[ad_1]

The easiest way to profit from a rising market is to buy an index fund. Individual stocks have the potential to be big winners, but there are many stocks that have not produced satisfactory returns. The downside risk is Amir Marketing and Investments in Agriculture Ltd. (TLV:AMRK) shareholders saw their share price drop 36% last year, so this contrasts with a market decline of 16%. But long-term returns aren’t too bad, and the stock has fallen 14% over the past three years. Shareholders have been even tougher in recent times, with his stock down 25% over the past 90 days.

With the stock down 11% over the past week, it’s worth looking at the performance to see if there are any red flags.

Read the latest analysis from Amir Marketing and Investments in Agriculture.

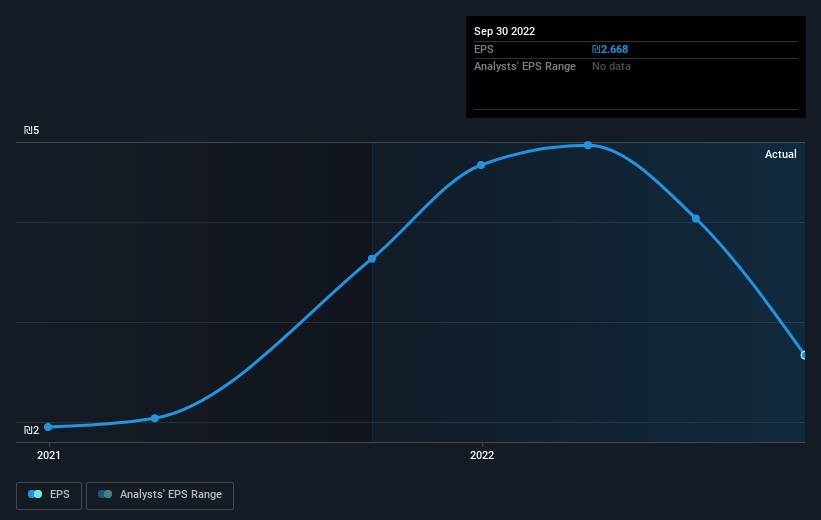

Markets are powerful pricing mechanisms, but stock prices reflect investor sentiment, not just underlying performance. One way to look at how market sentiment has changed over time is to look at the interaction between a company’s stock price and his earnings per share (EPS).

Unfortunately, Amir Marketing and Investments in Agriculture reports a 27% decline in EPS last year. This EPS drop isn’t as bad as the 36% stock price drop. Unsurprisingly, the market appears to be more cautious on equities given the lack of EPS growth. A P/E ratio of 9.26 also indicates negative market sentiment.

The image below shows how the EPS tracked over time (click image for more details).

Check out this interactive chart for Amir Marketing and Investments in Agriculture for a deeper dive into key Amir Marketing and Investments in Agriculture metrics. profit, revenue, cash flow.

another point of view

Unfortunately, Amir Marketing and Investments in Agriculture’s shareholders fell by 34% over the year (including dividends). Unfortunately, this is a worse result than his 16% drop across the market. But it could simply be that the stock has been impacted by broader market jitters. Given the good opportunity, it might be worth keeping an eye on the fundamentals. On the bright side, long-term shareholders are profitable, earning 0.3% per annum over five years. If the fundamental data continue to point to long-term sustainable growth, the current sell-off could be an opportunity worth considering. It’s always interesting to track stock performance over the long term. However, many other factors should be taken into account to better understand Amir Marketing and Investments in Agriculture.However, please understand that Amir marketing and investment in agriculture shows 3 Warning Signs in Investment Analysis what you should know…

However, please note the following: Amir Marketing and Investments in Agriculture may not be the best stock to buy. Now take a look at this freedom A list of interesting companies with historical revenue growth (and further growth projections).

Please note that the market returns quoted in this article reflect the market-weighted average returns of stocks currently traded on the IL exchange.

Valuation is complicated, but we’re here to help make it simple.

find out if Amir marketing and investing in agriculture You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link