[ad_1]

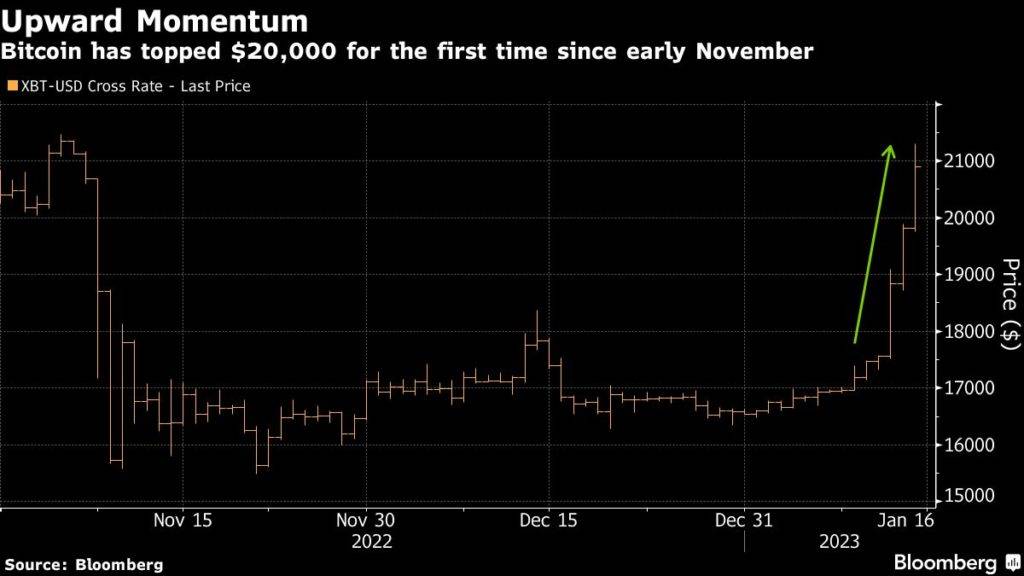

(Bloomberg) — Bitcoin surged above $21,000 on Saturday amid optimism that Bitcoin may have bottomed out and inflation may have peaked.

Bloomberg’s most read articles

The largest cryptocurrency rose 7.5% to $21,299. It has not crossed $20,000 since Nov. 8, and Saturday marked his 11th straight day of gains. Ether, the second largest, saw him rise by 9.7%, while other tokens such as Cardano and Dogecoin also posted solid gains. According to data from CoinGecko, the market capitalization of all crypto assets has crossed $1 trillion for the first time since early November.

The rise comes amid last week’s report on consumer prices that showed inflation eased in January from December levels. The U.S. Federal Reserve (Fed) is moving toward lower rate hikes in response to further cooling, but may continue to do so until price pressures show definitive signs of a slowdown. Risky assets such as the Nasdaq 100 stock index rose for a sixth straight day.

Sean Farrell, head of digital asset strategy at Fundstrat, said: “Crypto has performed well following a weak CPI index, suggesting macro correlations won’t disappear anytime soon. “The follow-through to price action this week is certainly encouraging” and, barring a forced liquidation from troubled crypto firm DCG, “an absolute bottom in crypto prices is likely near am.”

Bitcoin’s price has remained in a narrow range between $16,000 and $17,000 for weeks before this latest breakout. According to Coinglass data, short selling of cryptocurrencies has exceeded $100 million in five of the last six days. Saturday’s totals peaked at over $296 million.

Hayden Hughes, Chief Executive Officer of social trading platform Alpha Impact, said, “Crypto markets are forgetting the macro situation as the CPI drop coupled with the announcement that FTX liquidators have recovered $5 billion in liquidity. “Given a lot of factors, this is still bearish.” , said in a message on Saturday. “There is a lot of positive momentum in the market heading into the next FOMC meeting later this month.”

Bloomberg Businessweek’s Most Read Articles

©2023 Bloomberg LP

[ad_2]

Source link