[ad_1]

Bitcoin

Bitcoin

apply now Forbes CryptoAsset & Blockchain Advisor Navigating the Latest Bitcoin and Crypto Market Crash

After the $200 billion cryptocurrency market quake, the price of bitcoin settled at around $23,000 per bitcoin.

Now, the U.S. Federal Reserve has dealt a crushing blow to the crypto industry’s hopes of mainstream acceptance by denying cryptocurrency bank Custodia’s application to become a member of the Fed’s system. .

Brutal bear markets need up-to-date information the most! Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors and anyone interested in cryptocurrencies

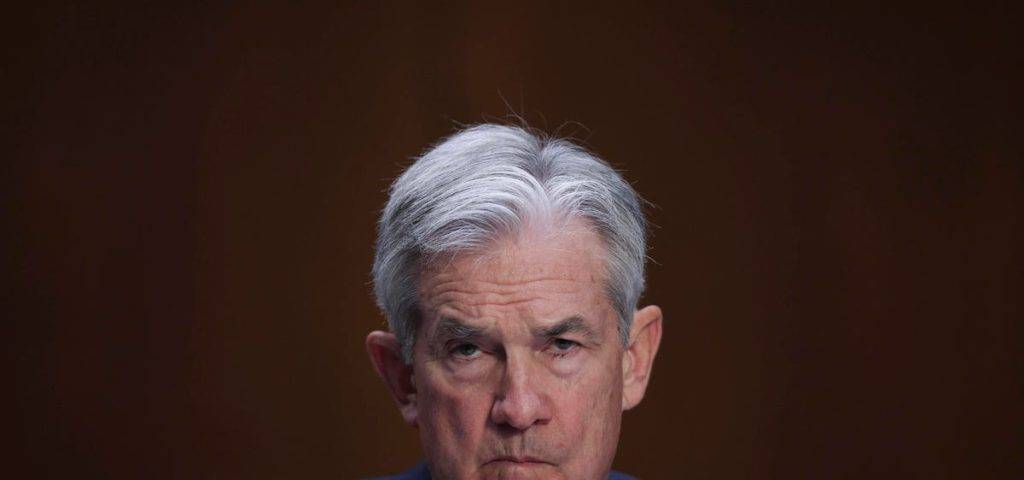

Federal Reserve Under Chairman Jerome Powell Finds Custodia Bank Bitcoin and Crypto Focus … [+]

Wyoming-based Custodia’s “novel business model and proposed focus on crypto assets pose significant safety and soundness risks,” the Federal Reserve said in a statement.

“The board has previously made clear that such cryptocurrency activity is highly likely to conflict with safe and sound banking practices,” the Fed said, adding that Custodia’s “risk management framework will It was not enough to address concerns about the heightened risks associated with cryptocurrency activity that has been committed,” he added. , including the ability to mitigate the risk of money laundering and terrorist financing. ”

Custodia, known as Avanti until last February, applied to become a member of the Fed system two years ago.

“Custodia is surprised and disappointed by today’s board decision,” Caitlin Long, CEO of Custodia, said. statement“The Federal Reserve Board gave Custodia 72 hours notice that it could withdraw or reject the application for membership, but the Federal Reserve Board rejected it in record time. bottom.”

Last year, Custodia sued the Federal Reserve Board and the Kansas City Federal Reserve Bank, accusing it of “illegally” delaying a decision on the Federal Reserve’s application for a master account.

Federal Reserve Chairman Jerome Powell previously warned against granting master accounts to cryptocurrency banks that could lead to a flood of applications, stating that the Federal Reserve is seeking “broader security and He said the sanity impact’ must be considered, calling the approval “very precedent”.

SIGN UP NOW crypto codex— Free daily newsletter for those interested in cryptocurrencies

Bitcoin Price Crashes Following Huge Pandemic Era Rally, But Some Think Bitcoin … [+]

The crypto banking slap by the Federal Reserve comes after the crypto banking industry suffered extreme volatility and withdrawals in the aftermath of the shocking FTX collapse.

California-based Silvergate, described by FTX founder Sam Bankman-Fried as revolutionizing banking for blockchain companies, saw its share price drop nearly 90% in the past six months, with a fourth-quarter recorded an outflow of over $8 billion in Bitcoin and cryptocurrencies. 2022.

[ad_2]

Source link