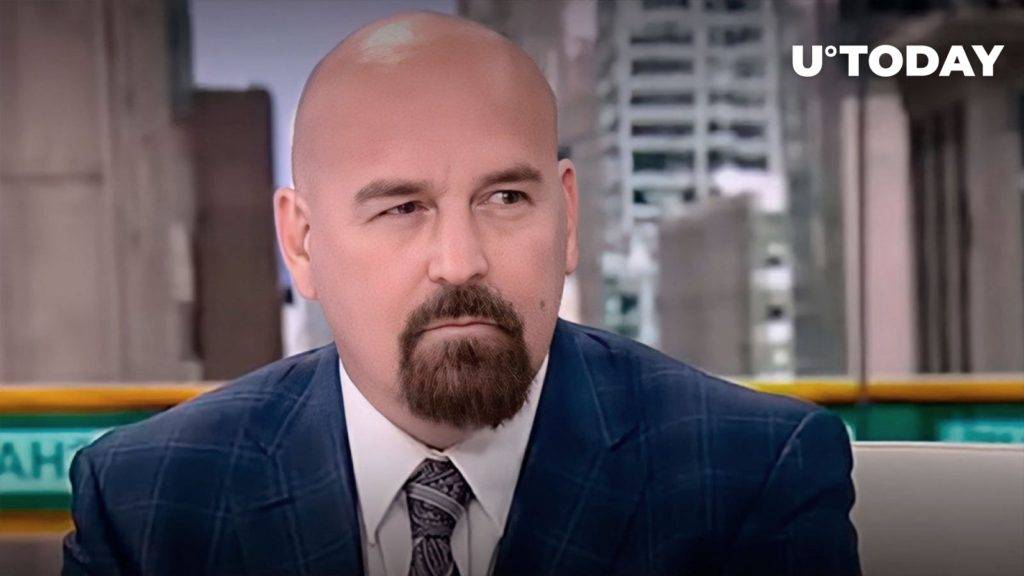

Founder of CryptoLaw John Deaton We believe the final and most aggressive push to shut down cryptocurrencies could soon be witnessed following the White House statement on mitigating the risks associated with cryptocurrencies.

“The final and most aggressive push to shut down cryptocurrencies will come soon,” Deaton wrote.

We will soon see the final and most aggressive push to shut down cryptocurrencies. https://t.co/w4O23zbN40

— John E Deaton (@JohnEDeaton1) January 28, 2023

The White House released a statement on Jan. 27 titled “The Administration’s Roadmap for De-risking Cryptocurrencies.”

The statement read:

“Over the past year, we have identified the risks of cryptocurrencies and used the authority of the executive branch to act to mitigate them.”

Legislative guidance provided by the administration called on the US Congress to step up its efforts.

“For example, Congress should expand regulators’ powers to prevent misuse of client assets that hurt investors, distort prices, and mitigate conflicts of interest,” the document further states.

SEC seeks to expand power claim

The U.S. Securities and Exchange Commission (SEC) has stepped up its crackdown on the cryptocurrency market under the leadership of Chairman Gary Gensler, who took office in April 2021.

As it stands, the SEC is trying to broaden its assertion of authority. Gensler has repeatedly stated that the SEC intends to become the main regulator of the US crypto market.

Gensler believes that almost any crypto token other than Bitcoin has the potential to become a security, and has pursued several recent actions.

Ripple is currently in a legal battle with the SEC, which claims the $1.3 billion sale of XRP constitutes an unregistered security offering.

Ripple executives expressed their views on cryptocurrency regulation earlier this year. Among these, her general counsel, Stu Alderoty, anticipates a judge’s ruling in her Ripple’s SEC case in the first half of 2023, and a ruling in Ripple’s favor.

He believes this will be the catalyst needed to move the U.S. crypto industry forward and stop companies from offshoring crypto work.

[ad_2]

Source link