[ad_1]

In this article, we take a systematic look at the performance of crypto assets in 2022. Given the sector’s performance over the past year, this is admittedly a somewhat uncomfortable topic, but it helps us understand how things work within this market.

Specifically, some of the most capitalized cryptocurrencies are considered, including BTC, ETH, BNB, and XRP, including several altcoins.

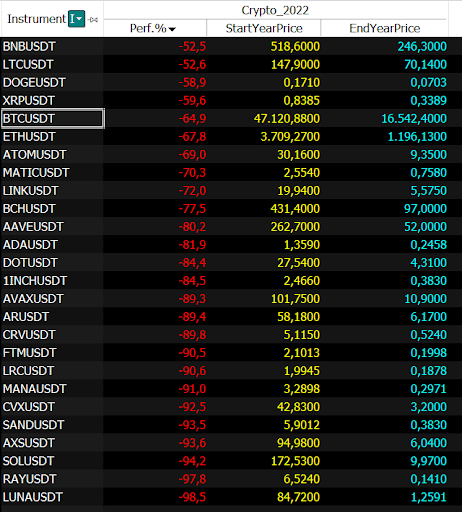

The ‘Perf. %’ column in Figure 1 shows that the 2022 performance of the assets under consideration was almost universally dismal. all cryptocurrencies A range of -52.5% to -98.5% is considered a very severe loss.

The best was BNB, posting a negative return of 52% despite the criticism and stress the ‘cryptocurrency exchanges’ sector received following the FTX scandal. $246.3.

Scrolling down this list, we also have BTC with a score of -64.9%, DOGE -58.9%, ETH -67.8% and MATIC -70.3%.

However, all users of the Terra ecosystem sadly knew about the incident, for example LUNA (-98.5%), and the entire DeFi sector, including AAVE (-80.2%) among others. Some people are. , FTM (-90.5%), AVAX (-89.3%) and CRV (-89.8%) suffer losses of over 80% of him.

Even in the Metaverse sector, which made a lot of headlines last year, SAND (-93.5%), MANA (-91%) and AXS (-93.6%) hit losses of 90% or more in other sectors.

Review of Crypto Sector Performance in 2022

As mentioned earlier, 2022 was a disappointment in that we saw heavy losses across the sector. It certainly left an indelible mark on all investors. It won’t be easy to regain confidence quickly, but as has happened with Bitcoin (and the crypto sector in general) in the past, the situation has changed in the short term. may change.

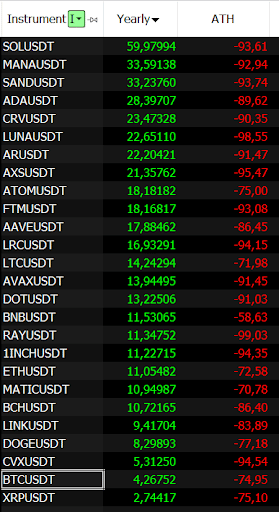

In fact, going forward with the analysis, Figure 2 shows SOL (+59.9% in the first few days of 2023), MANA (+33.5%) and SAND (33.2%), even though the year is just beginning. However, it is still far from an “all-time high,” the absolute highest the market has ever recorded. Bitcoin in particular rose slightly in early 2023, but is still a whopping -74.95% away from all-time highs.

In short, there is still a long way to go, but we could soon see another Bitcoin halving. This is usually preceded by a Bitcoin rally that accompanies the crypto sector as a whole.

The comparison to traditional markets shown in Figure 3 shows that the entire Bitcoin and crypto world remains a highly volatile market that requires research, dedication and good risk management to fully understand. also emphasized.

Notably, QQQ, an ETF investing in the top 100 technology stocks with the highest market capitalization in the US, will score -34% in 2022, while SPY (an S&P500 ETF) will score a more dignified -20.5%.

does not compare to the performance of Bitcoin or other Cryptocurrencycomes from a strong rally and has posted slightly worse returns than traditional markets.

However, the strong correlations that have linked markets such as the Nasdaq and S&P500 to the crypto sector in 2022 are still in the public eye. A sector initially thought to be independent, it shows clear links to traditional finance, especially due to restrictive central bank policies.

This brief concludes with TLT, an ETF that invests in US Treasuries with a maturity of 20 years or more.

Therefore, the only markets left out of the 2022 drubbing are USO (an ETF investing in oil) and GLD (an ETF investing in gold), marking +22.2% and +1.26% respectively.

We’re waiting to see what surprises 2023 brings, but especially before markets show clear signs of reopening, we’re looking at overexposure that could severely impact the overall performance of the portfolio. To avoid it, we strongly advise you to exercise extreme caution in the market.

Until next time, I wish you all the best in 2023!

[ad_2]

Source link