[ad_1]

The business model of the defense industry has changed due to the growing threat of war in Ukraine and conflict in the world, said the head of a large German contractor in the field.

Hensolt CEO Thomas Müller told the Financial Times that arms makers are now producing weapons and equipment without pre-orders due to soaring demand.

This means companies can get defense technology and products “almost like they would in a supermarket,” he added.

Many defense contractors avoid building weapons without pre-ordering, as manufacturing costs often run into the millions of euros per unit, leading to long waiting lists for advanced equipment.

“Normally, you would have had to have a firm order and a down payment. [But] Starting in April, we will be able to deliver one radar per month, but we do not yet know to whom,” Muller said of the company’s ground-based air defense radar TRML-4D.

However, recent heightened geopolitical instability has led several countries, such as Germany, to increase military spending.

This was most notable after Russia’s invasion of Ukraine in February, when investors flooded into companies such as Hensoldt, which specializes in missile detection radars.

The company also manufactures optronic systems for the Leopard 2 tank, which Germany is pressured to send to Ukraine. Optronics systems are used for surveillance and navigation.

In Germany, the invasion caused a historic shift in the country’s defense policy, and for decades it has cited the legacy of World War II as a reason to maintain a reduced military force.

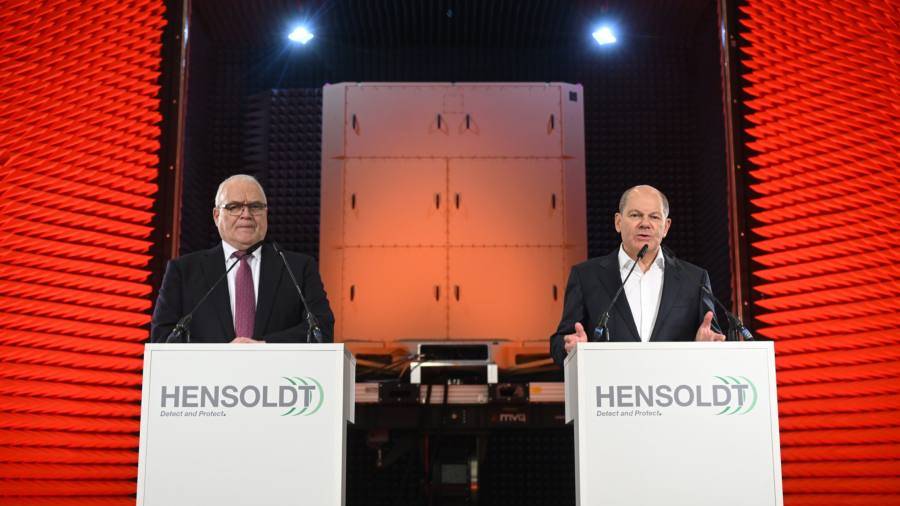

German Chancellor Olaf Scholz, who visited Hensoldt this week, was the country’s first leader to join the defense group and said last year it had decided to modernize its armed forces after years of pressure from NATO allies. It promised to spend 100 billion euros.

It’s not clear where the money will be invested, but Hensoldt is likely to see a surge in orders from the German government, which already accounts for around 40% of its sales.

“Even before the Ukrainian war, we benefited from budget increases. ” said Muller.

“We have so many potential customers in the pipeline and they are so happy to get [air defence radars] It’s like something you’d find in a supermarket,” he added, noting that it takes about a month to manufacture some of the company’s larger radars.

“Demand has grown so much that other defense contractors are doing the same, especially in the ammunition sector.”

This demand has increased the share of defense groups. Hensolt, which went public in Frankfurt about three years ago, is up nearly 90% since Russia’s invasion of Ukraine.

Shares of Rheinmetall, Germany’s largest defense contractor, have risen nearly 140% over the past year.

Rising geopolitical instability, including the Ukrainian war, has also helped boost the defense group’s finances. Hensoldt, whose 2021 earnings were €1.47 billion, raised his 2022 annual sales growth guidance in December.

In its last reported full year 2021, the company earned €261 million in adjusted earnings before interest, tax, depreciation and amortization.

[ad_2]

Source link