[ad_1]

After taking control of the House, Republicans are forming what they call the first congressional group focused on digital assets.

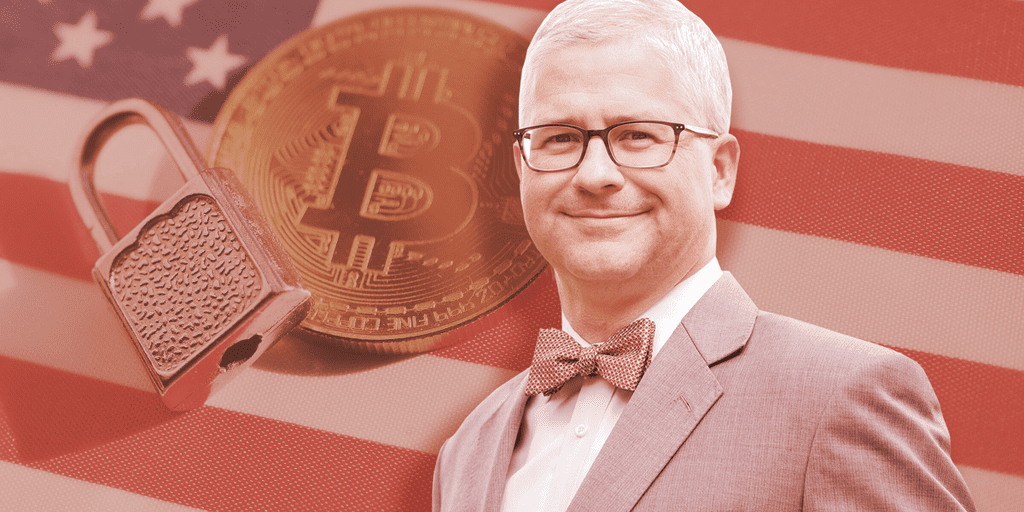

A new subcommittee on Digital Assets, Financial Technology and Inclusion was announced Thursday by Rep. Patrick McHenry (R-North Carolina) as other subcommittees of the House Financial Services Committee were formed. rice field.

McHenry said he believes there are “big holes in how the commission is structured” as the commission devotes more resources to topics related to the digital assets sector rather than the larger financial industry. rice field. Politico report Thursday.

The subcommittee is chaired by Rep. French Hill (R-AR), who has been appointed as Vice-Chairman of the entire committee. The new panel will not only provide “rules of the road” for federal regulators of the digital asset ecosystem, but also develop policies to reach underserved communities through fostering financial innovation. Press release.

“In an era of major technological advancement and change in the financial sector, our work is working across the aisle to foster responsible innovation while encouraging FinTech innovation to thrive safely and effectively in the United States. That’s it.” Hill is statement will be shared on thursday.

The panel’s creation comes at a time when multiple crypto-related laws are moving through the legislative process, including the Lummis-Gillibrand Responsible Financial Innovation Act, which was introduced in the Senate last June, and the most recent Stablecoin TRUST Act. .Introduced by former Republican Senator Patrick Toomey in the last few weeks of his parliamentary career.

Hill knows crypto policy initiatives well. In 2021, Hill co-sponsored a bill requiring the Federal Reserve to investigate the potential impact of the U.S. Central Bank Digital Currency (CBDC). call it “Important work” when the report was finally released.

Some Republican lawmakers have been critical of how regulators have treated the digital asset industry. called out It asked the Securities and Exchange Commission (SEC) under Chairman Gary Gensler for so-called regulation by an enforcement approach.

Republicans are expected to use the 118th Congress as an opportunity to establish regulatory clarity for this nascent asset class. This goal is widely shared across the financial sector and across government agencies.

When McHenry was elected as the new chairman of the House Financial Services Committee in December, he identified the digital asset ecosystem as an area the House Financial Services Committee needed to work on. “Comprehensive Regulatory Framework for the Digital Asset Ecosystem”

McHenry is chorus of criticism After the rapid collapse of crypto exchange FTX in November, a strong regulatory framework could help avert a crisis that shook crypto to its core and hurt countless American investors. claimed to be deaf.

“For years, I have advocated for Congress to develop a clear regulatory framework for the digital asset ecosystem, including trading platforms,” McHenry wrote. Press release“It is imperative that Congress establish a framework that allows innovation to thrive here in America while ensuring that Americans have adequate protection.”

He also spoke with companies such as Binance, focusing on what role CEO Changpeng Zhao played in the collapse of FTX after he telegraphed his company’s move to sell its stake in FTT. suggested the possibility. Exchange money.

“We look forward to learning more from FTX and Binance in the coming days about these events and the steps they are taking to protect their customers during the transition,” McHenry said.

Stay on top of crypto news and get daily updates in your inbox.

[ad_2]

Source link