[ad_1]

The constant growth of the app ecosystem has finally slowed down over the past year. The annual review of the app economy by mobile analytics firm data.ai (formerly App Annie) found that consumer spending on mobile apps will decline for the first time in 2022 after he saw a 19% year-over-year growth. I know what I did. Consumer spending will drop 2% in 2022 to reach $167 billion, according to the report. Meanwhile, downloads grew 11% year-on-year to reach 255 billion, and time spent on Android apps alone grew 9% to 4.1 trillion.

The new analysis, published in the company’s annual State of Mobile report, is based on consumer spending across all app stores, including third-party Android app stores in China. This shows the impact of the downturn on what has been a growing industry where apps have generated more revenue each year than in the previous year.

Data.ai CEO Theodore Krantz said in a statement about the company’s new findings: “While mobile demand is the gold standard, consumer spending is tightening,” he added.

Over the past few years, mobile gaming has driven much of consumer app spending, but that gap has narrowed as subscriptions have become a more popular way to generate revenue from non-gaming apps. .

Ultimately, data.ai proves that non-gaming apps are more resilient in a recession. This is probably because consumers see apps as more essential than games. In 2022, his spending on games will drop by 5% to $110 billion, while his spending on non-gaming apps will increase by 6% to $58 billion.

Image credit: Data.ai

Another angle that shows the disproportionate impact the economy has had on games is looking at how many games will earn more than $10 million, $100 million, or $1 billion in 2022. This year, the number of games in each of these categories decreased by 1%, 4%, and 33%, respectively.

In total, 1,419 apps and games will exceed $10 million annually in 2022, 224 will exceed $100 million, and only 10 will exceed $1 billion.

Ahead of data.ai’s report, Apple released its own 2022 App Store metrics on Tuesday, touting the record $320 billion paid to developers since the App Store’s inception. Calculations behind the napkin suggest that consumer spending may have slowed on that platform, but app developers, as a group, have given Apple his 30% commission for in-app purchases. I can’t give you an exact number because I no longer pay. Some indie developers may qualify for Apple Small his business discount. Additionally, Apple offers different commission structures for apps that provide access to media and apps run by some news publishers (similar to Google).

According to data.ai’s report, 2022 saw a clear hit to consumer spending, but growth was seen in other areas of the app economy. For example, her time spent per day per user increased slightly by 3% year-on-year, topping out at his 5 hours per day. It’s the mobile market, or one-third of your daily wake-up time, according to the company.

Some of the top 10 markets analyzed exceeded 5 hours per day, including Indonesia, Brazil, Saudi Arabia, Singapore, and South Korea. On the other hand, time spent in Saudi Arabia, Australia and Singapore increased the fastest in four years with 68%, 67% and 62% respectively.

Image credit: Data.ai

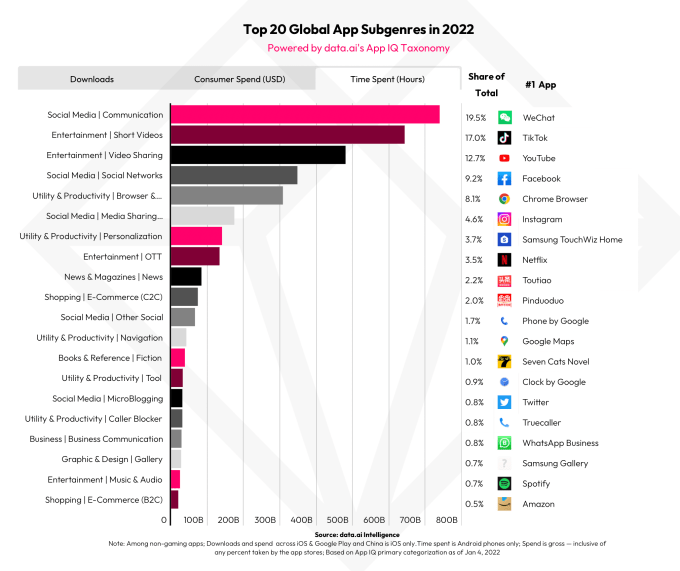

Consumers tended to spend most of their time in three app categories, accounting for half of the time spent on mobile. Social media/communications (19.5% of total time). entertainment/short video (17% of total time); entertainment/video sharing (12.7% of total time).

The first category, social media/communications, includes WeChat, WhatsApp, Facebook, Messenger, Telegram, LINE, and Discord. Meanwhile, the entertainment and short video categories include TikTok, Kwai, Vido Video, Baidu Haokan, and snack videos. The final category of entertainment and video sharing includes long-form videos on YouTube, YouTube Kids, bilibili, etc.

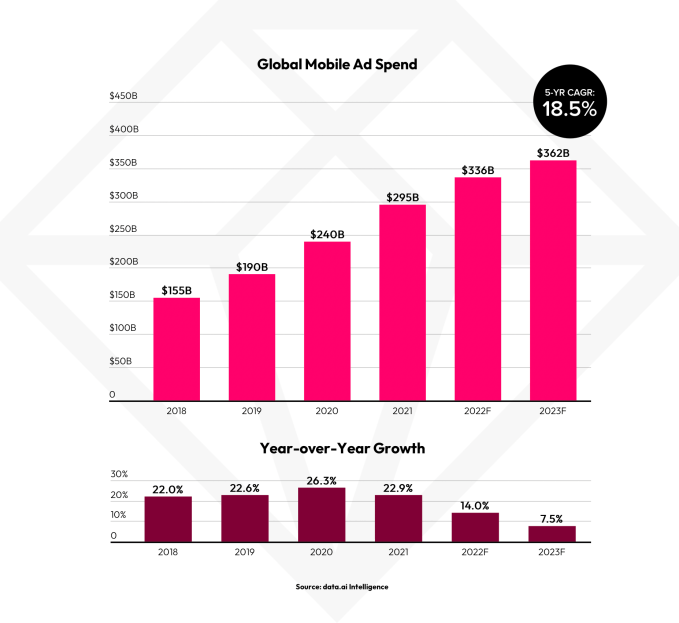

Mobile ad spend also grew 14% year-over-year to reach $336 billion in 2022, but data.ai warns that this growth will slow in the face of economic headwinds. Short-form video apps such as TikTok and YouTube are expected to drive much of this ad spend as social networking platforms decline.

Downloads will also grow in 2022, with game installs up 8% year-over-year to reach 90 billion and non-game downloads up 13% to reach 165 billion. Popular genres driving this trend include sim driving in games, hyper-casual sims, and sim sports. App downloads were driven by personal loan apps (+81%), buy now, pay later apps (+47%), coupons & rewards apps (+27%), and budget & expense trackers (+19%) .

However, both the cryptocurrency trading and investment apps categories experienced a 55% year-over-year decrease in app downloads.

Image credit: Data.ai

The full report delves deeper into other mobile trends for 2022, including those impacting sectors such as finance, retail, social, video, food and beverage, travel, health and fitness/sports. Gen Z trends are also highlighted, including videos, user-generated content, commitment to mindfulness apps, and interest in friend-finding apps like Yubo, Hoop, and Bumble (which have friend-finding capabilities).

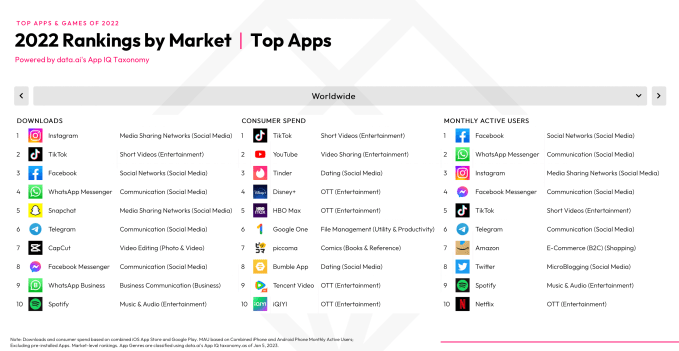

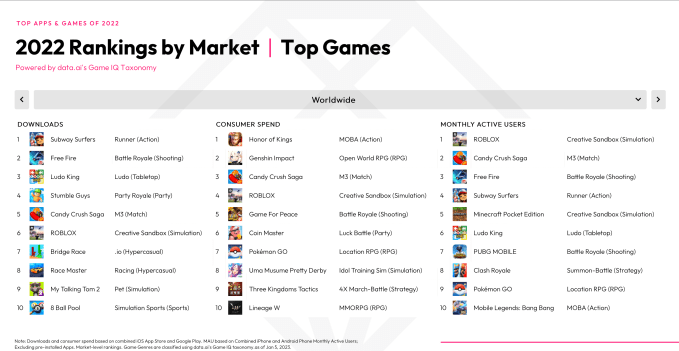

Data.ai also revealed this year’s top apps across downloads, consumer spending, and monthly active users.

Last year, TikTok was the top app by downloads and spend, while Facebook was the top by monthly active users.

2022 saw a bit of a twist as Instagram overtook TikTok to take the top spot in downloads, but the top spots in the other two categories remained the same. And while much has been said about Meta’s decline this year, its apps still hold their own by active users — Facebook, WhatsApp, Instagram and Messenger are listed by monthly active count. occupies the top four of

Image credit: Data.ai

Video and dating apps continued to generate the most revenue, with Tinder and Disney+ still topping the list, and TikTok was also the top social app by consumer spending. According to reports, TikTok has surpassed $6 billion in consumer spending this year, the second most ever for a non-gaming app. This year, TikTok reached the top spot with his consumer spending of over $3 billion.

Image credit: Data.ai

[ad_2]

Source link