[ad_1]

Initially, the term “crypto assets” meant only Bitcoin. However, the sector has experienced massive expansion over the last decade by creating thousands of alternative cryptoassets and tokens. All this activity was made possible by the Bitcoin network’s ingenious use of blockchain technology, but in reality Bitcoin’s intended utility is fundamentally out of proportion to all other virtual currencies. Your use case is completely different.

Bitcoin has a new, global, digital, decentralized, permissionless, non-administrative, non-political monetary and financial system that rewards and protects far more savers than the current central banking system. There is an example of usage as However, the rest of the crypto market mostly involves more risky and speculative use cases that may not stand the test of time, especially regarding issues around trust and counterparty risk. often reintroduces many of the problems it was trying to solve.

The underlying point of Bitcoin is to move away from central banks and into the Bitcoin standard. This includes restructuring the economy with a greater focus on savings and less speculation and outright gambling in financial markets. Frankly, most of the rest of the crypto market is the exact opposite of Bitcoin. It works more like a casino than a revolutionary financial phenomenon. These contrasting philosophies show why it makes sense to distinguish Bitcoin from other crypto markets.

What is the point of Bitcoin?

To understand the difference between Bitcoin and other crypto markets, it makes sense to first review the intent and purpose behind the creation of Bitcoin.

Bitcoin creator Satoshi Nakamoto wrote a little over a month after the network’s launch:

“The fundamental problem with traditional currency is all the trust it takes to make it work. Central banks must be trusted not to devalue a currency, but the history of fiat currencies is full of betrayals of that trust. Banks, which we must trust to hold our money and transfer it electronically, are lending out at a fraction of their reserves during the wave of the credit bubble. We must trust them with our privacy and trust them to keep identity thieves from exfiltrating our accounts. make it impossible. “

In essence, Bitcoin replaces today’s standard inflationary, government-issued currencies, and centralized banking institutions. Due to its deflationary monetary policy, Bitcoin allows users to store their savings in money with the aim of being valued in the long term as the economy grows.

In an inflationary regime, savings are hampered as the currency depreciates over time. Since they do not want to see their savings lose value over time, users of inflationary currencies are effectively pushed into investments that offer potential returns but also carry additional risks. Below, people can theoretically hold bitcoins as savings and not have to worry about central bank policies or make the right investments to combat inflation.

Prior to Bitcoin, this non-inflationary role was primarily played by gold. However, gold has some drawbacks that make it less suitable for the Internet age. This leads to many of the aforementioned bank-related issues that Satoshi wrote about 13 years ago. Additionally, Bitcoin can be stored securely in ways gold cannot, using methods such as multisig his addresses and brain wallets. This is why Bitcoin has long been called “digital gold” or “gold 2.0”.

Of course, Bitcoin has yet to reach its goal of becoming the gold standard for savings in the digital age. At this point, it’s still generally seen as a risk-on asset, as evidenced by recent price increases on news of slowing inflation. That said, as Bitcoin grows and continues to exist, it should become more understood in the market, less volatile, and a better form of savings.

Using blockchain for gambling and speculation

Having established the intended use case for Bitcoin as a safe and conservative form of digital savings, let’s compare and contrast it with other crypto markets. It is nothing more than gambling in a variation of the game or Nakamoto scheme. Everything about Bitcoin focuses on limiting risk, while almost everything else about crypto focuses on increasing risk and attracting more participants to casinos.

To get a clear picture of the crypto market, let’s take a look at the activity that uses Ethereum’s block space where much of the non-Bitcoin activity takes place today. As of this writing, the Ethereum network’s largest gas consumer falls into four categories. Widely criticized crypto tokens built around a cult of personality such as non-fungible tokens (NFTs), stablecoins, decentralized exchanges (DEXs), and XEN. and HEX. In particular, all of these use cases work in the realm of speculation rather than Bitcoin’s intended use case of money or savings.

NFT speculation involves factors other than the token itself. For example, his fictional 1-of-1 NFT associated with one of Ye’s (formerly Kanye West) albums saw the artist praise Adolf Hitler in an infamous interview with radio host Alex Jones. After that, we may have seen extreme devaluation.

Also, nothing stops issuers from diluting the value of a given NFT by creating and selling more tokens (similar to currency inflation). Moreover, the NFT phenomenon itself may be unsuccessful and become less relevant over time. Finally, if a successful NFT iteration does not use blockchain, any potential comparison to Bitcoin would also be bogus from a technical standpoint.

Similar to NFTs, today’s popular stablecoins also have centralized issuers, so they differ significantly from Bitcoin in that they require trust in a third party (Satoshi wrote very similar to a traditional bank setup). The asset itself is not speculative as it is aimed at stabilizing prices, but it serves as a chip in a cryptocurrency casino.

That said, stablecoins have also played a role in providing access to the US dollar for those dealing with troubled local currencies. However, it is unclear how long this will last as stricter stablecoin regulation could change the market dramatically. not found yet.

DEXs are currently primarily used for trading, including the aforementioned stablecoins. When stablecoins are removed from the equation, DEXs are mostly just casinos for Ponzi games, some of which could not be listed on traditional centralized exchanges (CEX).

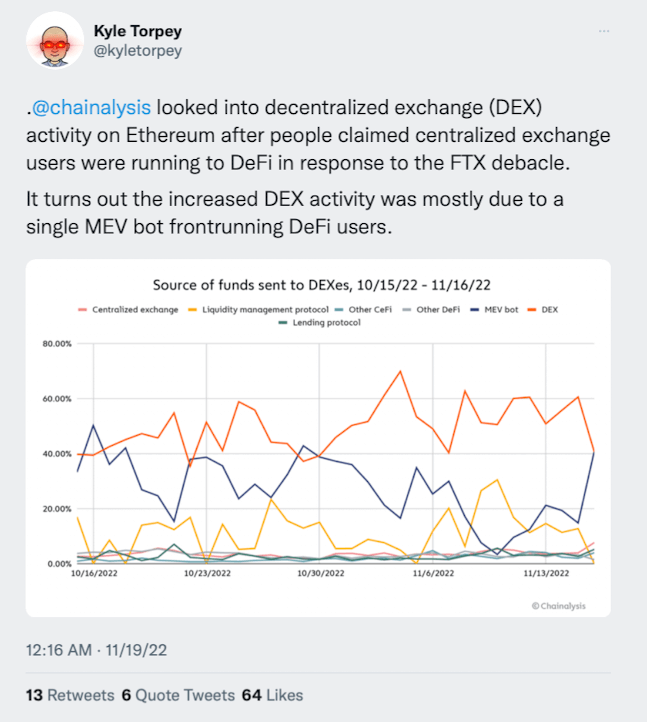

Additionally, Chainalysis recently revealed that the majority of DEX activity is often spearheaded by users with Maximum Extractable Value (MEV) bots. Besides, it is unclear how much of the trading volume is simply arbitrage trading with other exchanges. These DEXs and other decentralized finance (DeFI) applications also often have their own tokens, which can be used to speculate on the DeFi application’s chances of success. Note, however, that the relationship between your own tokens and your app’s success may not be known.

Crypto tokens such as HEX and XEN are pure Nakamoto schemes that have been repeated many times over the years. This is the Crypto Ponzi game in its purest form.

So when we take a closer look at these four use cases, it becomes clear that not only are they different from Bitcoin, but they often operate at opposite ends of the risk appetite spectrum. It remains unclear whether sustainable killer use cases can be built on top of Ethereum or one of the other similar blockchain platforms. With so many people interested in that sort of thing, cryptocurrency may persist as a new vehicle for online gambling and get-rich-quick schemes for some time. Either way, it makes sense to differentiate Bitcoin as a savings technology from other markets.

Those interested in developing a new monetary paradigm and a savings-based economy can stick with Bitcoin, while those who like to gamble can enjoy the rest of the crypto market. Of course, many people choose both options (and store their crypto profits in Bitcoin).

Native crypto assets such as Ethereum (ETH) and other similar blockchains (BNB, TRX, ADA, SOL, etc.) serve as the base blockchain layer for gambling, Ponzi games, and general speculation on blockchain experiments benefiting from doing

And owners of this kind of base-layer crypto can benefit as long as the game of chairs continues at the application level. So, do these base layer assets rival Bitcoin? Or what about more directly competing alternative cryptocurrencies such as Dogecoin and Monero?

[ad_2]

Source link