[ad_1]

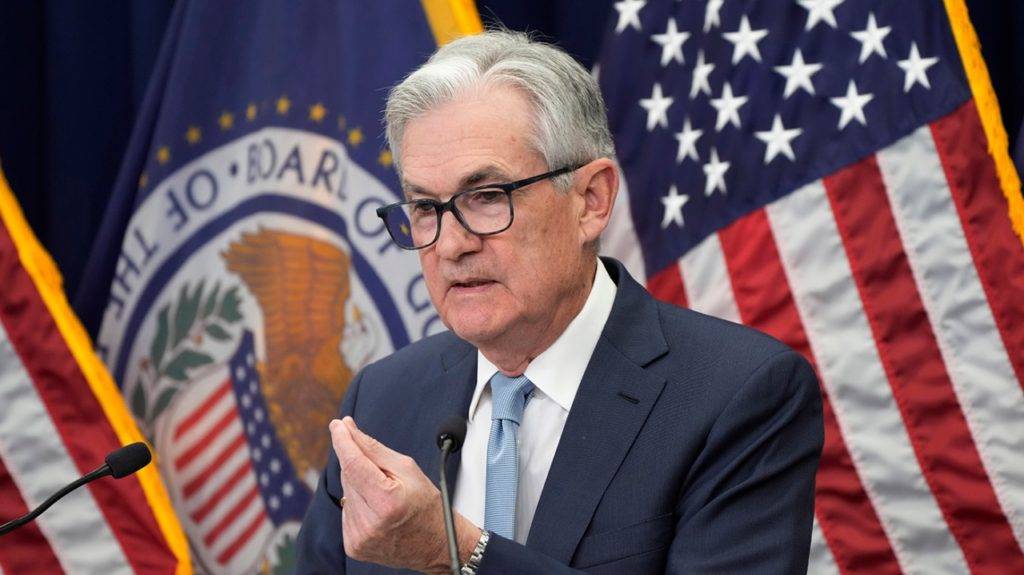

Inflation is likely to continue falling from its current 7.1% annual rate toward the Federal Reserve’s target of 2% by this fall, with little to no additional intervention. Federal Reserve Chairman Jerome Powell should refrain from stirring the inflation pot and allow the residual heat from previous tightening to moderately lower inflation.

The first sign of this continued fall in inflation is a rally in the stock market (historically a leading indicator), followed by an expected cut in mortgage rates.

On the one hand, slowing job growth will be the last signal of inflation and a slowdown in the economy. Such a decline has already begun confirming the downward trend in inflation.

As a result, investors should be ready to invest in the stock market soon, home buyers should wait until mortgage rates start to fall before the end of the year, and consumers will start to enjoy lower prices. must.

The Fed has effectively lowered inflation (from 9.1% in June to 7.1% in December) thanks to seven discount rate hikes in 2022. Inflation is now clearly in a downward trend.

Moreover, my own research shows that if the war in Ukraine ends without Fed action, inflation will drop another 1.65%.

Moreover, the stock market has stopped its decline and its major indices (S&P 500, Dow 30, and Nasdaq) have edged higher over the past week, signaling that they may be ready for a sprint. suggesting.

Even lagging indicators of inflation containment that fend off Fed intervention, such as contracting job growth, are already starting to occur. For example, employment growth is declining every month.

All of this suggests that inflation is coming under control and that it would be counterproductive for the Fed to continue panicking over high prices.

What if I’m wrong? What if inflation hadn’t continued to fall toward his Fed’s 2% target rate by the fall, mortgage rates hadn’t fallen from their current levels, and job growth hadn’t fallen further? .

These outcomes are possible, but unlikely. But even if this prediction doesn’t come true by the fall, it will come later.

The current downward trend in inflation is irreversible, so all the Fed needs to do is wait patiently for past tightening to take full effect.

Will Powell refrain from stirring up the inflation pot and let the economy cool down?

Given that Powell and other members of the Federal Reserve seem determined to tighten interest rates further, he believes the pot will run wild, leading the economy to a sudden, searing landing, and what’s going on in the process. Likely to continue to shake until it hurts a million Americans.

Avraham Shama is the former president of the University of Texas at Pan American School of Business. He is Professor Emeritus of the University of New Mexico Anderson School of Management. His book on stagflation was published by his Praeger Publishing, and his new book “Cyber wars: David Knight Goes to Moscow” was recently published by 3rd Coast Books.

[ad_2]

Source link