[ad_1]

Kearns, Utah — Money transfer apps are attractive for many reasons. For example, it is relatively easy to send money to friends and pay bills, fees are cheaper than traditional money transfer methods, and the app is available everywhere.

The Kearns woman thought she was protected by the money transfer app she uses for banking, until scammers emptied her account.

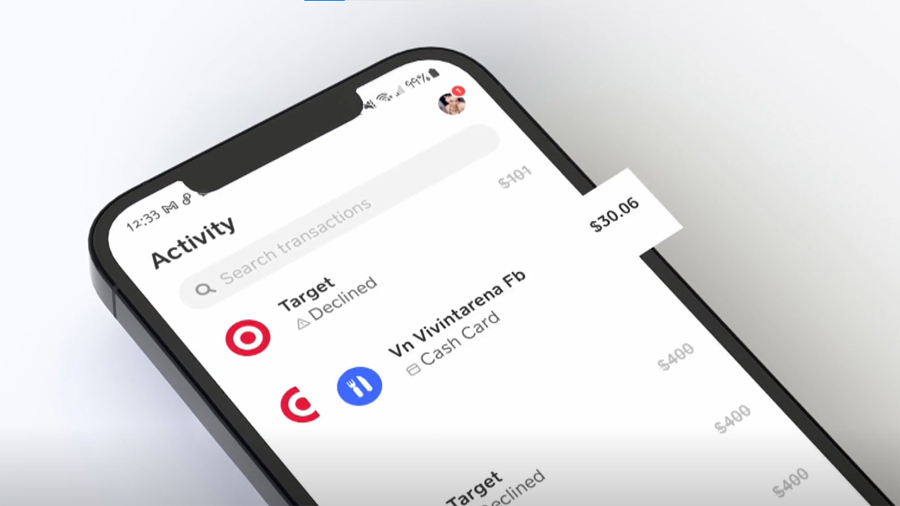

“There were 46 transactions, all from one merchant,” Brittany Peck said of the fraudulent transactions on her Cash App account, all from Target in New York City. I was. “It was about 20 minutes in total. I went to a concert.”

It’s a concert here in Salt Lake, not New York City. Some of her transactions indicated that Peck used her Cash App account to buy snacks in Salt Lake, but when she returned to New York, her scammers discovered that she stole thousands of dollars from her within 20 minutes of

“I had $10,000 in my account and they ran out of it,” Peck said.

She acted quickly to dispute the charge and said she also realized the potential fraud and hoped Cash App would help her get her money back.

“They stopped it due to suspicious activity on a few recent transactions,” she explained.

So when Cash App came back three days later and said, “No, the charge is valid,” she was puzzled. Peck tried to escalate her dispute.

“I’m put on hold. I run around. No one puts you in the fraud department,” she said. “there is nothing.”

Hoping to turn nothing into something, Peck decided it was time to get Gephart.

We reached out to Cash App headquarters. They declined to discuss her case, citing privacy concerns. I got

Peck’s relief was tempered by the frustration of having to involve the television station to resolve the issue.

“They were of no help to me,” she said.

We asked Cash App general questions about their fraud investigation and how the charges were determined to be legitimate in the first place. it was done.

[ad_2]

Source link