[ad_1]

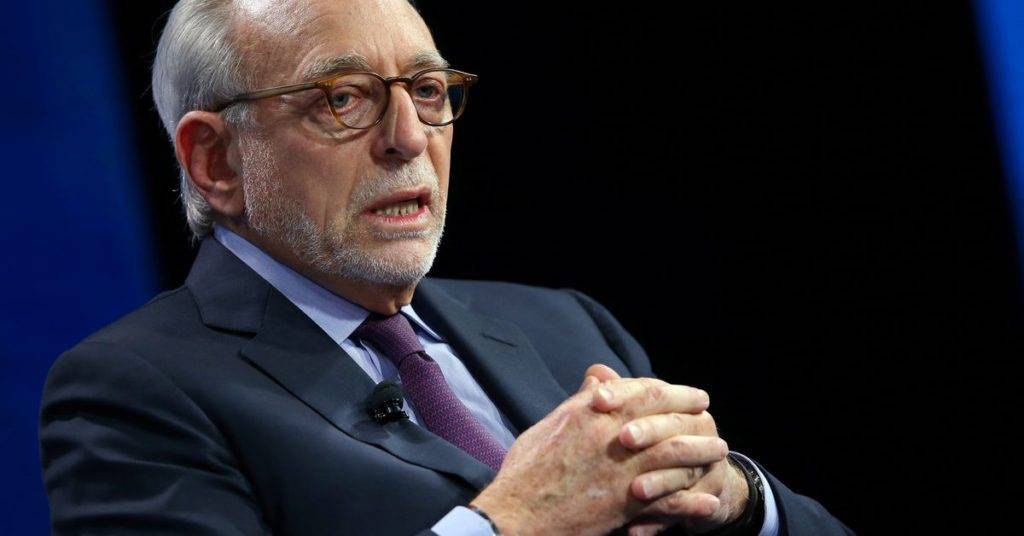

LOS ANGELES (Reuters) – Walt Disney (DIS.N) on Wednesday defended its decision to reject Nelson Peltz as a board member, prompting activist investors to seek “skills” to help the media and entertainment giant. and lacked experience,” he said.

In a letter to shareholders, Mickey Mouse House highlighted the company’s success under CEO Bob Iger, who recently returned from retirement to lead the company for the second time.

“Peltz does not understand Disney’s business and lacks the skills and experience to help the board deliver shareholder value in a rapidly changing media ecosystem,” Disney said.

The billionaire last week made his bid for a board seat to save the company from what he called a “crisis” of overspending on its streaming business, its acquisition of 21st Century Fox and a failed succession plan. has officially started.

Peltz’s internal advocate, Marvel Entertainment Chairman Isaac “Ike” Perlmutter, is an activist investor, according to Disney’s interim proxy statement and attachments filed with regulators. I asked six times to add Ike to Disney’s board of directors. Perlmutter said he has been working on the issue since July 2022 and has been in contact with former CEO Bob Chapek, director Safra Catz and other senior executives on behalf of Peltz.

Peltz’s move is seen as a serious challenge for Iger, pitting one of Hollywood’s most popular executives against an activist investor known for his work in consumer companies.

A billionaire investor told CNBC last week that Disney should buy the remaining stake in Hulu it doesn’t already own or exit the streaming business. Disney has agreed to acquire his one-third stake in the Hulu streaming service from Comcast (CMCSA.O) as early as January 2024.

Disney also needed to increase capital expenditures for its park operations, possibly raising ticket prices “too high,” he said at the time.

Disney is back

In Tuesday’s filing, Disney said it was already working to improve the profitability of its Disney+ streaming business, which Iger helped launch in 2019, and was rolling out broader cost-cutting measures. rice field.

The company has defended acquisitions it has made under the then-returning Iger CEO, including Pixar, Marvel and Lucasfilm.

Disney had conversations with Peltz as of July 11, 2022, according to a preliminary power of attorney filed with the U.S. Securities and Exchange Commission on Tuesday. The activist expressed support for his then-CEO Chapek and presented himself as someone who could be useful if he joined the board.

Disney employee and shareholder Perl Matter added his voice to Peltz’s campaign to join the board of directors, and at one point, activists announced that a beleaguered Chapek would “solidify his position as CEO.” Without Peltz’s help, the Marvel chairman warned that “former executives, including Mr. Iger, will return to Disney.”

As Peltz and Perlmatter continued to make their case, another activist was banging on Disney’s door — Third Point CEO Daniel Loeb.・I contacted McCarthy, told him that I had invested in Disney, and recommended a change. He agreed to appoint an independent director, Carolyn Everson, on September 23.

Meanwhile, Peltz’s board appointment campaign intensified.he

We notified Chapek on November 8 that we had acquired $500 million in Disney stock and planned to increase our stake to $1 billion. Peltz said his Trian Group intends to nominate a director for sale at its 2023 annual meeting unless he is nominated to the board.

Even after the board dismissed Chapek on November 20 and reinstated Iger, the activist continued to seek a board seat. In a video call three days later, Peltz rejected an offer by Iger and McCarthy to find a mutually acceptable independent director and join the board. Said they only accept additions.

Disney’s board chose not to offer Mr. Peltz a seat, citing concerns that it would “cause further disruption to Disney management nine days after Mr. Iger’s return.”

On January 11, Peltz took matters into his own hands. His Trian Fund Management issued a news release announcing Mr. Peltz’s appointment to its board of directors, launching a proxy contest.

Trian Fund Management, which owns about $900 million and 0.5% of Disney shares, declined to comment on Tuesday.

Unless Peltz settles with Disney, investors will vote on whether Peltz joins the company’s board this year. Last year, the annual general meeting of shareholders was held on March 9th.

Reporting by Dawn Chmielewski in Los Angeles and Eva Mathews and Aditya Soni in Bangalore Editing by Shinjini Ganguli and Matthew Lewis

Our standards: Thomson Reuters Trust Principles.

[ad_2]

Source link