[ad_1]

Supply chain disruptions, rising energy costs and tight labor markets are cited as key challenges for medium-sized businesses in Australia

Sydney, 10 January 2023–(BUSINESS WIRE)–A majority of Australian midsize business leaders (71%) are grappling with rising costs and challenges from inflation (71%). At the same time, JP Morgan’s second annual Australian survey found that nearly six in 10 (59%) are confident in the global and domestic economies, and that they are confident in their earnings (77%) and profits ( 74%) expect an increase. Business Leader Prospect Survey.

This press release features multimedia. Read the full release here: https://www.businesswire.com/news/home/20230110005176/en/

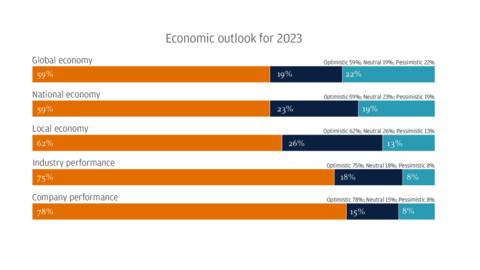

Economic Outlook 2023 (Graphic: Business Wire)

Annabel Mooney, Head of Commercial Banking, Australia and New Zealand, JP Morgan, said: “They see growth potential in the year ahead, but have had to be agile to adopt and deploy new strategies in response to changing market conditions.”

A survey of 200 senior executives at medium-sized companies in Australia found that the theme of optimism was clear, with less than half (46%) of local business leaders expecting a recession in 2023. ), UK (69%), India (61%), Germany (59%), France (53%).

Robert Bedwell, CEO of JPMorgan Australia, said: new zealand.

Alleviating inflation and supply chain disruptions

With rising inflation headwinds across economies around the world, 7 in 10 (71%) of midsize business leaders in Australia are experiencing rising costs as a result. More than two-thirds (67%) of those businesses facing inflation problems report that rising energy costs, rising interest rates and capital costs (61%) are causing rising costs of doing business. increase.

The main ways decision makers deal with inflation are by raising prices (43%), automating processes (43%) and changing pricing models (42%). To further reduce costs, almost half (45%) of Australian midsize businesses pass on up to a quarter of their increased costs to consumers.

In response to supply chain disruptions, less than half (40%) of respondents say pressures have gotten worse over the past 12 months, while a third (33%) say they have improved. To address ongoing supply chain challenges, business leaders are seeking to Allocating more funds.

survive a tight labor market

The Australian work environment remains a top concern for mid-sized business leaders, with more than half (52%) expecting headcount increases in the next year. As they battle high labor demand, those preparing for more jobs include:

-

Providing flexible working hours (54%)

-

Allow flexibility in where employees work (51%)

-

Provide upskilling and training opportunities (51%)

-

Increase in wages and benefits (49%)

Elevating what success is through corporate responsibility

Over the next year, Australian midsize business leaders will focus on the importance of corporate responsibility factors, with social (57%) and environmental (51%) as well as diversity, equity and inclusion ( 57%) are cited as most important to their business strategy. — 14%, 14% and 16% increases respectively from 2022.

The top results of these corporate responsibility initiatives are rooted in improving employee retention (52%) and building company culture (50%), up 4% and 11% respectively from last year. .

prepare for the future

As midsize business leaders in Australia prepare for the future, more than half expect to expand into new distribution channels (53%) and new geographic markets within the country (51%), and introduce new products and services (44%). are planning

Six in 10 business leaders say they have no plans to sell or transfer ownership at this time, a 36% increase from 2022. His 30% of leaders considering a full or partial transfer intend to sell to a third party or management group, and 19%. We plan to increase 12% from 2022 and pass it on to family members through gifts.

For more information on the 2023 Australian Business Leaders Outlook, please visit jpmorgan.com/business-outlook-AUS.

Survey method

JP Morgan’s Australian Business Leaders Outlook Survey will be conducted online from 21 November to 8 December 2022. In total, it covers his 200 business leaders (CEOs, CFOs, Treasurers and Owners) of medium-sized Australian companies ($20m to $2bn annual turnover). AUD) participated in the survey. The results are within the statistical parameters of validity, with an error rate of +/- 7.0% at the 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Company (NYSE: JPM) is a leading financial services company headquartered in the United States (“US”) with operations around the world. As of September 30, 2022, JPMorgan Chase had assets of $3.8 trillion and shareholders’ equity of $288 billion. The company is a leader in investment banking, consumer and small business financial services, commercial banking, financial transaction processing and wealth management. Under the JP Morgan and Chase brands, the company serves millions of customers in the United States and many of the world’s most prominent corporate, institutional and government clients worldwide. Information about JPMorgan Chase & Company is available at www.jpmorganchase.com.

© 2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, NA member FDIC. JPMorgan Chase Bank, NA is organized under the laws of the United States and has limited liability. See jpmorgan.com/cb-disclaimer for full disclosure and disclaimer related to this content.

View source version at businesswire.com: https://www.businesswire.com/news/home/20230110005176/en/

contact address

JP Morgan Australia: Mark Sefiani, mark.sefiani@jpmorgan.com

JP Morgan Commercial Banking: Bentley Weisel, bentley.r.weisel@chase.com

[ad_2]

Source link