[ad_1]

Method, a startup aimed at making it easier for fintech developers to build automated payments, balance transfers, and bill payments into their apps, today announced Y Combinator (Method’s Y Combinator alumni), Abstract Ventures, SV Angel, and more. . Co-founder Mit Shah said the new cash will be used for product development and he plans to grow the company’s headcount from eight to 28 by the end of the year.

Two of the company’s co-founders, Jose Bethancourt and Marco del Carmen, launched Method in 2021 after experiencing firsthand the difficulty of building debt repayment into their former company, GradJoy. (TechCrunch previously covered GradJoy, which allows students to better manage their loan repayment plans through an app-based system.) Integrating student loans into the GradJoy app is a fragile and insecure screen-scraping API. , turned out to be a patchwork of physical check mailings. A compliance hurdle, according to Shah.

“Jose and Marco saw an opportunity to provide developers with an embeddable API to add debt repayment to their apps and services,” Shah said in an email interview with TechCrunch. “In May 2021, we launched Method to provide developers with turnkey infrastructure.”

Shah points out that there is no standard, technically easy way to access all of a person’s financial debt (student loans, credit cards, mortgages, etc.) and push money onto those debts. Due to the lack of standardization, new-age fintech has resorted to using screen scrapers and login credential-based methods to aggregate and access data, he says. However, these approaches have drawbacks. Registering a new financial institution can take a long time, and because it is not directly connected, actions such as loan payments cannot be performed on your behalf.

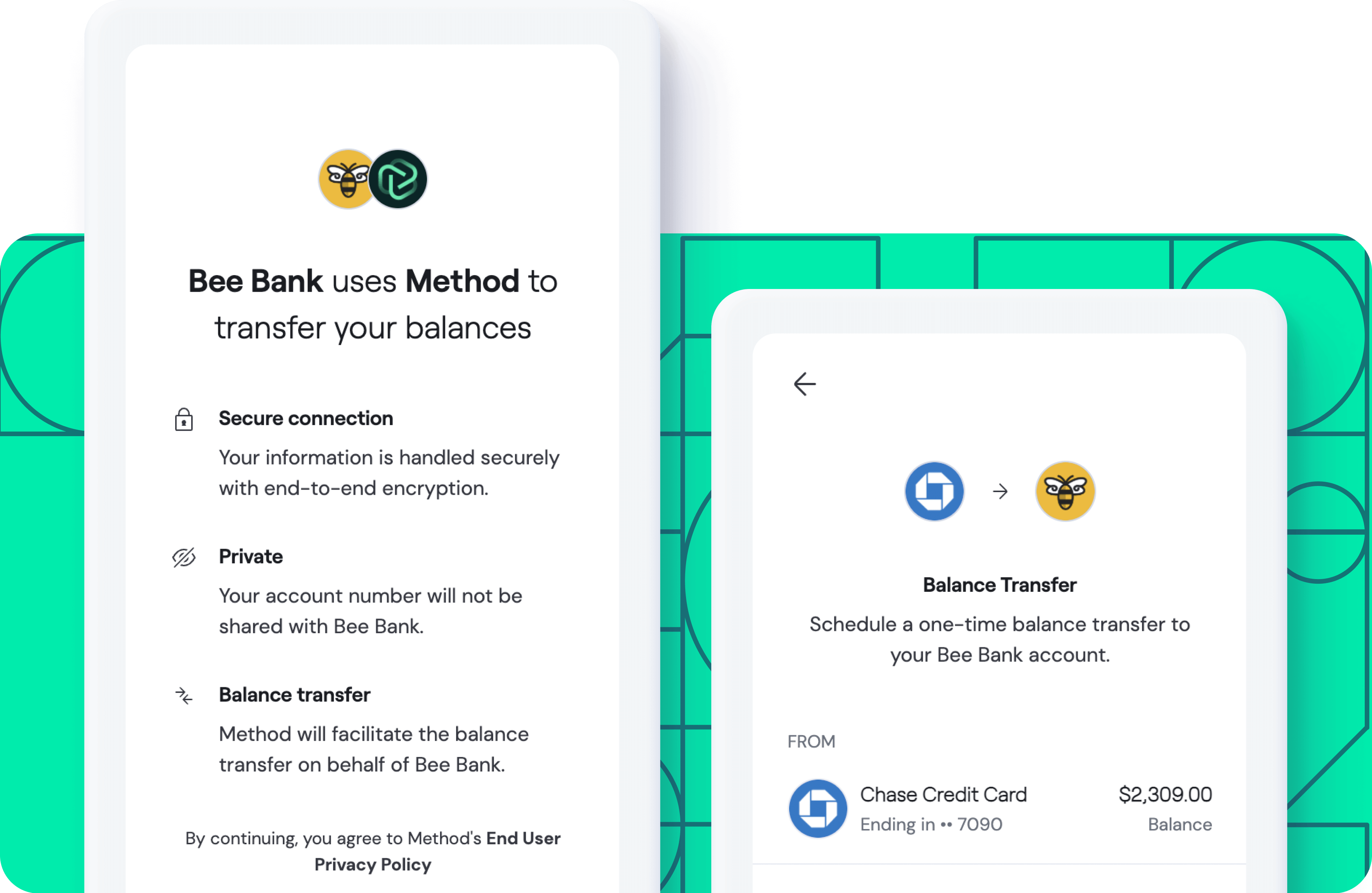

Image credit: Method

“The industry has pursued ‘open finance’ by developing solutions around user credentials and indirectly working with financial institutions,” said Shah. “Direct access to the source to enable read and write access to all consumer debt.”

This method works by leveraging consumer credit access protections enacted as part of the Dodd-Frank Act of 2010. Method draws on identity verification data from credit bureaus (such as Equifax) and wireless carriers (such as T-Mobile) and combines it with real-time data from financial institutions’ core banking systems to identify more than 60,000 of his agencies can reconcile personal debts. Initiate US and tasks such as transferring balances, payoffs, and paying bills.

“Method’s data API allows our customers (consumer facing businesses) to retrieve all of their existing liabilities using just their phone number. is possible,” explained Shah. “On the other hand, the method’s payment API allows users to push funds to all kinds of consumer debts and bills. The method handles the entire money transfer process end-to-end and excludes you from the flow of funds. “

Some end customers may pause as the method processes a large amount of sensitive data. But Shah said the company’s privacy policy was written to assuage the concerns of consumer advocates, noting that the method only collects “minimal user information” and does not sell user data to third parties. As another step in establishing trust, the startup plans to launch a portal where users can log in with Method and manage the data they share with other apps and services. increase.

According to the method, it currently has 35 customers and over 75,000 users with an annual recurring revenue of about $2.25 million. The startup competes with big names like his Plaid, MX, Spinwheel, and Dwolla, but Shah believes his Method holds its own. Especially as the platform rolls out new features such as real-time credit his card his transactions, instant balance transfers, and enhanced live in the coming months. Debt data points.

“Right now, new-age fintech is inaccessible. [sophisticated] Infrastructure and traditional financial institutions have set up manual processes to capture real-time data on consumer credit lines and to make payments by check,” said Shah. “We give fintechs the ability to innovate faster and compete with bigger banks with turnkey real-time data and payment operations. , which saves a lot of manual back-end processes.We are seeing demand for our products from all areas of traditional finance and new age fintech, in the areas of lending, debt consolidation and personal finance management. ”

To date, Method has raised $18.5 million in venture capital.

[ad_2]

Source link