[ad_1]

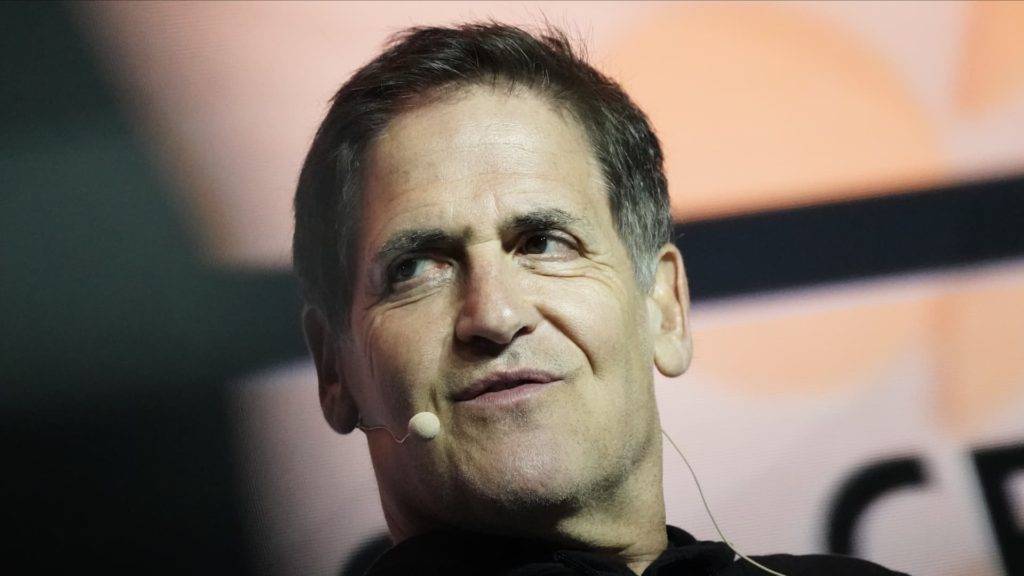

Billionaire Mark Cuban believes that age-old market manipulation tactics could be the next to rock the cryptocurrency industry.

“I think the next possible implosion will be the discovery and removal of wash trades on central exchanges,” the longtime crypto investor told TheStreet.

A wash trade is when a trader buys and sells the same financial asset over and over again to generate false trading volume and make it appear that demand for the asset is high. This artificially inflated demand can mislead other traders into investing real money in assets.

Traders can use this process as a sort of “pump and dump” scheme, as higher demand usually drives prices higher. If the price gets high enough that the trader deems acceptable, he can cash out and leave the money to other investors. Assets that are declining in value.

Wash trading has been illegal in traditional U.S. financial markets for decades, but policing its activity within the crypto space is arguably difficult.

Markets are so different and decentralized that hitting exact numbers in cryptocurrency trading is much more difficult than in traditional finance.

Chen Arad

Chief Operating Officer, Solidus Labs

Chen Arad, Chief Operating Officer of Solidus Labs, a crypto-native risk and market surveillance firm, said:

Bitcoin, for example, is traded on thousands of platforms, both centralized and decentralized, regulated and unregulated. This could create new opportunities for criminals to collude across exchanges and manipulate the market in new and sophisticated crypto-native ways, Arad told his CNBC Make It. I’m here.

According to Forbes’ latest analysis of 157 cryptocurrency exchanges worldwide, just over 50% of reported daily Bitcoin transactions may be fake. For this study, Forbes analyzed data from his four crypto media companies (CoinGecko, Nomics, Messari, and CoinMarketCap) and multiple crypto exchanges.

Cuban cautioned that he had no concrete information to back up his predictions, but noted that there are probably tens of millions of dollars in little-used digital token trading, suggesting how these types of assets are performing. I don’t know if it is used for It was easy to cash.

Arad agrees that wash trading is a major issue in the cryptocurrency market. “Without disrupting wash trading, cryptocurrencies cannot realize their potential to enable safer and more accessible financial services,” he said.

Unfortunately, finding wash trading on your own is not easy. Identifying market manipulation requires specialized skills and deep technical, financial and cryptographic expertise, says Arad.

However, he says it’s important to note that the crypto industry has made concerted efforts to combat this problem over the years.

“Most regulated exchanges have compliance and oversight teams that are larger than traditional finance and are led by seasoned veterans,” says Arad. “On exchanges that use market surveillance, wash trading percentages are often just a few percent.”

The best thing retail investors can do to prevent themselves from falling into pointless trading schemes is to ensure that they only trust regulated crypto platforms that utilize market surveillance techniques to detect suspicious trading activity.

Sign up now: Get smart about money and your career with our weekly newsletter

Do not miss it: Bitcoin lost over 60% of its value in 2022 — here’s how much six other popular cryptocurrencies lost

[ad_2]

Source link