[ad_1]

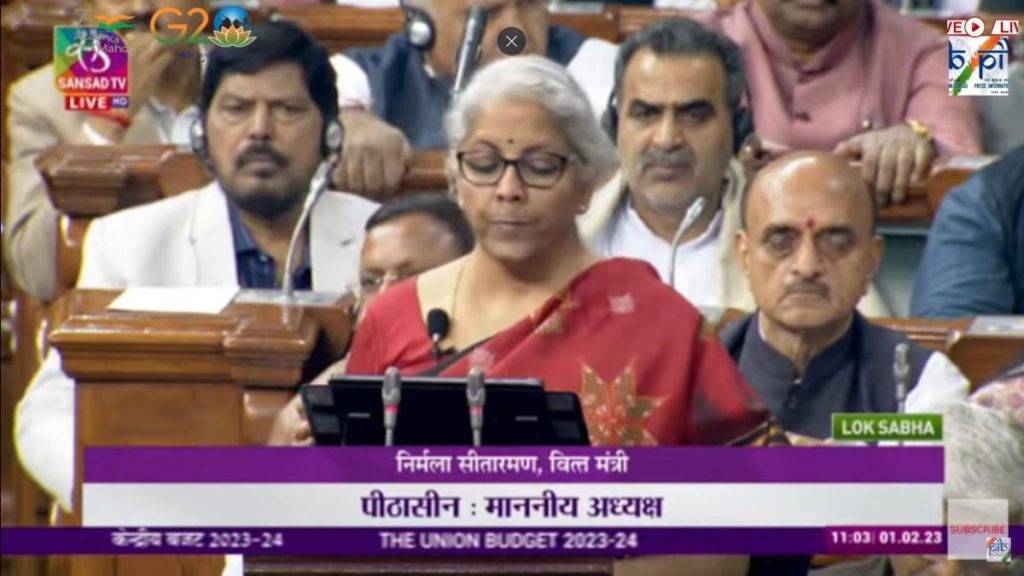

India’s Finance Minister Nirmala Sitharaman presented the budget for 2023-24 in parliament on Wednesday, failing to mention the digital asset class, ignoring calls from the crypto industry for tax breaks on cryptocurrency trading.

On April 1st last year, India imposed a flat tax of 30% on all crypto income and on July 1st imposed a 1% withholding tax (TDS ) was set.

The South Asian country also does not allow cryptocurrency traders to offset losses against gains on other investments for tax purposes.

“The 2023 Federal Budget of India makes no changes to the existing cryptocurrency tax, leaving Indian cryptocurrency companies on the ‘stairway to heaven,’” said local executive Rajagopal. Menon jokingly commented on the government’s cold shoulder. Menon is Vice President of WazirX, India’s largest cryptocurrency exchange by trading volume.

He said high taxes and a lack of a robust regulatory framework have hampered the industry’s progress.

“Indian exchange volumes are likely to level off at rock bottom. Last year was the worst year on record. Any change will be for the better,” Menon said.

The tax has reduced trading volumes by as much as 90% on Indian cryptocurrency exchanges, significantly reducing revenue from trading fees. Between February and October 2022, US$3.8 billion migrated from India to offshore cryptocurrency exchanges as investors sought to avoid tax, according to a study by the Esya Center, an Indian technology policy think tank. presumed to be possible.

Backfire?

Sumit Gupta, chief executive of Indian cryptocurrency exchange CoinDCX, said in an interview last week that India’s harsh tax rates on cryptocurrencies are backfiring, with investors moving offshore and tax rates becoming more reasonable. He said that he was depriving the country of tax revenue that would have been earned if it had been targeted.

The Indian Economic Survey, which explores country trends and helps establish budgetary resource allocation, has proposed for the first time an analysis of the domestic cryptocurrency industry for 2022/23.

“The recent collapse of crypto exchange FTX and subsequent crypto market sell-off has put a spotlight on the vulnerabilities of the crypto ecosystem,” said the report.

“Crypto assets are self-referencing vehicles and do not strictly pass the test of being financial assets. [they have] There is no intrinsic cash flow attached to them.” “The geographically pervasive nature of the crypto ecosystem calls for a common approach to the regulation of these volatile instruments,” he added.

The local cryptocurrency and blockchain industry wanted India to use the ongoing G20 presidency as an opportunity to cooperate with other countries to address new asset classes with clearer regulations.

Ashish Singhal, co-founder and CEO of Indian cryptocurrency exchange Coinswitch, said, “Regulatory ineffectiveness and lack of accountability tend to enable bad actors to It gives everyday users and investors little to no legal recourse. said on Twitter on tuesday.

“With India’s G20 Presidency, we hope that 2023 will finally be the year that the cryptocurrency framework is established.”

[ad_2]

Source link