[ad_1]

patronage

In January 2023, ViaBTC Capital and CoinEx jointly released the 2022 Crypto Annual Report, with data analysis on nine sectors including Bitcoin, Ethereum, Stablecoins, NFTs, Public Chains, DeFi, SocialFi, GameFi, and Regulatory Policy. and provided insight. The report also predicts crypto trends for 2023.

According to the report, the entire cryptocurrency industry will be bearish in 2022, influenced by factors such as the macro environment and the bullish-to-bearish transition. Most of the cryptocurrency sector has been bearish, especially following the Terra meltdown in May. Below is an overview of each segment.

1. Bitcoin

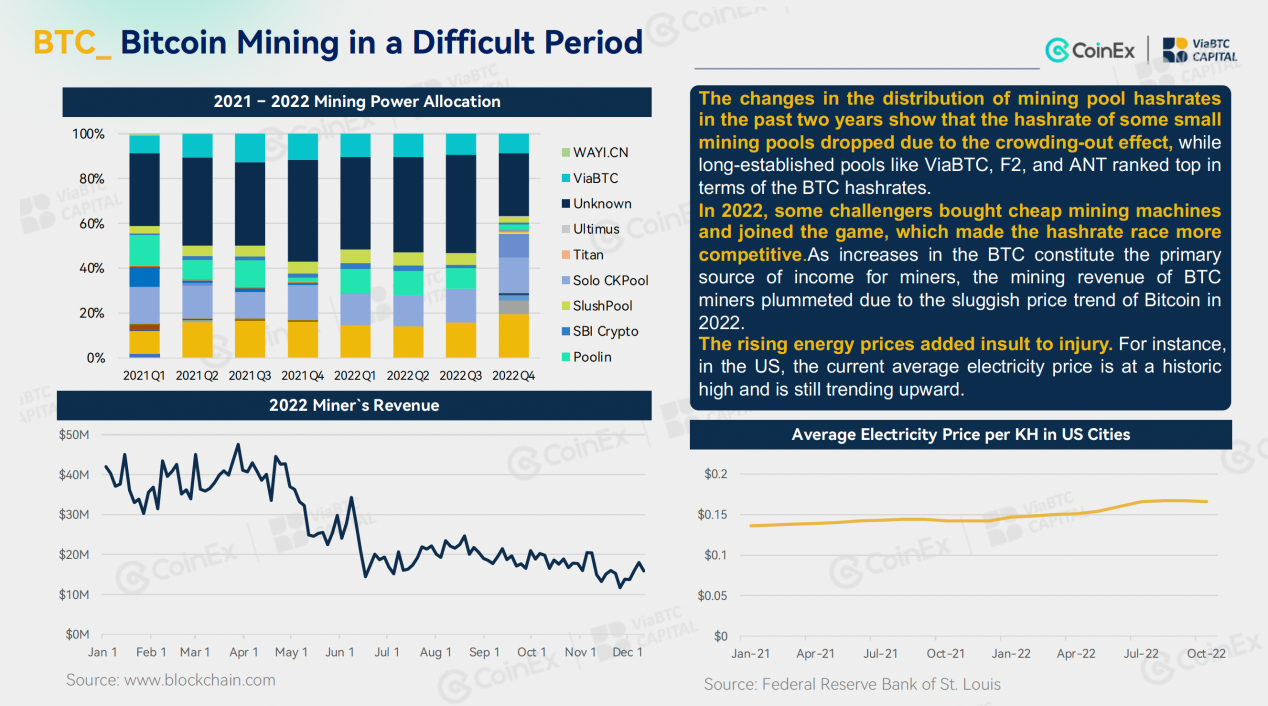

In 2022, Bitcoin’s overall performance remains subdued, with prices and trading volumes significantly lower than in 2021. End-2022 prices have fallen below the last bull market peak. Bitcoin’s price movement throughout the year is clearly influenced by the pace of US interest rate hikes, but as the US rate hike policy progresses, the impact on Bitcoin’s price is gradually diminishing. When it comes to BTC mining, the network difficulty remained at a historic high. Meanwhile, mining revenues plummeted, and miners had to shut down older models. Affected by multiple factors, the mining industry witnessed a strong crowding out effect, pushing small mining farm owners out of the market for a variety of reasons. At the same time, long-established mining pools and mining farms were able to maintain a certain level of stability.

2. Ethereum

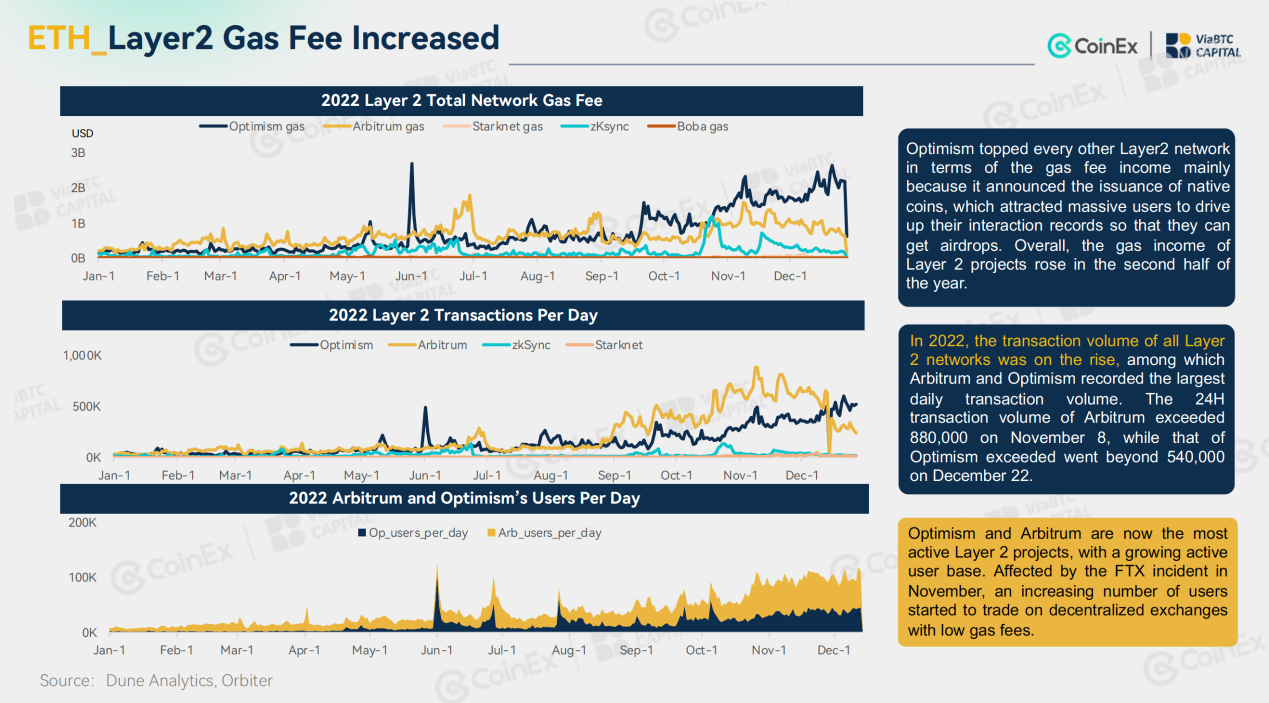

Ethereum primary stats trended downward in 2022. In addition to secondary market prices and transaction volumes, on-chain data such as TVL, transaction costs, active addresses and burn volume also plummeted. Nevertheless, the network has made a lot of progress in his 2022. On September 15th, Ethereum completed his historic transition from PoW to PoS. The Merge has significantly reduced the network’s energy consumption and daily output, thereby alleviating dumping pressure from the secondary market. Meanwhile, Layer 2 projects such as Arbitrum, Optimism, zkSync and Starknet have launched all or part of their mainnet. Their daily trading volume was much less than Ethereum’s mainnet, but the project surpassed Ethereum in terms of the number of addresses. Additionally, their gas prices were generally 1/40th of his on Ethereum. At the same time, the network saw an exponential increase in gas prices in 2022.

3. Stablecoin

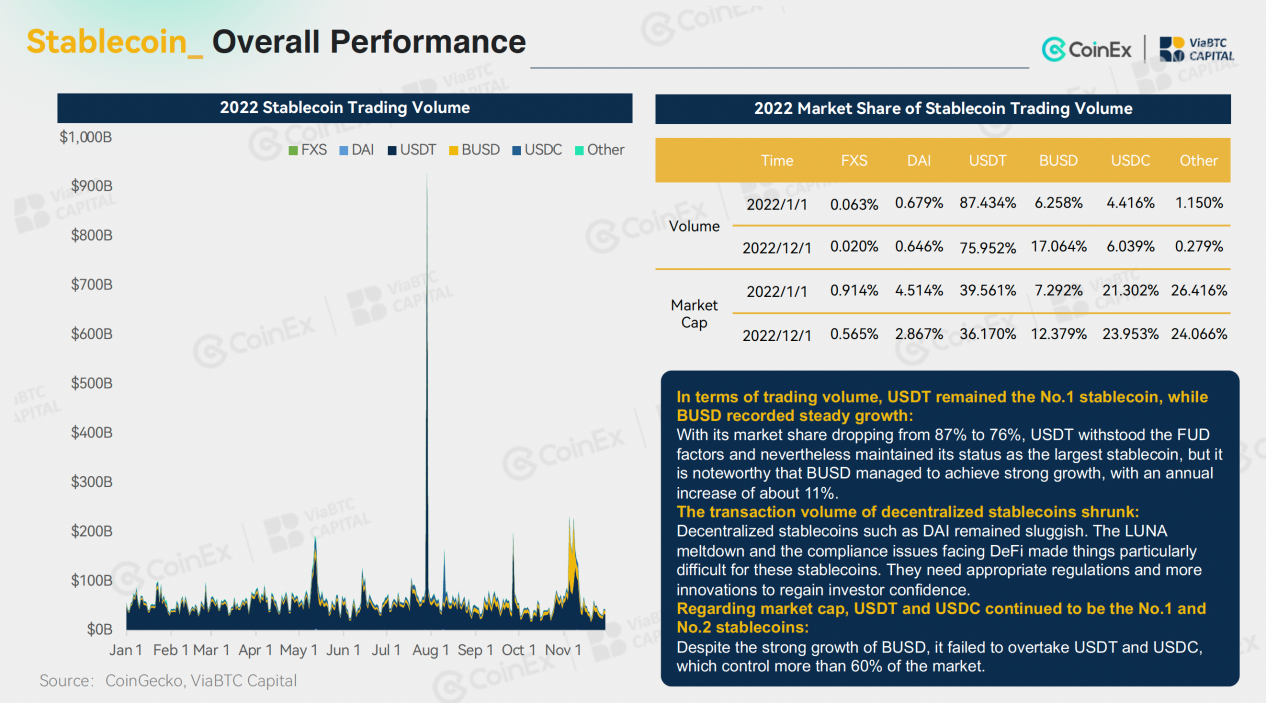

Overall, the stablecoin market has been stable in 2022. Specifically, over the course of the year, stablecoin supply declined by 6%, from $157 billion to $148 billion. In this respect, the decline was not significant. When it comes to centralized stablecoins, USDT has maintained its dominance, while BUSD has grown rapidly with the backing of Binance. In contrast, algorithmic stablecoins were hit hard by the collapse of his LUNA, shattering confidence in decentralized stablecoins and reducing transaction volumes. The result has been a clear decline in the number of new decentralized stablecoins.

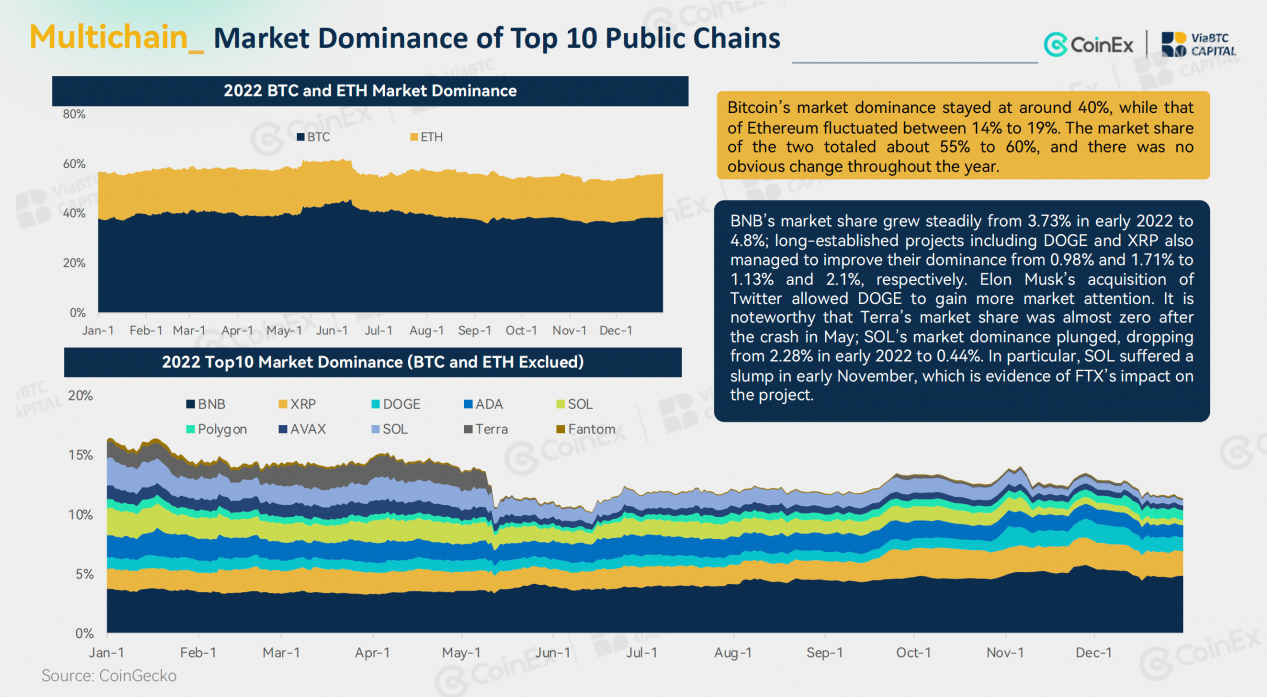

4. Public chains

Despite the tough market conditions in 2022, public chains remained a competitive sector. Due to the overflow of demand caused by the congestion of the Ethereum network, the new public chain with low fees maintained a bright performance until May. Many public chains were greatly affected, and the decline was even more serious than Ethereum. In May, Terra collapsed in just a few days, becoming the first known public chain to do so. Moreover, Terra’s meltdown was also a signal that the market had turned completely bearish. November saw the fall of FTX and Alameda Research, sending Solana’s token price and his TVL plummeting even further, while projects within its ecosystem also took a hit. Other newer chains such as Fantom and Avalanche also struggled. At the same time, many new public chains debuted in his 2022, including Layer 2 projects such as Arbitrum and Optimism, and meta-related chains such as Aptos and Sui.

5. NFTs

Last year, the NFT sector declined after an initial boom. In April, NFT’s market capitalization reached his $4.15 billion, an all-time high. In May, the sector’s trading volume hit a record high of $3.668 billion, fueled by the boom in Otherside, a metaverse NFT collection developed by Yuga Labs. Shortly thereafter, however, the NFT market faltered and trading volumes declined. Meanwhile, the price of prime NFTs and ETH plummeted, both negatively impacting the market. Meanwhile, the number of NFT holders continued to grow, reaching a record high in December.

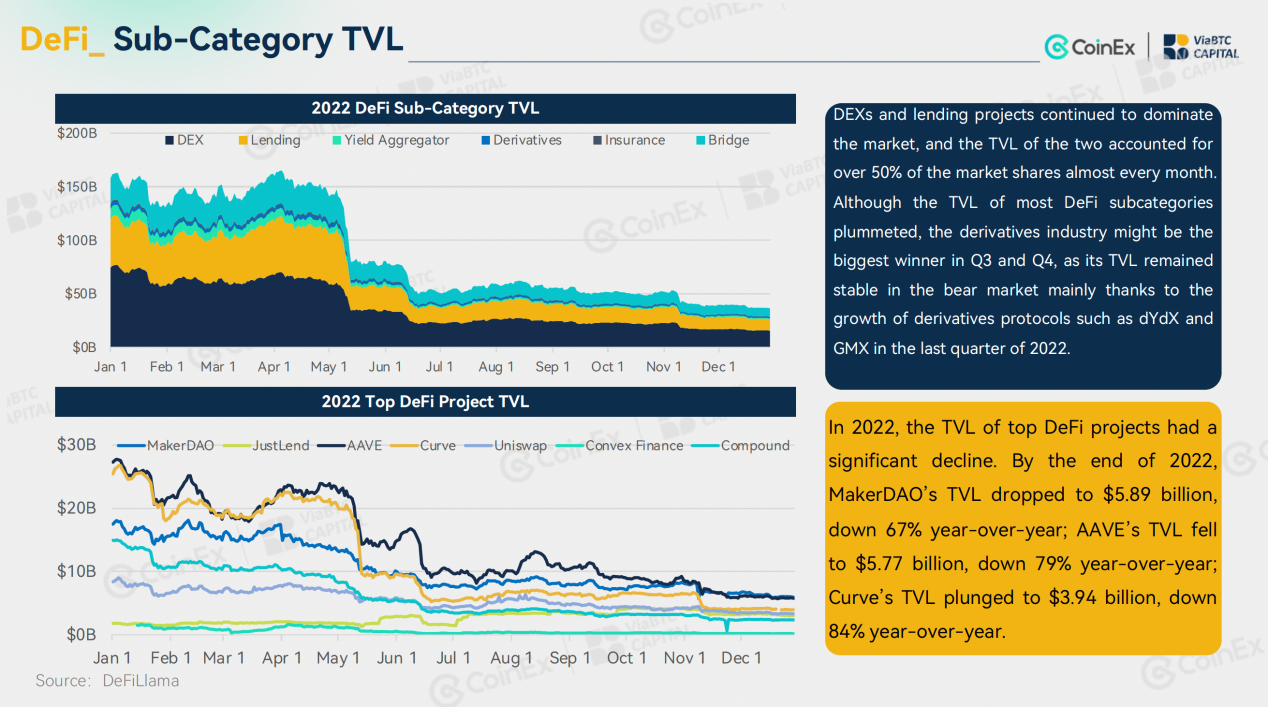

6. Defy

DeFi TVL also trended downward in 2022. Notably, his LUNA/UST meltdown in May saw mainstream coins witness the most spectacular crash in cryptocurrency history, followed by the collapse of TVL. Additionally, his DeFi was also frequently hacked in this past year, raising DeFi security concerns. When it comes to innovation, the first two quarters of 2022 have occasionally seen trendy hype about DeFi 2.0, along with the OHM slump and the (3, 3) meme, but DeFi 2.0 is a completely false narrative. One thing has almost been proven. And the market has once again turned its attention to his DeFi 1.0 infrastructure projects such as Uniswap, Aave and MakerDAO. Despite the bearish situation, mainstream his DeFi projects such as AAVE and Compound maintained stable operations and attracted many new users from certain his CeFi projects (such as Celsius and FTX).

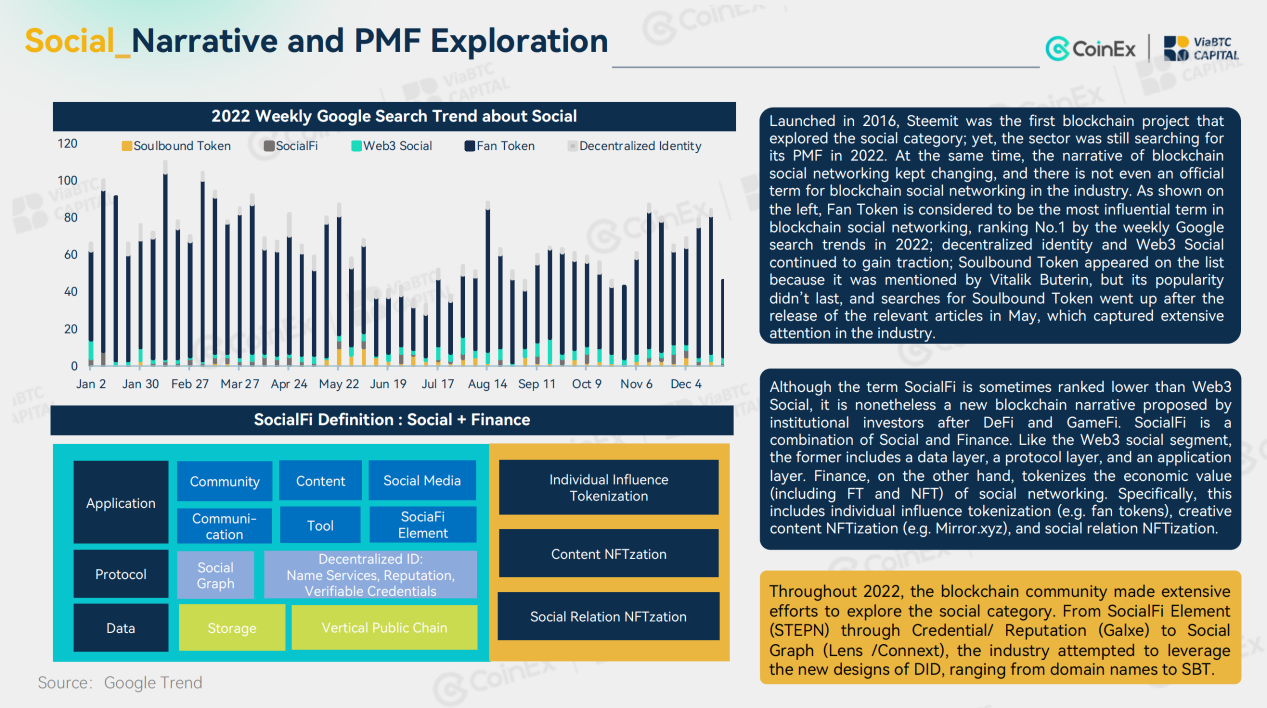

7. Social Fi

In 2022, the blockchain industry continued to explore new possibilities for SocialFi. In this year, iconic terms such as Fan Token, Soulbound Token (SBT), Web3 Social and Decentralized Identity (DID) emerged, but PMF (Product-Market Fit) was not identified. Nevertheless, SocialFi has many star projects, such as the Web3 lifestyle app STEPN with SocialFi elements, the credential network Galxe, the BNB chain domain name service SPACE ID, the social graph Lens Protocol, and the Web3 gamified social learning platform Hooked. provided. protocol. Apart from that, the 2022 Qatar World Cup has also helped Fan Token grab the attention of the market, and as a result, instead of plummeting on the bearish impact, Fan His Token will also outperform his 2021. He has performed slightly better in 2022.

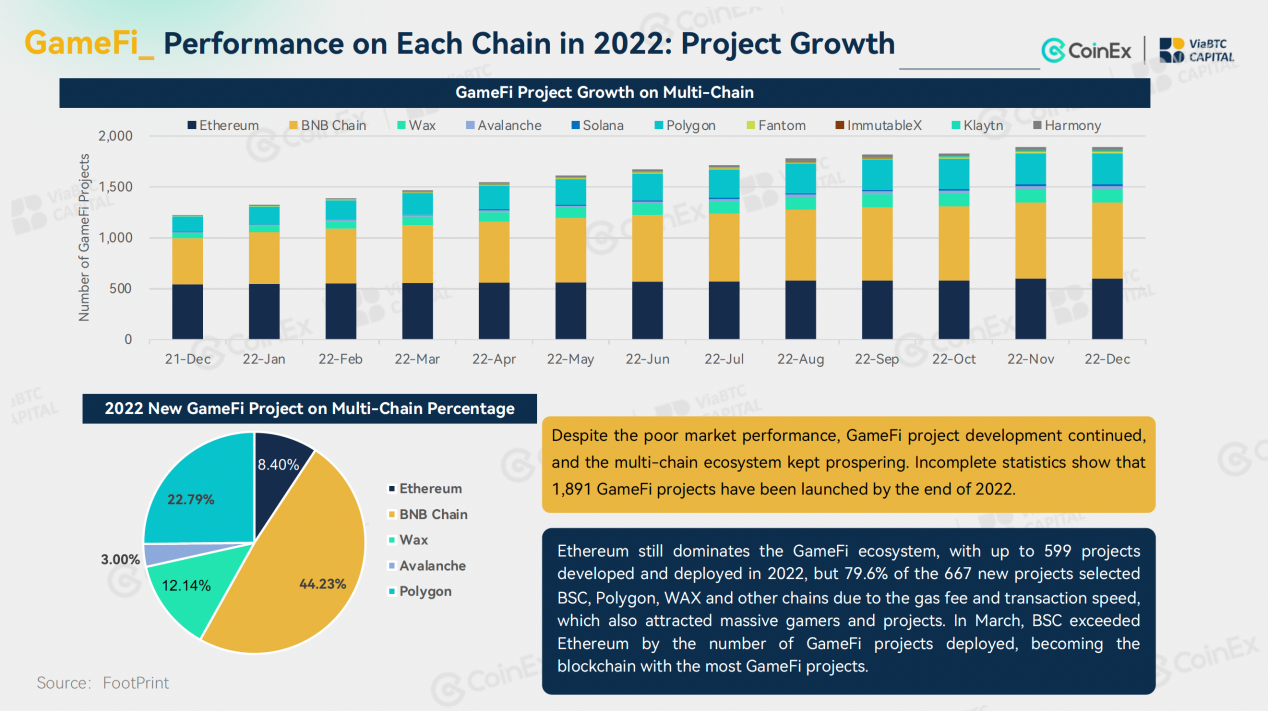

8. Gamephi

2022 was also the beginning of GameFi Bear. There have been no major innovations in the P2E blockchain game model. Institutional investors turned away from his P2E model as the number of users increased and trading volumes declined. In the first half of this year, the Move-2-Earn model created by STEPN attracted attention for its innovative dual-tokenonomics and marketing approach, bringing new dynamics to GameFi. Last year, blockchain projects raised the most money in his April, with blockchain investments totaling him $6.62 billion. However, the market did not respond to other project teams focused on reality and token models.While Ethereum maintained its dominance in the GameFi ecosystem as multi-chain ecosystems grew in popularity, , the growth rate of the Ethereum project did not match the growth rate of the BNB chain and Polygon. Additionally, most chains were heavily dependent on top projects, and there were still many of his GameFi projects with small user bases, subpar interactions, low transaction volumes and low quality.

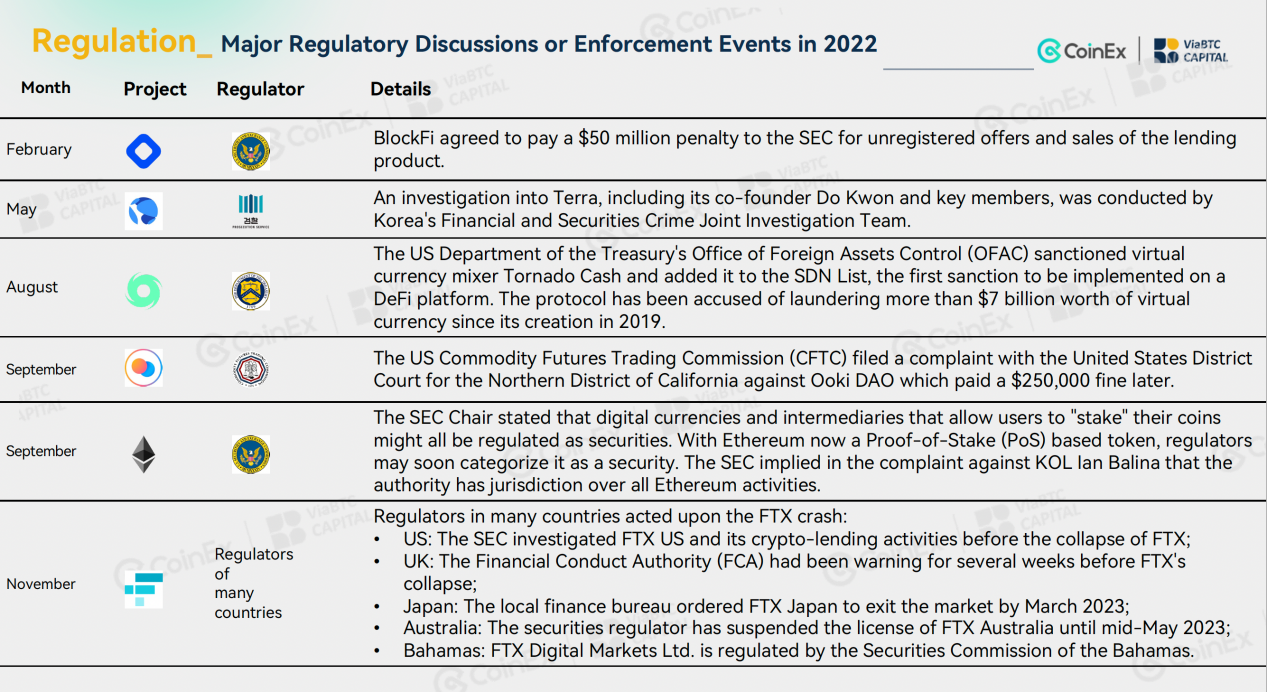

9. Regulatory Policy

Generally speaking, 2022 has been full of ups and downs for the cryptocurrency industry, but regulation is heading in the right direction. In his one year, regulators in developed countries have made many strides. The United States has released a regulatory framework for cryptocurrencies. The European Union initially approved the MiCA and TFR laws. The UK and South Korea have advanced the establishment of related institutions. Russia and Hong Kong facilitated discussion and implementation of policies on cryptocurrency mining and crypto-asset securities. The turmoil in the cryptocurrency industry in 2022 was partly the result of a sharp decline in funding and partly the result of regulatory loopholes and crackdowns. Last year, the bankruptcies of Terra and FTX, two top cryptocurrency projects, prompted regulators and law enforcement agencies around the world to step up their scrutiny and investigation of cryptocurrencies.

For more information, please visit ViaBTC Capital’s website at the following link.

For more information, please visit ViaBTC Capital’s website at the following link.

https://capital.viabtc.com/blog/ViaBTC-Capital:-2022-Review-and-2023-Forecast-in-Crypto-Industry-193?category=0&lang=en_US

This is a sponsored post. Learn how to reach your audience here. Please read the disclaimer below.

image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. This is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. NEITHER THE COMPANY NOR THE AUTHOR WILL BE LIABLE, DIRECTLY OR INDIRECTLY, FOR ANY DAMAGE OR LOSS ARISING OR ALLEGED TO OCCUR ARISING OUT OF OR RELATING TO YOUR USE OF OR RELIANCE ON ANY CONTENT, PRODUCTS, OR SERVICES DESCRIBED IN THIS ARTICLE. We are not responsible.

[ad_2]

Source link