[ad_1]

Ruza Studios

Bitfarms Co., Ltd. (NASDAQ: BITF) is one of the largest Bitcoin mining companies in the world, with an operational hash rate of about 2% of the global Bitcoin network.Stocks hit their heyday in 2021, but have reached peak market value Above $1.5 billion, 2022 has been a disaster with stocks losing more than 90% in the Bitcoin crash (BTC-US Dollar) price. In hindsight, it’s clear that expectations for the company and the broader sector were ahead.

That being said, Bitfarms has remained a survivor as the operation unfolded and is, in our opinion, one of the better names in this highly speculative segment. The business model as a “self-miner”, not relying on outsourced hosting or even providing mining services to other parties, has led to bankruptcies where these steps have attracted attention among other industry players. Given that, it has proven to be an advantage.

There is no easy turn for Bitfarm, which relies on a sustained rise in the Bitcoin price for its long-term success. Still, even in the current pricing environment, we can point to some promising fundamentals, such as continued mining growth and positive operating cash flow.A relatively large balance sheet of cash and bitcoin holdings. The position will dispel solvency concerns and mean that BITF will remain relevant for the foreseeable future.

BITF Key Metrics

Bitfarms are self-miners, which means they build data centers where Bitcoin mining machines are located. The strategy was either contracting with his suppliers for third-party hosting like Marathon Digital Holdings, Inc. (MARA) did, or mining-as-a-death sentence for mining and Core-Scientific (CORZ). provision of service.

In the case of MARA, the company’s hosting provider, Compute North, went bankrupt after a combination of skyrocketing energy prices and the fall in Bitcoin led to a collapse in demand for its services. MARA had partnered with Compute North on the development of the new project, but the disruption represents a setback in its expansion plans. Once considered a ‘blue chip’ sector due to its size, Core-Scientific was crushed by extreme energy prices at its Texas facility, but the company finally filed Chapter 11 this month. What led to this was a large amount of debt.

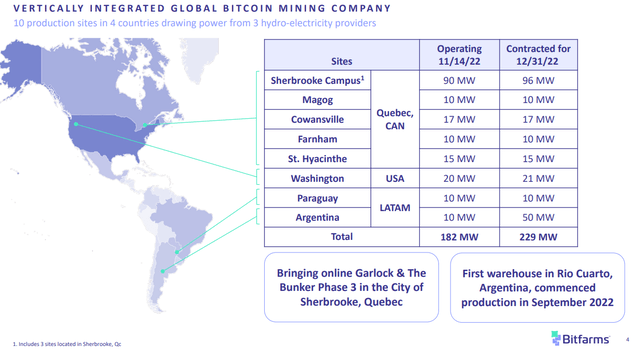

In this regard, Bitfarms benefits from vertical integration by focusing on setting up and managing production facilities while avoiding hosting arrangements. Today, the company has 10 locations in Canada, the United States and Latin America, and sources renewable energy primarily through hydropower purchase agreements.

Company Profile

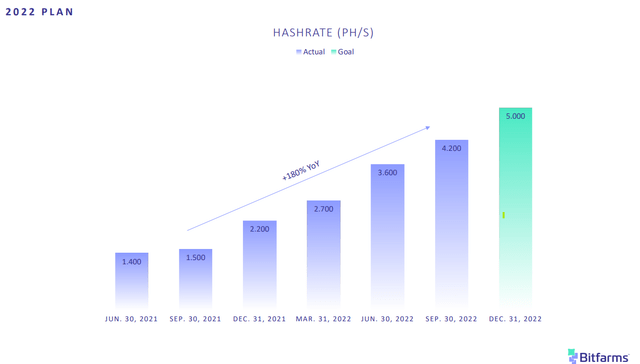

According to the latest update, the company plans to operate 188 MW of electricity by the end of 2022, which means its Bitcoin mining hash rate capacity is 5.0 exahash compared to 4.4 EH/s in November. suggesting. This result is almost double the operation Bitfarms announced at the end of 2021. In Q3, the company installed its latest 7,000 “MicroBT Whatsminers” mining rig, adding about 0.8EH/s.

Company Profile

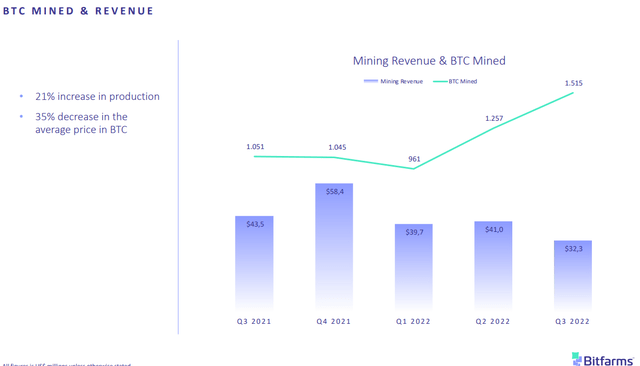

Meanwhile, Bitfarms produced 1,515 BTC in Q3, up 21% from Q2 and up 45% year-on-year, but its momentum could not escape sharply declining BTC pricing. . Revenue in Q3 was $32.3 million, down from his peak of $58.4 million in Q4 2021, which was at the height of the Bitcoin cycle.

Company Profile

The important point here is that Bitfarms reported Bitcoin production cost of 9,400 BTC in Q3. This is up 18% from the end of last year. Part of this reflects the difficulty of the climbing network along with moderate energy and FX volatility. This number was down 5% from the second quarter. This is based in part on operational efficiencies from distributing production to lower cost locations. Management says it remains the lowest-cost producer among publicly reported miners.

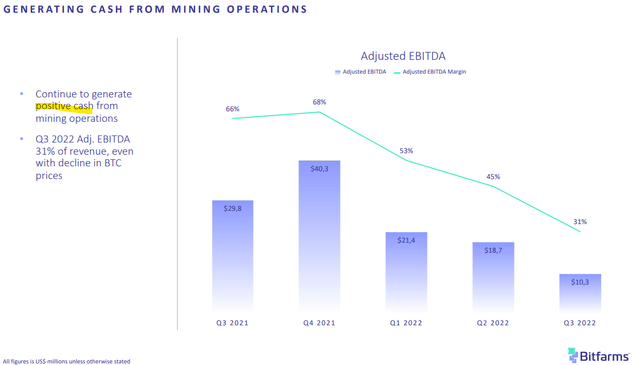

More importantly, the underlying mining business remains profitable, acknowledging that margins above breakeven are tighter. Adjusted EBITDA for the third quarter was $10.2 million, with a margin of 31%, down from a peak of $40.3 million, with a margin of 68% in the fourth quarter of 2021. This trend largely explains the poor performance of the stock in 2021, when the BTC price rises above $50,000, an entirely different reality in terms of potential profitability.

Company Profile

The company ended the third quarter with $36 million in cash and 2,064 BTC on its balance sheet, with $86 million in total long-term debt and $76 million in total liquidity at the end of the quarter. One of the strategies employed to address its ongoing expansion efforts is the periodic sale of a portion of its Bitcoin production and holdings as a way to generate cash as part of its funding strategy. was.

In the second quarter, Bitfarms postponed the delivery of some equipment to 2023 and was able to negotiate payment terms with vendors taking into account changing market conditions. Still, it plans to move forward with building facilities in Quebec, Canada, Argentina and Paraguay. In this regard, although some logistical issues with the import of equipment into Argentina will delay some deployments in 2022, management intends to expand operations in the country, along with neighboring Paraguay as a low-cost mining jurisdiction. I am particularly keen on growth opportunities.

Company Profile

The latest update from its November operations report shows that Bitfarm sold 400 BTC from its holdings during the month, converted 453 it mined during the period, generating $14.6 million in revenue, and went into loans and equipment purchases. paid off a related $10 million debt. His 1,664 BTC, reported on Nov. 30, is worth about $27.5 million in current market value. Note that this is all in the context of a company with a current market value of around $100 million.

Next steps for Bitfarms

Bitfarms and the Bitcoin mining industry as a whole need to restore the BTC price, ideally at some point in the future to return to all-time highs. Whether it’s 2023 or a few years from now, the other side is a scenario where BTC falls or goes to zero amid more pessimistic or cryptoskeptic forecasts.

The attraction of BITF is that we believe it can outperform the market price of Bitcoin as a direct play leveraging digital assets. Assuming Bitcoin price rises, we expect BITF to gain momentum as sentiment improves and valuation multiples expand to some extent.

Bitfarms’ current monthly BTC mining production level averages around 475 BTC per month, and an annualized rate approaching 5,700 means a potential revenue of around $100 million at current market prices. increase. On this measure, the stock trades in about 1x futures contracts.

Simply put, a $1,000 increase in the BTC market price could increase annual revenue by $5.7 million. In a scenario where BTC rises towards $25,000, operating leverage supports significantly higher Adjusted EBITDA and a 50% increase in sales.

Conversely, especially if BTC approaches the company’s cost of production, mining revenues will decrease in proportion to the falling BTC price, and operating losses will skyrocket. Another dynamic to consider is the increasing difficulty of the network over time. This means that the value of Bitfarm’s hashrate mining capacity will gradually be diluted. This means that either the company should continue to expand capacity faster than the network, or we should expect BTC’s price to rise significantly sooner or later.

Again, there are many moving parts and BITF requires a combination of luck and constant execution to make its long-term strategy work. Going forward, facilities under development will come online, while infrastructure investment requirements will continue to decline, leaving room for improvement in operating margins.

Company Profile

We are bitcoin bulls and we have seen the collapse of “virtual currencies” like Terra Coin (LUNC-USD), the “Celsius Network”, Voyager Digital (OTCPK: OTCPK: VYGVQ) and the latest “FTX”. A scandal can signal a yielding cycle. The advantage of Bitcoin is that establishing itself as the “gold standard” of cryptocurrencies makes it stronger.

In retrospect, there is too much enthusiastic and speculative money in the sector, although there are cases where the long-term vision of Bitcoin as an alternative asset and a storehouse of digital assets is still alive and well. Clearly there was.

It shows that BTC has been trading in a relatively narrow range over the past few months. One interpretation of this apparent stable bottom is that we are taking the first steps towards a rebound. A broader market upturn in 2023, including the view that “technology” and high-growth segments will pick up steam, could provide the potential for Bitcoin to outperform its gains.

On the downside, Bitcoin also hopes to be exposed to further deterioration in the macro outlook that will trigger renewed volatility in financial markets. Acceleration may begin.

looking for alpha

final thoughts

BITF has had very bad trading behavior, but it feels like the underlying value is being discounted beyond the underlying trend. In our view, the bullish outlook for Bitcoin puts the BITF well-positioned to rebound as higher Bitcoin prices further strengthen financials.

The bitcoin and cryptocurrency sector remains high risk and the possibility of further declines for any reason is very real. Among that group, Bitcoin miners stand out as an absolute chasm in the market following a disastrous 2022 that forced a reassessment of the industry’s long-term viability.

Still, we believe Bitfarms’ upside potential represents an attractive risk-adjusted return opportunity. Stocks act as small positions with a larger diversified portfolio. Monitoring points are the monthly production level and the next update of the balance sheet.

Editor’s note: This article covers one or more microcap strains. Please be aware of the risks associated with these stocks.

[ad_2]

Source link