[ad_1]

Despite the upward trend in prime lending rates, consumers can continue to access good mortgage opportunities through their domestic banks, according to Ooba Home Loans statistics for Q4 2022.

Ooba CEO Rhys Dyer said:

Higher Prime Rate Impacts Mortgage Demand

A series of rapid interest rate hikes from November 2021 onwards are impacting the homebuying market. “At the end of Q4 2022, the prime lending rate was up 350 basis points from where he is now at 10.5%,” Dyer said.

“Ooba’s Q4 2022 mortgage application numbers are down 17% from Q4 2021, returning to levels similar to those recorded in pre-pandemic Q4 2019.

Bank Competitiveness Helps Approvals Still Strong

Ooba achieved an 84.1% homebuyer approval rate for Q4 2022. This is similar to his 83.7% approval rate in Q4 2021. “Banks’ confidence in the South African residential property market is also evident in their willingness to grant mortgage lending at this level despite slowing economic growth,” he said. .

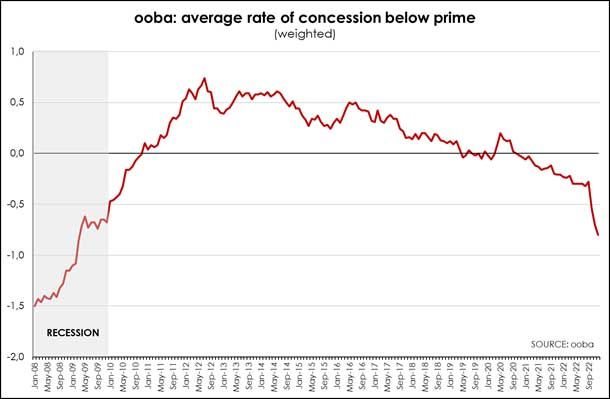

At current levels, the average below-prime interest rate (-0.68% in Q4 2022) is well below levels reached in the early stages of the pandemic and the last rate cut more than a decade ago. is consistent with Lower borrowing costs at this low interest rate will improve the affordability of mortgage financing.

“Prime and below rates have improved significantly across all regions, with the Western Cape seeing a -0.88% drop in prime rates in Q4 2022. It’s significantly lower than the rate offered during the height of the Covid-19 buying boom, which reached -0.71%,” Dyer said. “Gauteng North and West Rand hit a peak of -0.76% in Q4 2022 after hitting a low of -0.86% in April 2020.”

Falling real estate prices are good news for new homebuyers

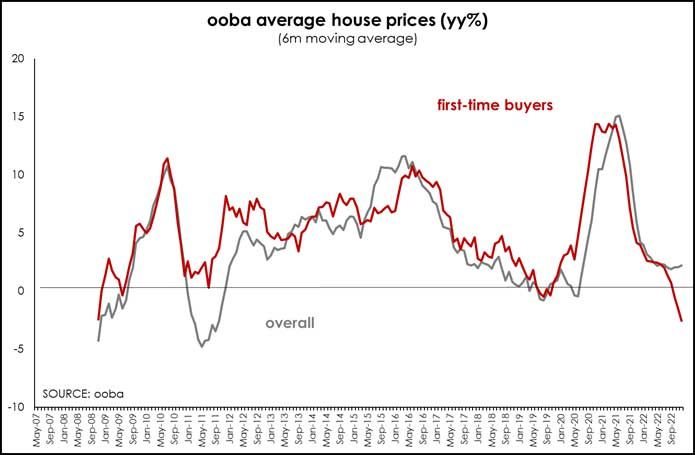

Real estate price growth has slowed due to the influence of the prime rate, and now the nominal growth rate is slowing. The average purchase price for Q4 2022 was R1,422,992. This is only a 1.5% increase from his R1,402,408 in Q3 2022 and a 2.4% year-on-year increase from his average purchase price of R1,389,715 in Q4 2021.

In particular, real estate prices for first-time homebuyers have recorded a negative real growth rate. In Q4 2022, the average purchase price of first-time buyers fell to R1,113,157, representing a year-on-year decline of 2.4% for this segment.

This is driven by a combination of slowing real estate price growth and first-time homebuyers opting to buy smaller properties on average to meet their monthly repayment capacity.

Changes in purchase price categories

Properties priced above R1.5 million accounted for 59% of final grants in Q4 2022, unchanged from Q4 21, ranging from R750,000 to over R1.5 million properties accounted for 30%, up from a recorded 31% in Q4 2021. 11% of bonds finally granted in Q4 2022 fell into the price category below R750,000, up 1% from Q4 2021.

“Rising interest rates have therefore only slightly shifted more homebuyers into this more affordable property price segment. Homebuyers will face the affordability hurdle in 2023. So we expect to see a significant shift from mid-range to low-end,” said Dyer.

First-time homebuyers remain interest rate sensitive

Despite the Prime price concessions available, the economic pressure hits first-time buyers the hardest. This is evidenced by the lower volume of applications received from this market segment in Q4 2022.

“First-time homebuyer frenzy peaked in May 2020 following historically low interest rates, accounting for 62% of all applications received during that period,” said Dyer. I will explain.

“By comparison, just under 49% of applications in Q4 2022 were from this segment. It represents a decline.”

Demand from first-time homebuyers will vary widely by regional housing market, from a low of 42.5% of applications in the Western Cape in Q4 2022 to a high of 62.1% of applications in the Free States. Not surprisingly, the average purchase price for a first-time homebuyer in the Western Cape was R1.37 million in the fourth quarter of 2022, the highest among regions, while in the Free State he was R890,000. and was more affordable.

Homebuyers are more financially savvy

Banks continue to lend at high levels and offer cost-inclusive loans to first-time homebuyers, but more buyers are choosing to deposit money. “This is evidenced by the growth in average deposits and the 7% drop in demand for no deposit loans in Q4 2022 from Q4 2021, which now accounts for 57% of our applications. occupies,” Dyer points out.

Average deposits also increased 23% year-over-year, from 7% of the average purchase price in Q4 2021 to 8.6% in Q4 2022. “This shows that homebuyers are prioritizing deposits as a financial tool,” he said.

The percentage of loan value varies significantly among local housing markets. All states are down, but Gauteng North and West Rand continue to rise at 95.3% in Q4 2022, down from a peak of 100.7% in April last year.

“By contrast, the Eastern Cape, where loan values fell to 87.1% in Q4 2022, recorded the second strongest increase in home prices in the region last year at 7.8%, making it the most expensive region in the country. ‘s housing market, the Western Cape has the second lowest loan rate of 90.2% after a high of 97.5% in the second half of 2021.”

Deposit prioritization for the first-time homebuyer segment continued, with average deposits at 8.8% of gross purchase price in Q4 2022, up 14% from Q3 2021 (gross purchases 7.7% of the price).

Towards a resilient real estate market

With rising interest rates expected to plateau and nominal property price growth expected to be low in 2023, homebuyers will prioritize savings and more affordable properties, driving homebuyers to new buyers. will continue to provide opportunities for

“In the current tougher economic environment, housing affordability will be the biggest challenge for the residential real estate market in 2023, at the level we experienced in 2022,” Dyer said.

“We expect several key trends to take the lead this year. Long-term affordability will lead to fewer 100% mortgages. An area where buyers can get more value for their money. We focus our purchasing decisions on the growing popularity of energy-efficient homes, and the ongoing buy-to-rent investments,” concludes Dyer.

[ad_2]

Source link