[ad_1]

Latest ETF news

Visit the ETF Hub to learn more and explore detailed data and comparison tools

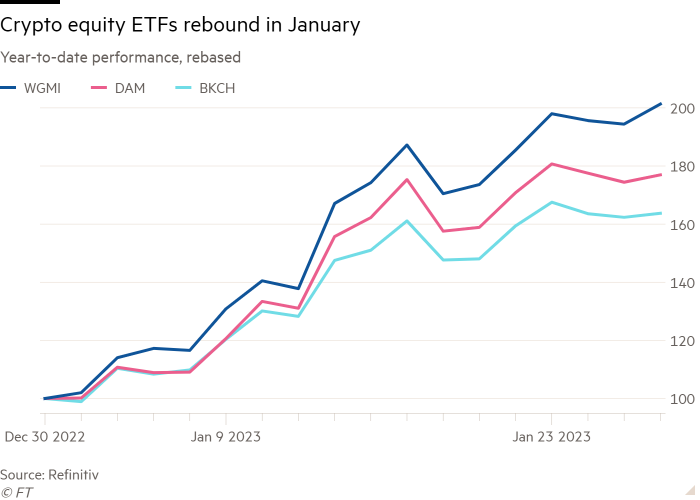

A swarm of crypto-focused stock-exchange-traded funds are off to an amazing start to 2023, posting steep gains rarely seen in diversified equity funds.

The $3.9 million Valkyrie Bitcoin Miners ETF (WGMI) has led the way since the start of the year with a 101% return, while a bevy of rival funds have also returned between 40% and 80%.

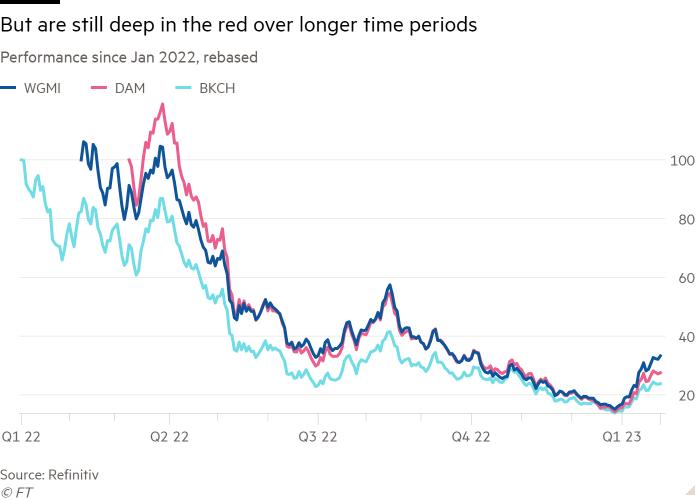

Most of these ETFs have been battered by last year’s “crypto winter” and broader declines in tech stocks, and while they remain well below water for long-term investors, the early rally suggests that niche sectors are Demonstrates ability to recover due to: its inherent volatility.

Some technology funds, such as the Ark Innovation ETF (ARKK), have also experienced a more modest but partial recovery. It’s up 25% so far this year, and he’s plummeted 75% between 2021 and 2022, but he’s on track for potentially record monthly returns.

“If the Ark story convinced you two years ago, the technology is for sale,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar.

The recovery of crypto ETFs has been driven by a putative sign of life in the crypto markets. $70,000 in November 2021. A smaller digital token, Solana, surged 145%.

This recovery has largely been attributed to indications that inflation may have peaked, especially in the United States, with global interest rates likely to peak at lower levels, and more ‘risk on’. It could pave the way for your investment strategy.

“These, if not some of the worst-performing ETFs in 2022, are likely to rebound sharply as bitcoin and other cryptos themselves have recovered,” said Todd, head of research at VettaFi. Rosenbluth said

“This is why people invest in cryptocurrencies,” said Lamont. “For many investors who invest in cryptocurrencies, it is effectively a high-stakes gamble. It is high-risk and potentially high-return.”

WGMI was the best-performing unlevered equity ETF globally in the first few weeks of 2023, but is still down two-thirds since its launch in February 2022, according to Morningstar Direct data. .

Its largest holdings are cryptocurrency miners Bitfarm, Marathon Digital Holdings and Digihost Technology, whose shares have surged between 148% and 279% since the beginning of January.

The VanEck Digital Assets Mining ETF (DAM) isn’t far off, with holdings like cryptocurrency miners Riot Platforms and CleanSpark and Chinese computer hardware maker Canaan fueling a 77% gain. However, DAM has only returned to early November levels, still down 76.8% from its March 2022 high.

The huge rebound isn’t limited to crypto mining ETFs, it also owns the VanEck Digital Transformation ETF (DAPP), whose holdings include payments firm founded by Twitter co-founder Jack Dorsey. A Block and cryptocurrency exchange Coinbase Global are included, up 66.8%. .

Global X Blockchain ETF (BKCH), Bitwise Crypto Industry Innovators ETF (BITQ) and iShares Blockchain and Tech ETF (IBLC) are also up over 60%.

However, Lamont said thematic funds are known to exhibit “whip saw” returns.

“Cannabis has seen some incredible volatility in the past.In the post-Covid recovery, some ETFs posted triple-digit returns within a year when things started picking up again. did,” he said.

The Invesco Solar ETF (TAN) surged 305% from April to December 2020, according to Morningstar data. This is perhaps the most explosive example of how thematic funds can make incredible returns when the market turns.

However, investors are sticking with crypto-related equity ETFs and investors in the broader tech sector despite last year’s losses, suggesting some resilience.

“Thematic funds collapsed [last year]Mr Lamont said: Still, no door stampede was seen. It was interesting.

“If you accept the basic story, the basics of these themes haven’t changed.”

Latest ETF news

Visit the ETF Hub to learn more and explore detailed data and comparison tools

[ad_2]

Source link