[ad_1]

- BlockFi Bitcoin mining loans will be supported by 68,000 mining machines.

- Some of these loans are short of collateral as mining rig prices have fallen.

- Earlier this month, Celsius Mining filed a petition in court to sell mining equipment worth $1.3 million.

BlockFi was hit hard last year following the collapse of FTX in November and Three Arrows Capital in Q2 2022. His BlockFi, which filed for bankruptcy shortly after FTX, has started a list of companies trying to recover customer funds. BlockFi itself is trying to achieve the same.

BlockFi Bitcoin Mining Loan

BlockFi is now looking to sell loans backed by Bitcoin mining machines to users with 68,000 rigs. The $160 million loan is expected to be under-collateralized due to falling mining machine prices.

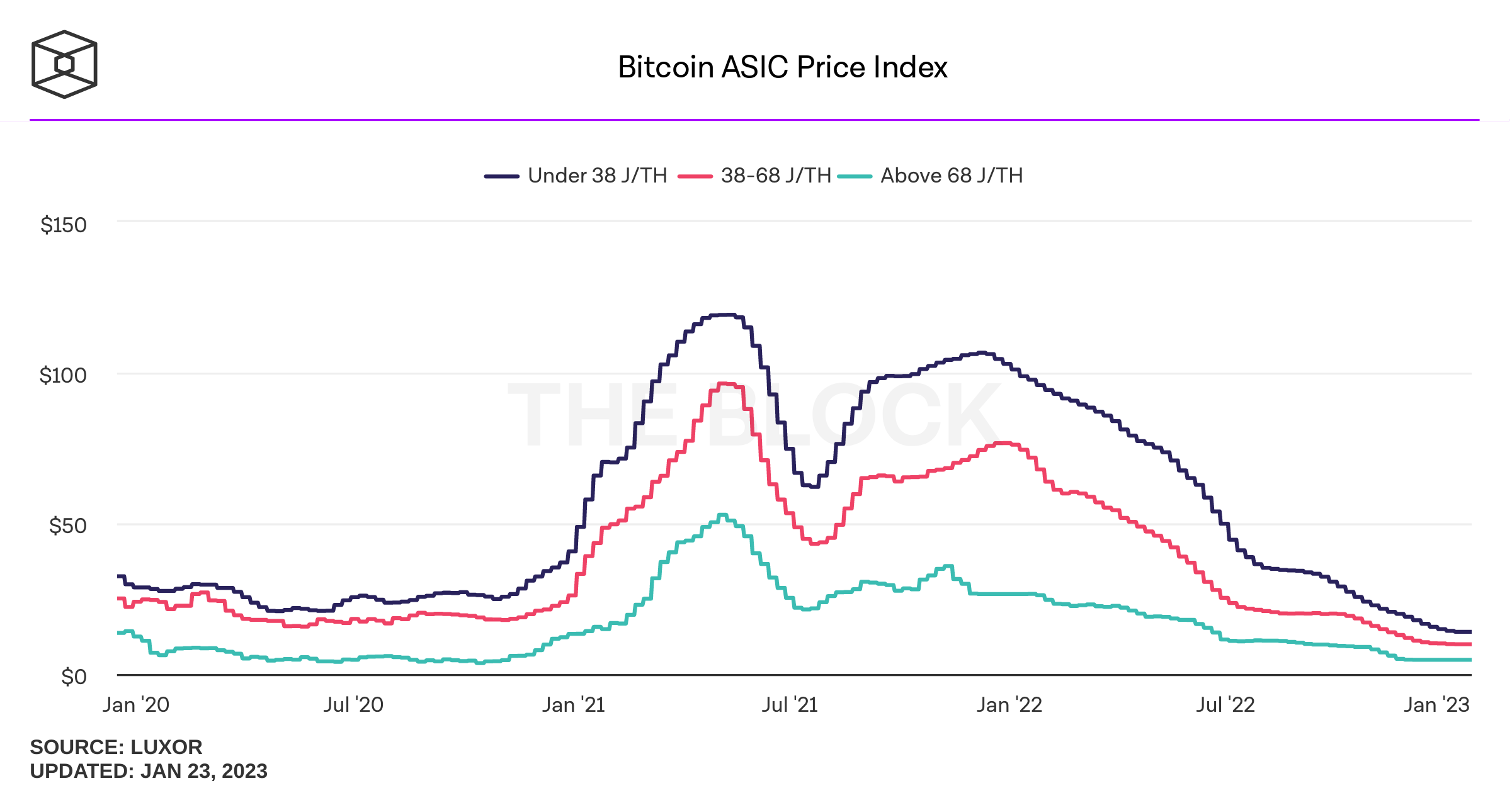

On average, at this time last year, mining rigs with J/Th less than 38 were worth around $98, but have since fallen in value by almost 90% and are now worth around $9.9. The reasons behind this range from the crypto market crash and his falling BTC price, as well as rising operating costs, including electricity costs.

Bitcoin ASIC Miner Price

The drowning mining market had funds like BlockFi, even as traditional lenders kept their distance due to the high volatility of the cryptocurrency market.

Other investors include New York Digital Investment Group, Digital Currency Group Foundry, Galaxy Digital, and bankrupt lender Celsius Network.

Celsius Mining Sells Miner

Unlike BlockFi, which sells loans backed by Bitcoin mining machines, cryptocurrency lender Celsius Network is reportedly selling mining equipment. Filed in bankruptcy court on January 13, the mining arm of the bankrupt company said it was considering selling about 2,687 bitcoin miner rigs to an investment firm called Touzi Capital.

Earlier this month, bankrupt lender founder and CEO Alex Mashinsky was sued by New York Attorney General Letitia James.

According to James, Alex was responsible for defrauding hundreds of thousands of customers and tried to assure him that he would resume business in New York along with recouping the losses faced by investors.

[ad_2]

Source link