[ad_1]

After a week-long Chinese New Year holiday, the bull market in cryptocurrencies and Chinese stocks underperformed, leading to profit-taking speculation.

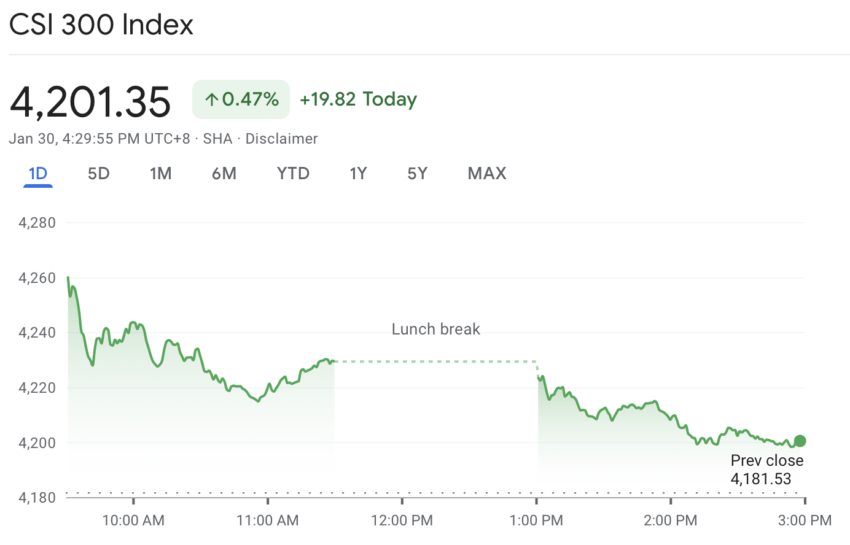

The CSI 300 index, which tracks mainland China’s largest listed Chinese stocks, failed to sustain its momentum and closed 0.5% higher after an initial rally.

Post-Chinese New Year stock performance

Many analysts see this slight drop as a healthy pause after three months of rallying, as the CSI 300 Index has risen 19.88% from its October 2022 low. But negative factors are still at work, including the Biden administration’s tech war against Beijing, the Covid epidemic, the widespread economic slowdown and the housing crisis.

In the US, Chinese stocks also plunged in pre-market trading, with the KraneShares CSI China Internet ETF down 4%.

Bank of America’s latest survey shows long Chinese stocks make it to list of most congested trades this month, suggesting investors may be profiting after long gains indicates that

Crypto is also a hit

The cryptocurrency market has also experienced a slight dip, with bitcoin and other cryptocurrencies rising after the weekend’s rally. Bitcoin price has fallen less than 1% to $23,250 over the past 24 hours after he approached $24,000 over the weekend as the Chinese trader returned to his desk.

The reaction of the crypto market after the Chinese New Year is over has been mixed throughout history. Some years the cryptocurrency price went up, some years it went down.

For example, in 2018, the prices of cryptocurrencies, including Bitcoin, fell following the end of the Chinese New Year. This is due to oversight of tightening regulations by the Chinese government. However, in 2019, the prices of cryptocurrencies, including Bitcoin, rose after the Chinese New Year holiday as investors saw opportunities to invest in cryptocurrencies during a period of market volatility.

It is important to note that the crypto market is highly volatile and can be affected by a number of factors including regulatory developments, economic conditions and investor sentiment. As a result, it is difficult to predict how the cryptocurrency market will react after the Chinese New Year is over.

The fall in Chinese stocks and cryptocurrency markets may seem like a cause for concern, but it could also be seen as a necessary pause after months of rallying and signs of profit-taking by investors. That said, markets will continue to monitor the impact of negative factors such as the Biden administration’s tech wars and COVID-19.

Disclaimer

BeInCrypto has reached out to the companies or individuals involved in the story to obtain an official statement regarding the recent developments, but has yet to hear back.

[ad_2]

Source link