[ad_1]

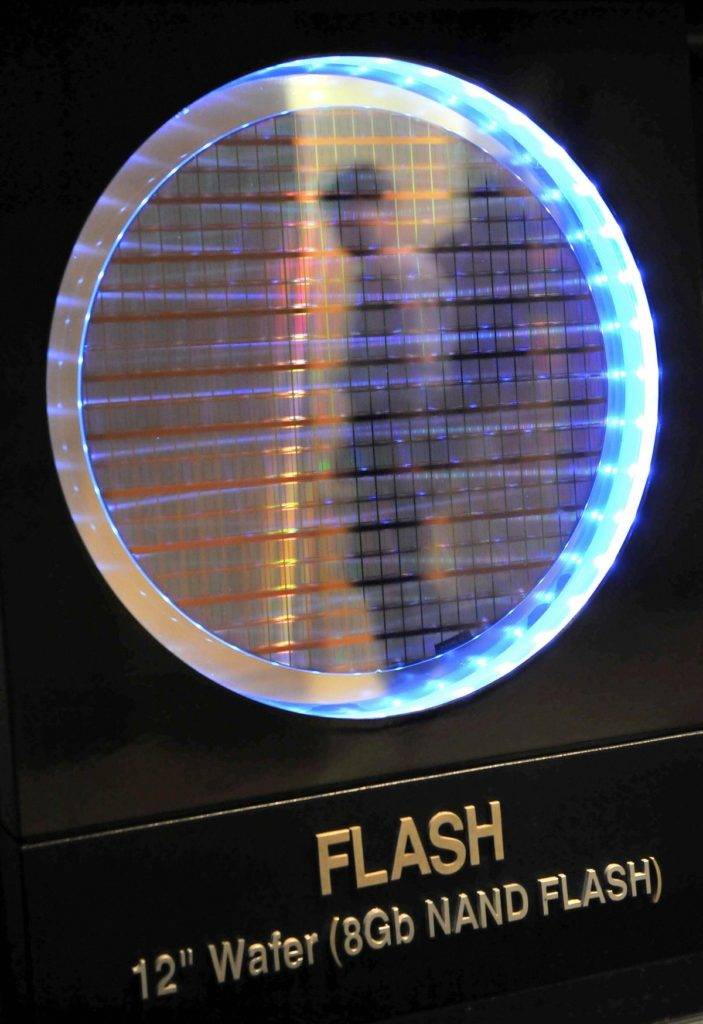

A man reflected in a nandflash wafer

AFP via Getty Images

Recently, there have been rumors that Kioxia and Western Digital’s NAND flash and SSD divisions may merge. Western Digital has explored the possibility of acquiring what used to be Toshiba Memory (since renamed Kioxia) when it was spun out of Toshiba in 2018 to finance its troubled parent company’s operations. may have been A joint venture with Toshiba to obtain the best conditions for continuing the NAND flash and SSD business.

Recent speculation stems from a settlement with activist investor Elliott Management in June 2022, when WDC said it would consider separating its hard disk drive and flash memory businesses. Since then, the company has considered whether to launch a separate business, sell its flash business, or other options that make sense. Recent rumors suggest that a decision regarding the future of WDC’s storage business will be made in the near future.

Let’s look at the benefits and costs of WDC selling its flash memory business to Kioxia. First, let’s look at the market shares of the major NAND suppliers. According to Trend Force in Q3 2022, Samsung holds 31.4% of the market, followed by Kioxia at 20.6%, SK hynix and Solidigm (Intel’s former NAND business) at 18.5%, WDC at 12.6%, and Micron at 12.3% and other companies 4.6%. Combining Kioxia with his NAND business in WDC ostensibly makes him the largest NAND maker with 39.1%, but it doesn’t work out that way.

If Kioxia and WDC merge, some customers may shift some of their business from the new joint venture to other vendors in order to reduce their reliance on that company and support their competitors. That was certainly the case when there were big mergers of HDD companies in the 2010s. So Kioxia and WDC combined may not be the market leader, at least not for long.

Also, let’s take a look at WDC’s flash and HDD revenues and profits from the quarterly report to see how the two WDC businesses compare to each other. The chart below shows the company’s NAND flash and HDD quarterly earnings from Q1 2020 to Q3 2022. From a revenue standpoint, the two businesses are somewhat aligned with each other, with the HDD business typically generating the most revenue each quarter.

History of WDC NAND/HDD Business

Coughlin Associates chart

The following graph shows WDC’s NAND Flash and HDD business gross margins. WDC’s NAND gross margins typically exceed those of its HDD business. Gross margins should generally correlate with business profitability. The slight decline in the HDD business margin in Q2 2022 was due to the company’s significant adjustments in his HDD business, and the decline in the company’s legacy business after a surge during the pandemic and overstocking in its nearline HDD business. Note that it is due to continuous decline. After talking about Kioxia’s financials over the last few years, we’ll talk again about his NAND profitability in WDC.

Comparison History of WDC NAND Flash and HDD Gross Profit

Coughlin Associates chart

The following graph shows sales and profits in yen from Kioxia’s quarterly report. While sales have generally increased from Q1 2020 to Q3 2022, the company’s earnings are much more dynamic. Kioxia and WDC get their NAND flash from the same fab in Japan. Why is the profitability of the two businesses different?

Kioxia Sales and Profit History

Coughlin Associates chart

Objective Analysis analyst Jim Handy wrote an article analyzing the profitability of WDC’s NAND business and Kioxia’s business in 2019. Jim points out that a business deal between WDC and Kioxia (then Toshiba Memory) allows WDC to account for up to 50% of the output. of the joint venture fab. However, he doesn’t have to acquire all 50% of the stock, joint he only needs to pay Kioxia for the products he acquires from the venture’s fab. Building a NAND flash fab is very expensive. Once built, it makes sense for the factory to produce as many products as possible in order to get a return on the capital cost of the factory.

This is an advantage for WDC when demand for flash memory declines and prices drop. The company can limit its potential losses by acquiring as much production from the joint fab as it can sell, but Kioxia will have to sell its own shares and what his WDC can’t. This puts additional price pressure on Kioxia. As a result of this agreement, WDC NAND business profitability tends to be more stable than Kioxia.

Based on this information, does it make sense for WDC to sell its NAND flash business to Kioxia? Kioxia will undoubtedly benefit, but WDC will lose significant revenue streams and profits. . So it’s amazing that WDC does that. While the two businesses could be separated as separate companies as long as the new NAND business maintains product deals with Kioxia, it doesn’t seem to make sense for WDC to sell its NAND business to Kioxia.

Looking at the fab arrangement between Kioxia and WDC and the profitability history of both companies’ NAND businesses, the merger is far more favorable for Kioxia than for WDC. This makes it hard to believe that WDC will spin this business out to Kioxia, but time will tell.

[ad_2]

Source link