[ad_1]

If you want to find potential multibaggers, there are often underlying trends that can provide clues. return Capital Employed (ROCE) and, accordingly, base of capital used. Essentially this means that companies have profitable initiatives that they can continue to reinvest. This is a feature of the compound interest calculator.So when we run our eyes jalil marketing (TADAWUL:4190) ROCE trends.

What is Return on Capital Employed (ROCE)?

For those of you who don’t know, ROCE is a measure of a company’s annual pre-tax earnings (earnings) relative to the capital used in the business. Analysts calculate Jarir Marketing using the following formula:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

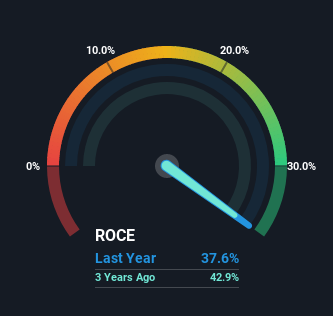

0.38 = £976m ÷ (£4.2b – £1.6b) (Based on the last 12 months to September 2022).

yes, Jarir Marketing’s ROCE is 38%. This is an impressive return, and not only that, it beats the 18% average for its peers.

Check out the latest analysis from Jarir Marketing.

In the chart above, you can see Jarir Marketing’s current ROCE compared to its previous return on equity, but we don’t know much from the past. See the analyst’s predictions if you’re interested. freedom A report on the company’s analyst forecasts.

What can Jarir Marketing’s ROCE trends tell us?

Jarir Marketing deserves credit when it comes to revenue. Over the past five years, ROCE has remained relatively flat at around 38%, and the business has put 47% more of his capital into the business. A return like this is the envy of most companies, and it’s even better considering it’s been repeatedly reinvested at these rates.If Jarir Marketing can keep this up, I’m very optimistic about its future. target.

Conclusion is…

Jarir Marketing is demonstrating its proficiency by generating high returns by increasing the amount of capital used, which is exciting. So it’s no surprise that if shareholders have held it for the past five years, they’ve gotten a respectable 67% return. As such, the stock may be more “pricey” than it used to be, but we believe the strong fundamentals warrant further investigation into this stock.

Finally we found 1 Jarir Marketing warning sign We think you should know

Jalil Marketing isn’t the only company with high returns.Check us out if you want to see more freedom List of companies with solid fundamentals and strong return on equity.

Valuation is complicated, but we’re here to help make it simple.

find out if jalil marketing You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link