[ad_1]

As the end of 2022 draws to a close, many Bitcoin supporters are wondering if the bottom has been reached as far as the official end of winter for cryptocurrencies is concerned. We have just entered the longest trough formation since Bitcoin’s bear market in 2015. Additionally, analysts point out that most of the technical bottom indicators used to predict the Bitcoin price fail to predict whether a bottom has been reached.

Rainbow and S2F: List of Technical Indicators That Couldn’t Predict Bitcoin’s Bottom

A month ago, crypto supporters celebrated enduring one of the longest and most severe Bitcoin bear markets since Bitcoin’s bear market of 2013-2015. At the time, the 2013-2015 Bitcoin bear market was the longest bear market, but today, the current crypto economic contraction period is set to exceed the 2013-2015 crypto contraction period. It has been.

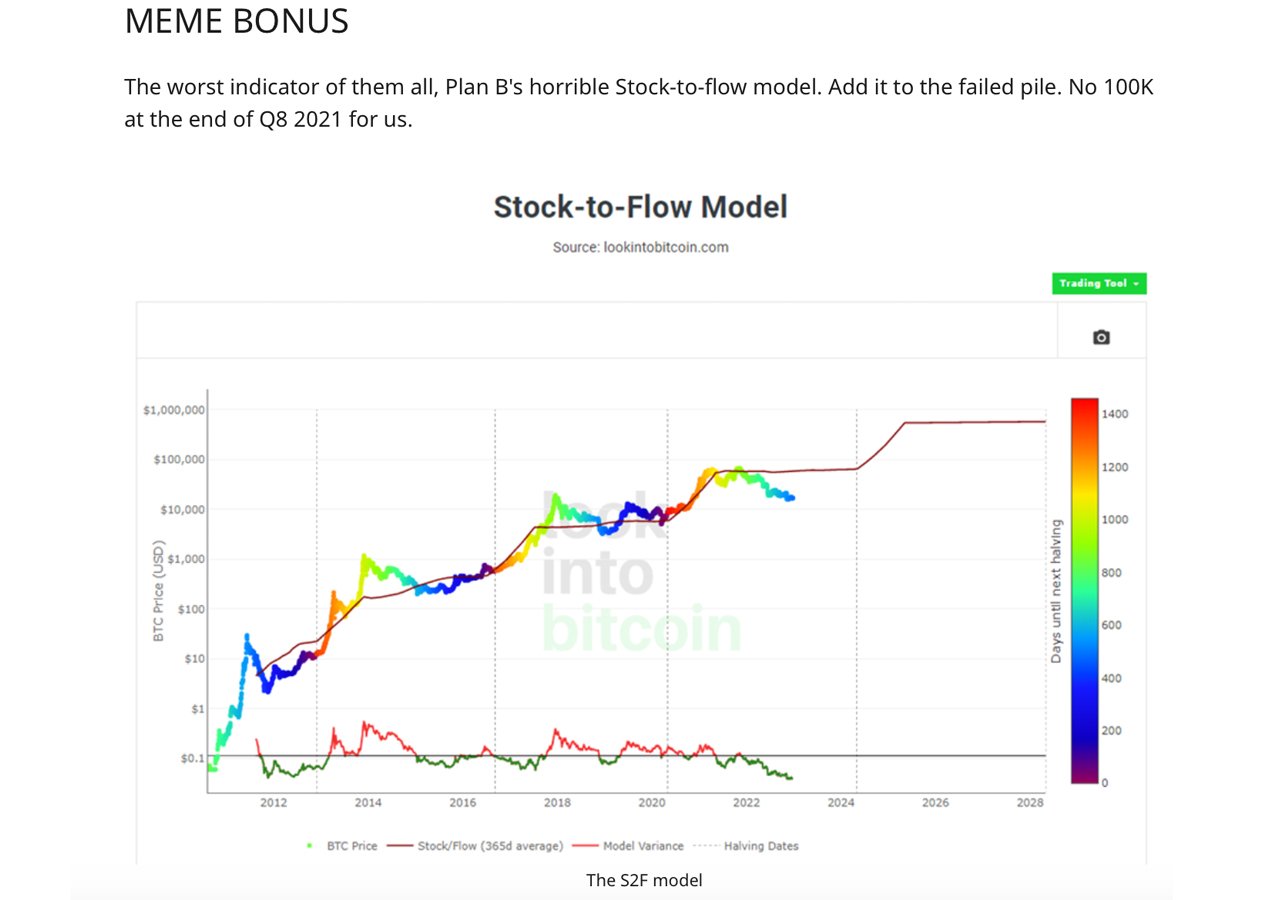

In addition to longest bottom phase, Bitcoin.com News reported 144 days ago that many technical indicators have failed this year to predict Bitcoin’s future US dollar value. One of the biggest pricing model failures mentioned this year was the stock-to-flow (S2F) model.

“I need more pain before I hit bottom”

My man, we saw:

– Top 3 Exchange Collapse

– Liquidation of two industry-leading VCs

– 2 top 10 coins in $60B+ mcap go to zero

– The lending market has been wiped out

– Bitcoin up to 80% down from ATH

– 90-99% down from ATHWhat more do you want?

— Kaleo (@CryptoKaleo) December 22, 2022

With all the so-called “best” technical indicators failing miserably, many crypto advocates are still writing forum posts, social media thread About the confounding bottom of Bitcoin. For example, on December 27th, the Twitter account Crypto Noob murmured: “Bitcoin is currently trading in the oversold zone. This is where historically bottoms have formed. Do you think BTC has bottomed out?”

Questions and posts like this litter crypto-focused forums and social media platforms like Facebook and Twitter. On Reddit, the subreddit forum r/cryptocurrency featured a post highlighting how Tech Bottom his indicator failed, and the author of the post said the analyst had “no clue” and this time “IS is different.”

The author of this post, u/Beyonderr, explains why 8 technical indicators were unreliable for Bitcoin traders this year. For example, the Weekly He RSI (Relative Strength Index) was thought to mark oversold levels and bitcoin bottoms, but Beyonderr says, “This has not been true this year.” .

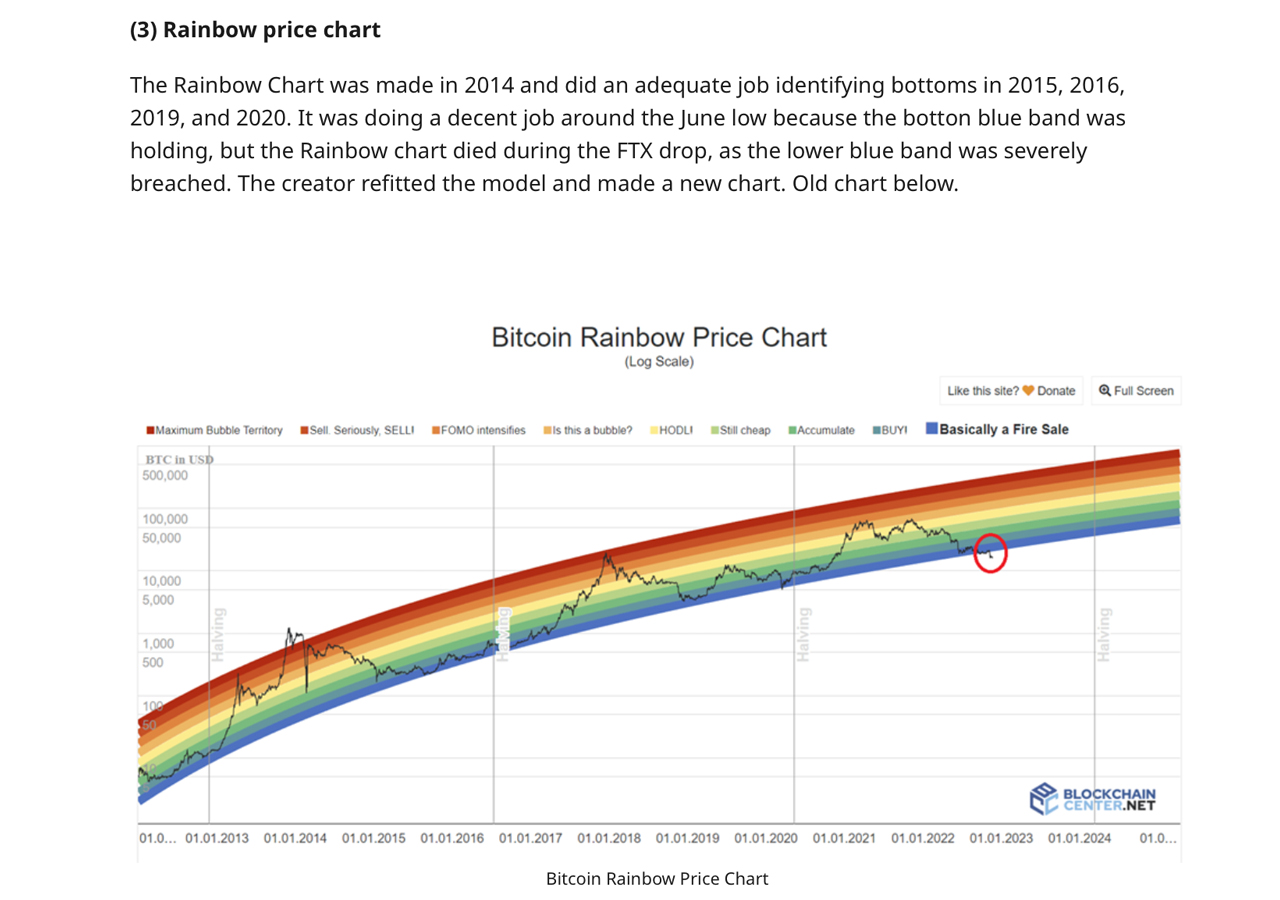

Other unreliable technical indicators that Beyonderr mentioned include Monthly MACD (Moving Average Convergence/Divergence), Rainbow Price Chart, 200 Weeks Moving Average, 100 Weeks Moving Average X 20 Weeks Moving Average, Pi Cycle Indicator, Hash Ribbon Indicator. , and the average percentage of drawdowns from cycle highs.

Additionally, Beyonderr derided the S2F pricing model by calling it a “meme bonus” indicator. “The worst metric of them all is Plan B’s horrible stock-to-flow model. Add to the failing pile,” Beyonder wrote. In a post on r/cryptocurrency, at least he also says there may be four indicators suggesting that the bottom “may be in,” according to Beyonderr.

Indicators cited by Beyonderr include signals such as ‘time in the market’, ‘Puell Multiple’, ‘Mayer Multiple’ and ‘MVRV Z-score’. On the other hand, many people on social media platforms like Twitter genuinely believe the bottom is pretty close, but so far most technical signals are just unreliable deviations.

What are your thoughts on the failing technical indicators that failed to predict Bitcoin’s bottom? Let us know your thoughts on the matter in the comments section below.

image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. This is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. NEITHER THE COMPANY NOR THE AUTHOR WILL BE LIABLE, DIRECTLY OR INDIRECTLY, FOR ANY DAMAGE OR LOSS ARISING OR ALLEGED TO OCCUR ARISING OUT OF OR RELATING TO YOUR USE OF OR RELIANCE ON ANY CONTENT, PRODUCTS, OR SERVICES DESCRIBED IN THIS ARTICLE. We are not responsible.

[ad_2]

Source link