[ad_1]

Business aviation operators often face crew and aircraft shortages to meet the growing demand for air travel after the pandemic. With industry-wide staffing shortages, operators must find ways to attract pilots and other crew members. Fill full-time vacancies or add temporary positions to meet urgent scheduling needs.

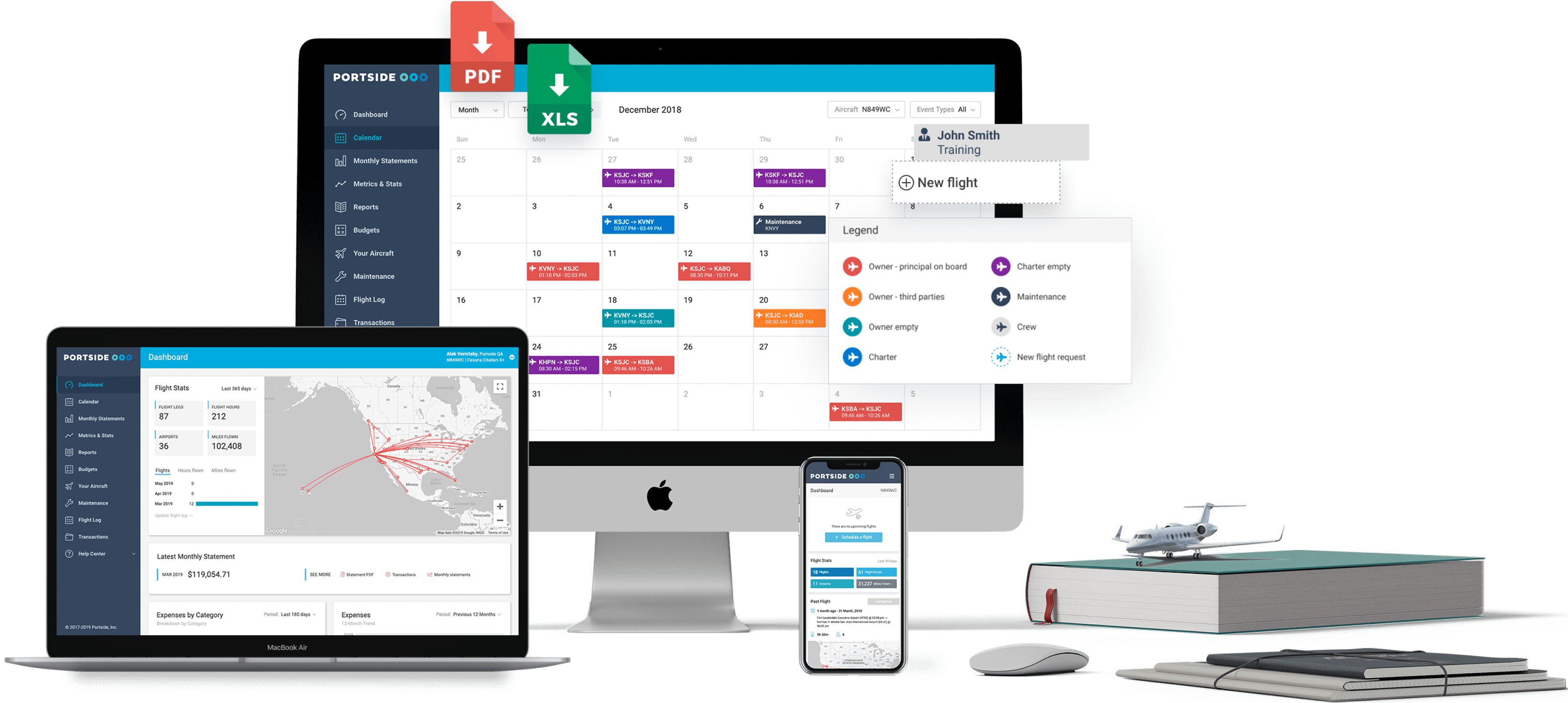

Alek Vernitsky and Alek Strygin co-founded Portside inspired by building technology-forward solutions. Portside allows aircraft operators to share schedules, financial and maintenance data and other critical aircraft information with owners, banks and insurance companies through his web-based portal. Portside today announced it has raised $50 million in a Series B funding round led by Insight Partners with participation from existing investors including I2BF Global Ventures, bringing the company’s total funding to $70 million. exceeded.

Portside is the second venture for Vernitsky and Strygin, following travel agency startup GetGoing, which was sold to travel management company BCD Travel in 2016. Acquired GetGoing.

“Portside provides an integrated platform and strives to be a one-stop-shop for the flight sector,” Vernitsky told TechCrunch via email. “As operators grow in scale, they need to be more efficient through technology. Portside’s suite of products allows us to maximize our aviation assets while streamlining our workflows.”

Image credit: port side

To this end, Portside provides tools to automatically assign crews and aircraft according to given schedules and standardize how travel is reported. Portside’s staffing marketplace gives employers access to a database of pilots and crew, and a dedicated service app to manage crew accommodations. Additionally, Portside maintains an operations management portal that helps schedule and dispatch government, corporate, and charter flights using existing aviation systems.

“Business aviation is more capable than ever in terms of flying more people over longer distances. It means that it is,” continued Vernitsky. “Having an integrated system that combines operational, financial and maintenance data is now paramount to a successful trip.”

Business is doing very well, even during the pandemic, Vernitsky said. This helps business aviation as a market to expand rapidly. A Honeywell study released last October projected delivery of up to 8,500 new business jets worth $274 billion between 2023 and 2032, up from projections for the same decade a year ago. Both deliveries and spend are up 15%. Another poll (this one by Airbus) found that 89% of companies with annual revenues above his $500 million plan to increase their use of business aviation in 2023.

What are the reasons for the strong growth? An Airbus poll offers some insight. While 81% of respondents said their reliance on business aviation has increased during the pandemic, 63% cite continued problems expected in the commercial aviation sector, including flight delays and cancellations.

Whatever the reason, Portside definitely benefits. The company claims it currently supports approximately 1,000 commercial, business and government aircraft operators in more than 30 countries. The Portside platform has more than 10,000 aircraft and more than 50,000 users, according to Vernitsky.

“Business aviation has grown significantly during the pandemic, with Port Said growing nearly threefold annually over the past few years. Business aviation continues to grow and has developed innovative products for the industry. We will continue,” said Vernitsky.

Vernitsky said the latest funding round will be used for software development and “further expansion” of Portside’s customer base and product portfolio. The startup currently employs 110 people and he plans to grow to 150 by the end of the year.

[ad_2]

Source link