[ad_1]

Strike, a Bitcoin-based payment network and financial app, is expanding to the Philippines to grow the cross-border payments and remittances market.

Strike CEO Jack Mallers told TechCrunch, “The Philippines is one of the largest remittance markets in the world, especially from the United States. was sent to the Philippines from US-based Filipinos.

“When it comes to the technology we build, it’s one of the easiest achievements to achieve. Cross-border payments are a huge pain and have always been. It’s still very difficult.”

Even in Western countries, traditional cross-border money transfer services are slow as it can take days for a bank wire to move from one account to another.

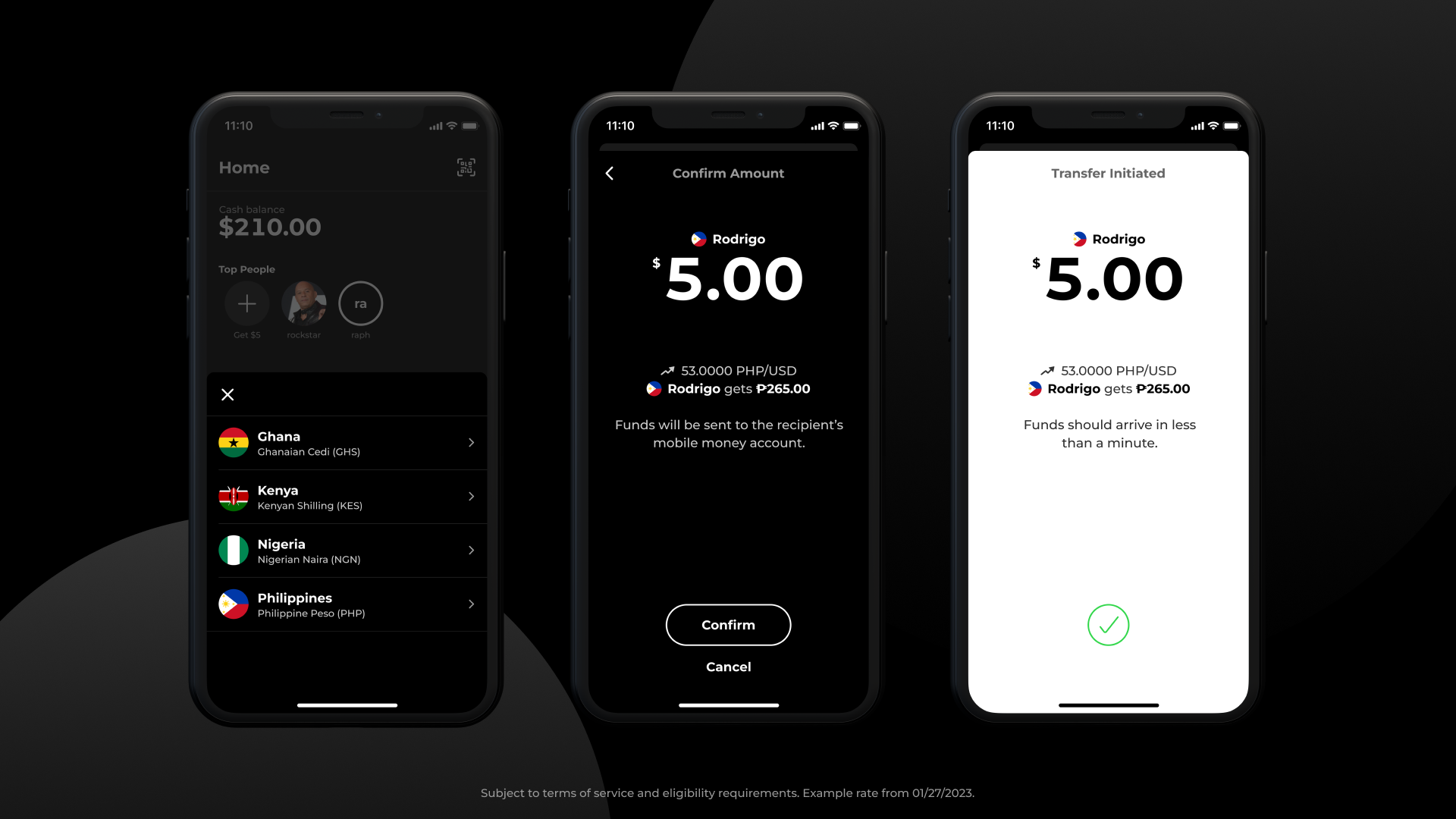

Strike uses instant, low-cost micropayments via the Lightning Network, a Layer 2 payment protocol on top of Bitcoin. This results in millions to billions of transactions per second across the platform. The app’s platform also allows users to transfer US dollars to local fiat currencies, such as the Philippine peso, for less than a cent per transaction, Mallers said.

Image credit: attack (opens in new window)

“None of our users need touch Bitcoin,” Mullers said. This app uses Bitcoin to transfer money from one user’s account to another regardless of price. “The purpose of the business is to hide bitcoin under the hood,” he added, allowing users to profit from its payment network.

For example, if a customer wants to transfer $5 to a country like the Philippines, Bitcoin will be converted through the Lightning Network and reconverted back to the local currency “on the order of seconds to minutes, not days or weeks.” will be Mullers said.

Besides the Philippines, Strike plans to expand further in Latin America and Africa because of “so much demand”, Mullers shared.

Now Strike is capturing demand, with partners seeking integration from everywhere from the UK to across Europe to “20 new countries that may be added in Africa in February.” increase.

Strike earlier this month partnered payment provider Fiserv, the parent company of Clover (the flashy white digital register of many small businesses today), and expanding its offerings.

Last year, the company raised $80 million in Series B funding to drive efforts to expand payment solutions for merchants, marketplaces and financial institutions, the company said.strike too Partner with Visa In August 2022, we will launch a loyalty card paired with that application.

In general, the company’s partnerships and announcements show its focus on growing the remittance market through applications and other alternatives like Clover.

“The goal is to make cross-border and global payments cheaper and faster,” Mallers said. “But it has become more accessible. There is great value in financial inclusion.”

Some Strike users send family members as little as 10 cents, Mallers said. But in a traditional financial system, the fees would outweigh the benefits, he added. “We can process his dime payment…and don’t need to be logged into Chase for international wire transfers.”

He added that in the future, there are opportunities to improve the existing remittance market while opening up new markets. “We are going to see a renaissance of tools really closing that big delta gap and more financial institutions like Square and CashApp taking advantage of this.”

Over the next decade, Mullers believes remittance networks and applications like Lightning and Strike will expand opportunities to all 2-3 to 8-billion people “typically included in global international payment systems.” .

“It’s going to be like a Renaissance moment,” Mullers said. “It’s a really big deal.”

[ad_2]

Source link