[ad_1]

The Bank for International Settlements (BIS) has released a brief paper exploring options for dealing with cryptocurrency risks.

Cryptocurrencies claim to feature many of TradFi’s risks, but while similar, risks tend to be exaggerated. mismatches, and significant information asymmetries.

I’ll add an observation about maturity discrepancies. For example, cryptocurrency lenders have deposits that can be withdrawn immediately, but offer borrowers loans over months or years. TradFi may have similar discrepancies. However, as cryptocurrencies are networked, including at the social/Twitter level, “bank runs” and herd migrations are much more frequent, exaggerating the maturity mismatch problem.

The BIS report highlights that DeFi is often not decentralized, either because the founders have significant token holdings or because others can wield significant clout. It also points out the important role of centralized cryptocurrency exchanges as a gateway for cryptocurrencies. Another observation we have made is that decentralized wallets increasingly allow direct on-ramp with credit cards, which will partially erode the role of exchanges’ on-ramp over time. There is likely to be.

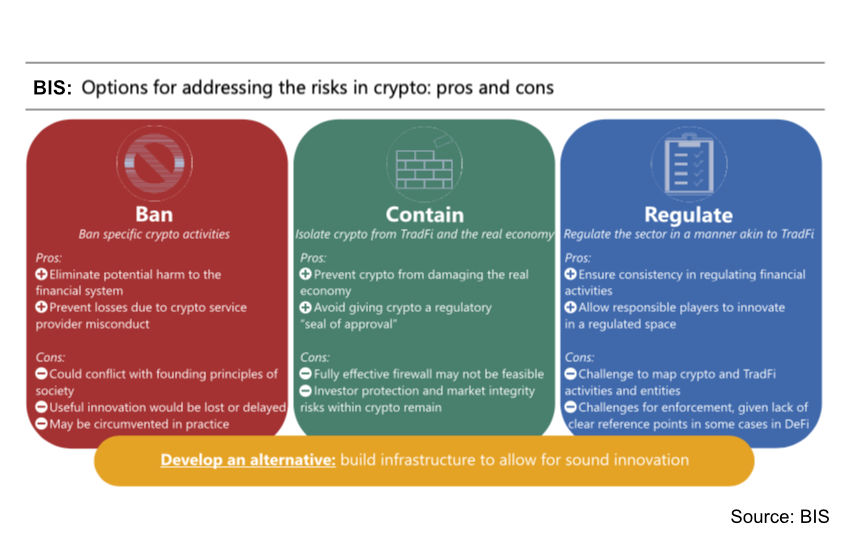

4 Ways to Address Crypto Risk

The BIS report highlights three routes that directly address cryptocurrency risk, but the report also mentions a fourth route. This is to reduce payment costs or make TradeFi more attractive through Central Bank Digital Currencies (CBDC). However, while it is understandable that it is the hottest application for the central banking community, he argues that payments are just one of the applications.

The three direct routes to controlling crypto risk are prohibition, containment, or regulation.

BIS recognizes that: Ban may not be accepted in a free society. Also, bans can be avoided and can stifle innovation.

To including crypto BIS stands for Ring Fencing Ciphers, so minimal overlap with TradFi is maintained. As an example of containment, BIS cites the Basel Committee Crypto Regulations for Banks. The final version he published in December. Another example is the SEC’s refusal to allow spot Bitcoin ETFs. However, even with TradFi ring-fenced, the issue of investor protection still exists. The BIS also notes that regulators could lose credibility if steps are not taken to protect cryptocurrency investors.

and the behavior is probably regulationA common approach is to map cryptographic activity to traditional activity, applying the same risks and rules. However, mapping is not always straightforward. For example, some jurisdictions regulate stablecoin issuers as banks, others as payment systems, and others as banks. A second challenge is identifying entities in a decentralized world. However, the starting point is considered the entity that controls the protocol.

With the cryptocurrency crash, especially the collapse of FTX, the cryptocurrency community is preparing for widespread regulation. But politicians are not always as conservative as central bankers. For example, in the UK this week the Treasury Department emphasized that it wants to balance innovation and investor protection to avoid “future foreclosures”.

[ad_2]

Source link