[ad_1]

Now that I’m back at work after a festive holiday season, I can’t help but think about the ongoing cryptocurrency story through the lens of my favorite Christmas movie. Personally, I love the 1946 Jimmy Stewart classic. it’s a wonderful lifeIf you haven’t seen it, the movie’s concept involves a man who wishes he was never born, gets the chance to change his life, and what the people in his life would be like without him. Observe Taka. It’s a pretty moving movie.

One thing I revisited over and over again in the film is the collection of Bedford Falls Savings and Loans, the bank owned by the main character, George Bailey. The town depositors rush to the bank and withdraw the money before it runs out. This bank lock-in scenario, which happened a lot more often decades ago before the FDIC created deposit insurance, is also a good analogy to what happened with FTX, I think.

The 2022 Exchange Collapse Through the Lens of a 1946 Movie

In this analogy, FTX is savings and loans. Customers gave them money, and in return they were allowed to place leveraged bets on cryptocurrencies on the exchange. It is explained that his money was not physically kept in a bank vault when he was in prison. Most of it was lent out as loans to other depositors (e.g. mortgages).

Now imagine that instead of having many small depositors, you have one really big depositor. To maintain the cinematic analogy, imagine someone closely associated with the bank, banker George Bailey’s Uncle Billy, as one of the biggest borrowers of cash to speculate on assets. Let’s look at. But in this example, let’s assume that Uncle Billy had a very high risk appetite, unlike the movie.let’s say he borrowed $500$,000 to buy a racehorse, not for a mortgage, is a highly speculative and risky asset. should have done so (i.e. he has other assets/deposits in the bank that he could sell to cover the loss if something happened to his racehorse) but he didn’t that. Maybe he was trying to give his family good terms. Maybe he was terribly negligent. I do not know. But if Uncle Billy’s racehorse broke his leg and became worthless, he wouldn’t have enough assets to put in the bank. $500,000 loan.

The sale of crypto assets caused FTX to plunge as customers came looking for the rest of their money.

Alameda Research, a hedge fund started by Sam Bankman-Fried (‘SBF’), is, in my view, like ‘Uncle Billy’ in the FTX debacle. This fund is closely related to his FTX, and along with allegations of misuse of client assets, borrowed large amounts of money without having to post the collateral necessary to cover losses (the amount was It’s still unclear and this is part of the problem). When the cryptocurrency starts selling in 2022, while several other coins and companies are collapsing, Alameda is drowning in its trading, effectively creating a “runaway bank” for FTX’s remaining customers. caused it. Allegedly not properly segregating client assets and properly managing collateral accounts for highly leveraged trades, the sale of cryptoassets can be difficult when clients come looking for the rest of their money. He gave FTX a tailwind.

Case studies of how to manage risk (and not)

Fraud allegations aside, the FTX/Alameda Research bankruptcy is, to me, a case study of poor risk management. It appears that they did not fully understand or properly measure how much collateral their counterparties needed to hold. SBF apologized to the customer. Metaphorically speaking, he pulled out his pockets to show that they were empty and there was nothing he could do, but that’s mostly for investors who just got to zero (or close to) holdings. It wasn’t comforting.

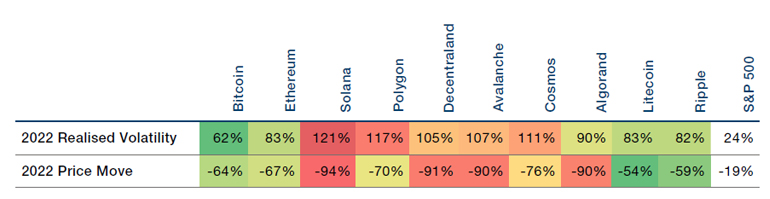

How far-reaching was the sale of the crypto assets that helped this train wreck its way? The answer is trickier than you might think. Looking at some of the largest and most liquid cryptocurrencies over the last two years (Fig. 1), we can see that their “best” drawdown is -54% (Litecoin). 54% down – this is the best result! How scary is that? The group’s worst performer was him 94% down (Solana).

Figure 1. Crypto Volatility and Drawdowns in 2022

Source: Mann FRM; as at 31 December 2022. Financial instruments mentioned are for reference only. Nothing in this material should be construed as a recommendation to buy or sell.

The level of volatility in crypto assets is staggering.

The level of volatility in crypto assets is also amazing. Bitcoin was the least volatile of the options we looked at, with a realized annual volatility of 62% in 2022. Even if only slightly Volatile crypto assets in this space we considered. Some other cryptocurrencies have achieved annualized volatility of 110% or more. Compare that to the S&P 500 Index’s realized volatility of 24% and its 2022 drawdown of -19%.

Have multiple crypto assets? Don’t assume you’re diversified

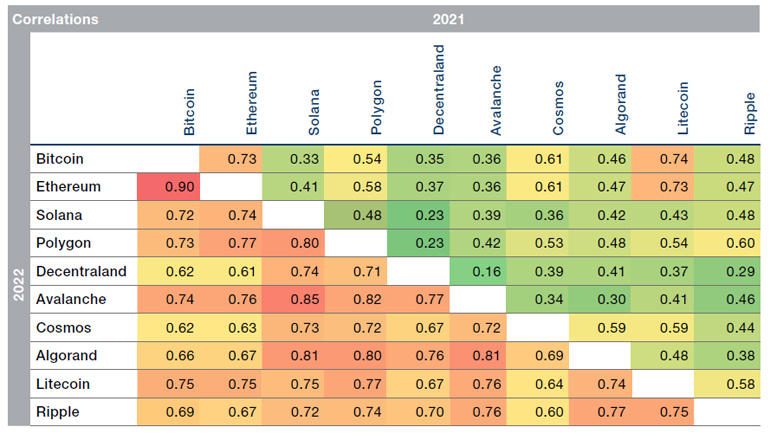

As if the volatility and huge drawdowns weren’t too much to bear, we’ve noticed a significantly higher correlation in the crypto space in 2022 compared to 2021 (Figure 2).

Figure 2. Crypto Correlation, 2021-2022

Source: Mann FRM; as at 31 December 2022. Financial instruments mentioned are for reference only. Nothing in this material should be construed as a recommendation to buy or sell.

The average pairwise correlation of the 10 cryptocurrencies observed in 2021 was 0.45, with positive correlations on average but no excessive correlations. Fast forward to 2022 and that average pairwise correlation jumps to 0.73, a significantly higher correlation. The extent of correlation between these assets has also changed over the past two years. In 2021, the two least correlated currencies had a correlation of 0.16 (Decentraland and Avalanche) and the highest of 0.74 (Bitcoin and Litecoin). This is a fairly large range meaning that some of these assets are not as correlated as other currencies. In 2022, that range has narrowed, with a lowest correlation of 0.60 (Cosmos and Ripple) and a highest correlation of 0.90 (Bitcoin and Ethereum).

The problem with these cryptocurrencies is that they are not decentralized from a risk perspective, even though they have diversified wallets containing all 10 types mentioned here.

In many cases, when managing riskier assets, managers will want to spread them across many assets rather than stacking them in one or two assets. The problem with these cryptocurrencies is that even though he has a diversified wallet containing all 10 types, they are not decentralized from a risk perspective. If the correlation tends to 1.0, there is effectively only one trade. You may be asking yourself: Does all of this mean that FRM investment risk is a resounding “no” when it comes to investing in cryptocurrencies? Maybe, but we’re okay with that…with a few important caveats.

Holding highly volatile and highly correlated assets without strong risk management and proper volatility targeting is a recipe for drawdowns, but we can accommodate managers investing in cryptocurrencies. volatility. Additionally, you need to ensure that you have adequate liquidity (can you sell assets at or near the current mark) and no operational risk concerns. Managers should have strong risk management around collateral maintenance and stop losses to prevent cash management issues. For more information on this topic, I recommend reading my colleague’s article. A guide to cryptography.

According to e-cryptonews.com, 10,024 cryptocurrencies have been issued by May 2022. At least 2,400 (~24%) of them have already failed. last year.This makes me wonder about a line from George Bailey’s daughter it’s a wonderful life: perhaps instead of “every bell rings, an angel flaps its wings”, it could be updated to a 2022 version of “every bell rings, cryptocurrencies clip their wings”.

[ad_2]

Source link