[ad_1]

Bitcoin

Bitcoin

apply now Forbes CryptoAsset & Blockchain Advisor Navigating the Latest Bitcoin and Crypto Market Crash

Bitcoin’s price is below $17,000, a level not seen more than two years ago (although one small cryptocurrency surged in the new year).

Now, billionaire investor and crypto-converter Mark Cuban warns that the next bitcoin and cryptocurrency meltdown may already be looming.

Brutal bear markets need up-to-date information the most! Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors and anyone interested in cryptocurrencies

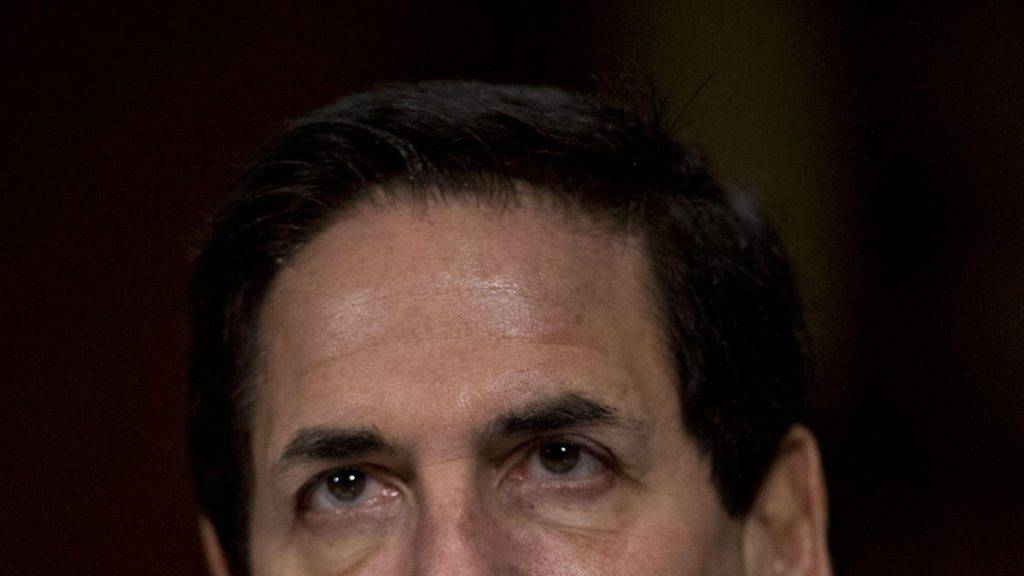

NBA’s Dallas Mavericks billionaire owner Mark Cuban has flipped Bitcoin and cryptocurrencies … [+]

“I think the next possible implosion will be the discovery and removal of wash trades on central exchanges,” Cuban said. street“There are probably tens of millions of dollars in trading and liquidity for a little-used token.

But shark tank “I don’t have any details to support my speculation,” Starr said last month, saying he hopes the price of bitcoin will continue to fall to allow people to buy more.

Crypto wash trading involves artificially creating interest in a cryptocurrency through exchange-based trading, which can lead to price increases.

last year, forbes After analyzing over 150 cryptocurrency exchanges around the world, we found that 51% of reported daily Bitcoin trading volume was likely wash trades.

According to a December report from the National Bureau of Economic Research, 70% of cryptocurrency trading activity on many of the world’s largest bitcoin and cryptocurrency exchanges could be illicit wash trading.

“These estimates equate to over $4.5 trillion in wash trading in the spot market and over $1.5 trillion in the derivatives market in the first quarter of 2020 alone,” the report’s authors wrote.

A recent study on non-fungible token (NFT) wash trading revealed that wash trading will account for more than half (58%) of total NFT trading volume on the Ethereum blockchain in 2022. explained By market watchers as cryptocurrency’s most “overlooked issue”.

SIGN UP NOW crypto codex— Free daily newsletter for those interested in cryptocurrencies

The price of Bitcoin has skyrocketed over the past few years, … [+]

Meanwhile, Bitcoin and cryptocurrency investors are hoping that improving macroeconomic conditions could mean the end of the brutal bear market in 2022.

“In our bullish scenario for 2023, US inflation will fall as Fed monetary tightening peaks and the labor market remains strong,” said trading platform Woo Network. co-founder Jack Tan said in an email.

“This means that risk sentiment in the cryptocurrency market has improved. fell unexpectedly, but more evidence is needed to confirm the shift Uncertainty may still remain over inflation in 2023. Impact of Fed rate hikes on the real economy there is a delay,” he said.

[ad_2]

Source link