[ad_1]

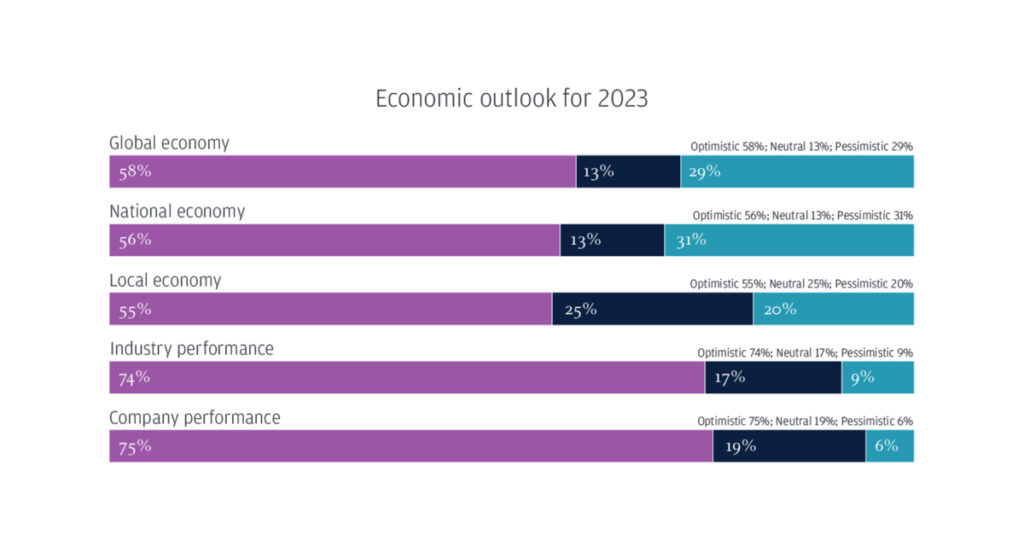

Paris – (business wire)– Similar to last year, more than half of French midsize business leaders are optimistic about the global (58%), national (56%) and local and regional (55%) economic prospects in the year ahead. I feel. JP Morgan’s second annual French Business Leaders Outlook survey released today. This is despite 53% expecting a recession in his 2023, a lower rate than the UK (69%) and Germany (59%), and preparing for its impact. am.

Olivier Simon, Head of Commercial Banking for France and Benelux at JP Morgan, said: “Business decision makers continue to demonstrate their ability to rapidly adapt to and overcome global and local challenges.”

Business leaders continue to demonstrate confidence and resilience, according to a survey of more than 250 senior executives at medium-sized companies in France. Despite many preparing for the 2023 recession, nearly three-quarters (72%) plan to retain or add headcount over the next year, leaving medium-sized businesses in France More than two-thirds (68%) of leaders still expect an increase. revenue and sales, with 6 in 10 (61%) predicting increased profits.

“Many French companies have had to adapt to today’s conditions of high inflation and other external pressures,” said Kirill Courboin, Head of France and Senior Country Officer at JP Morgan. “French business leaders have pragmatic expectations about the real threats ahead, but are rather optimistic about their expectations for business growth.”

Dealing with inflation and addressing supply chain challenges

Inflation remains the number one challenge for the global business community, with more than half (56%) of French business leaders experiencing rising costs as a result.

- Influence of business leaders: Two-thirds (67%) of businesses experiencing inflation challenges report that rising costs of raw materials and rising costs of energy (62%) are causing rising costs of doing business .

- Response of business leaders: To compensate, most leaders (70%) say they are offsetting up to half of the increased costs by passing them on to consumers. Of those, 85% of them could continue to raise consumer prices next year.

Additionally, many business leaders report continuing supply chain challenges, with 63% pointing to worsening in the last 12 months.

- near shoring: In response, 35% of French midsize business leaders continue to shift manufacturing to new regions, and more than 30% are now adding new suppliers from new regions, a trend expected to grow by 2022. slightly accelerated from

- Other adjustments: Slightly more business leaders (38%, up 5% from 2022) are allocating more funds to cover rising costs associated with moving products, but a similar proportion are investing in materials or manufacturing It’s a process change.

Overcoming energy uncertainty, the biggest challenge for French business

A third (33%) of French business leaders see energy prices as the biggest external threat, the highest among European business leaders (UK (25%) and Germany (23%)). remains high. As a result, companies that cite energy prices as the biggest external threat plan to invest in renewable energy sources next year (69%).

Respond to labor market challenges and address social and environmental emergencies

French decision-makers continue to navigate a complex job market and labor shortages, with most expecting to increase (41%) or maintain (31%) headcount over the next 12 months. increase.

To retain and attract top talent, business leaders are meeting employee expectations by:

-

Increase in wages and benefits (46%)

-

Have flexibility in working hours and locations (43%)

-

Investment in automation technology (43%)

-

Providing flexible working hours (42%)

Corporate social responsibility remains a priority for French midsize business leaders as well, particularly in light of the current energy crisis, with a focus on reducing carbon emissions, waste management and energy efficiency (54% from 2022). 21% increase) are becoming increasingly important. A protection strategy deployed throughout France. Additionally, 44% claimed that a focus on energy and environmental factors helped their company establish or strengthen its position within the community, which in turn helped it strengthen its marketing and find new customers. (43%).

Future business

In the following year, decision makers will focus on expanding into new markets, both domestically and internationally (46% and 42% respectively), and prioritizing profitable products and services (40%) and introducing new products (32%). %) is focused. %).

Additionally, the majority of French business leaders have full or partial migration plans, with a third transferring to family members (50%, up 10% from 2022), third parties or sales management. We plan to sell to a group (33%). The majority (67%, up 23% from 2022) expect these transitions to occur within the next two years.

For more information on the 2023 French Business Leaders Outlook, please visit jpmorgan.com/business-outlook-FRA.

Survey method

The JP Morgan Business Leaders Outlook Survey will be conducted online from November 21 to December 8, 2022. In total, it covers his 254 business his leaders (CEO, CFO, Treasurer, Owner) of medium-sized French companies (annual revenues ranging from his €20 million to €). 2 billion) are used in a variety of industries. The results are within the statistical parameters of validity, with an error rate of +/- 6.2% at the 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Company (NYSE: JPM) is a leading financial services company headquartered in the United States (“US”) with operations around the world. As of September 30, 2022, JPMorgan Chase had assets of $3.7 trillion and shareholders’ equity of $288 billion. The company is a leader in investment banking, consumer and small business financial services, commercial banking, financial transaction processing and wealth management. Under the JP Morgan and Chase brands, the company serves millions of customers in the United States and many of the world’s most prominent corporate, institutional and government clients worldwide. Information about JPMorgan Chase & Company is available at www.jpmorganchase.com.

© 2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, NA member FDIC. JPMorgan Chase Bank, NA is organized under the laws of the United States and has limited liability. See jpmorgan.com/cb-disclaimer for full disclosure and disclaimer related to this content.

[ad_2]

Source link