[ad_1]

Tom Lee, managing partner at Fundstrat Global Advisors, believes it is unlikely that the terrible macroeconomic conditions of 2022 will continue next year.

In a new Twitter thread, Lee To tell He believes inflation is declining faster than the market and the Federal Reserve expected.

A CNBC contributor also said the Fed wants a strong labor market.

“Remember, many inflation drivers have spiked mid-year, then literally implode, then dip/flatten out into 2022. You don’t have to look far to see progress.

Wages are important, but the Federal Reserve doesn’t want to kill the economy, and it doesn’t necessarily want to kill jobs. “

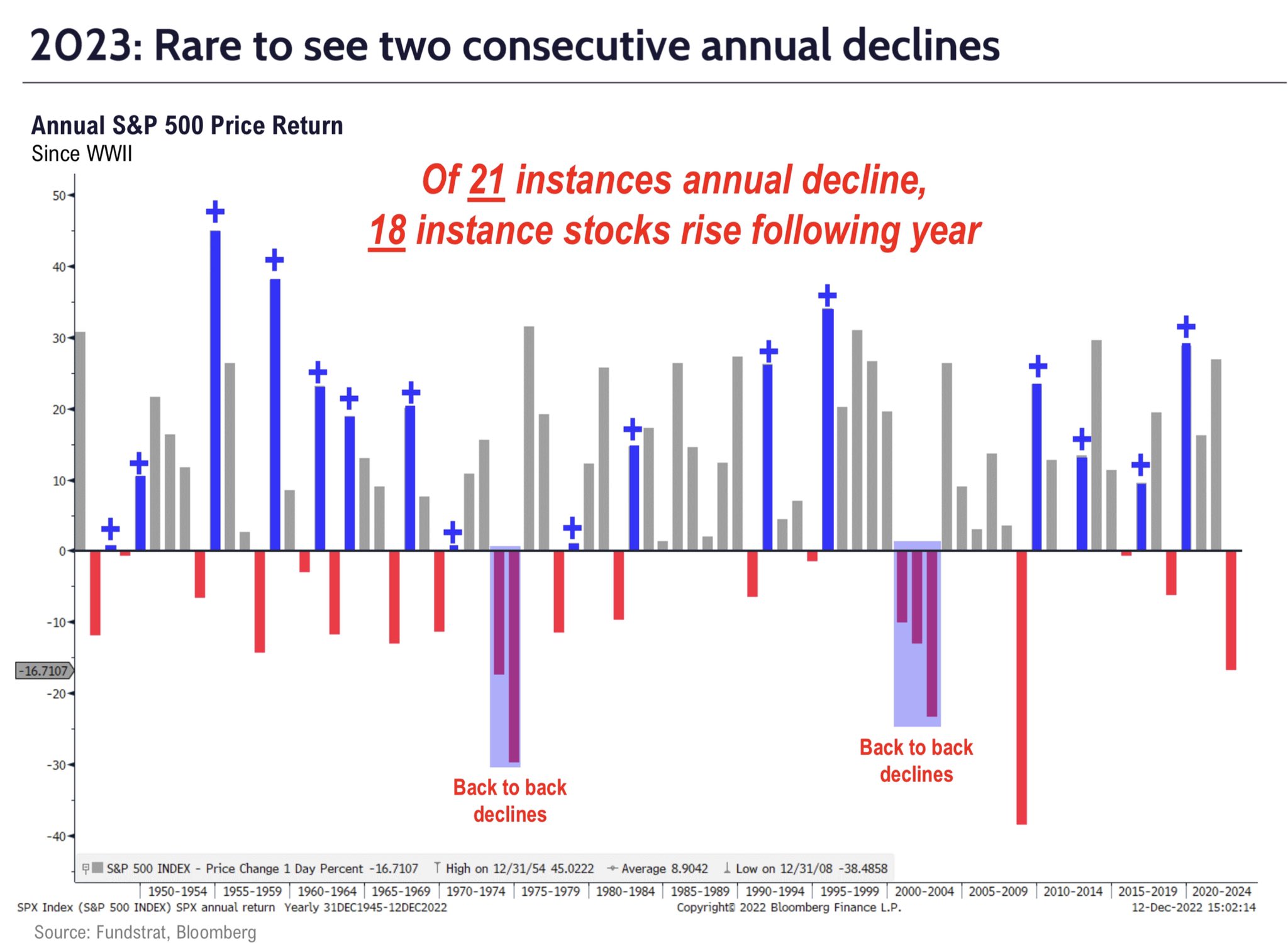

Lee also said stocks tend to bounce back after years of decline.

“Unless the inflationary crisis persists, financial conditions will ease.

And it still doesn’t make sense why the US is the worst performer in global stock markets outside of China-speaking countries in 2022. Are you performing?”

Lee points to a statistic shared by Fundstrat research associate Matt Cerminaro. Cerminaro says that in the last 50 years (1974, 2002, 2008) he has only had three years where the S&P 500 has had as many -1% days as his 2022.

Years since 1974, 2002 and 2008 have all seen increases of at least 23%. according to to Cerminaro.

“It’s been a tough year for investors.

The S&P 500 in 2022 had 63 -1% days. Ah.

In the last 50 years, there have been only three days when it was -1% down.

1974: n=67

2002: n=73

2008: n=75

Return next year:

1975: 32%

2003: 26%

2009: 23%

2023: ?”

Don’t miss a beat – subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitterfacebook, telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should exercise caution before making risky investments in Bitcoin, cryptocurrencies or digital assets. Please note that your money transfers and transactions are made at your own risk and you are responsible for any losses you may incur. The Daily Hodl does not endorse the buying or selling of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. The Daily Hodl participates in affiliate marketing.

Generated image: In the middle of the journey

[ad_2]

Source link