[ad_1]

Many of the challenges faced by cryptocurrencies in 2022 were exacerbated by global economic headwinds related to high inflation and the effects of Russia’s war in Ukraine, but owner’s lack of foresight exacerbated many more. project collapsed.

Following the bull market riots of 2021, cryptocurrency’s reputation has been tarnished by fraud, Ponzi schemes, and lack of adequate investor protection. But as prices improve in 2023 and new optimism emerges in the market, there are five key actions cryptocurrencies should take to ensure they learn from past mistakes.

1. More intelligent regulation

One of the most important lessons learned from 2022 is the need for synergies between decentralization and investor-protective regulation.

The collapse of FTX, a major high-profile exchange, was a damaging event for investors and the cryptocurrency ecosystem. FTX struggled to find the liquidity to deal with the mass exit of investors amid rumors that the exchange was in trouble.

In the days that followed, FTX claimed to have been hacked by someone using “on-chain impersonation” to steal $500 million in crypto assets from wallets.

FTX’s demise isn’t the only thing that’s grabbing attention in 2022. Other projects such as LUNA, Celsius and BlockFi have all caused investors to lose wealth and confidence in the market.

With this in mind, the landscape must be more effectively regulated if cryptocurrencies are set to go mainstream. It’s closer to the heart of the house, but if it’s serious about gaining a mainstream audience, regulatory measures need to evolve to protect the interests of all users.

2. Learn from the last bull market failure

2023 has ushered in a new wave of optimism across the cryptocurrency market. The rally boosted both Bitcoin and many altcoins, with many hoping for a price increase similar to 2021.

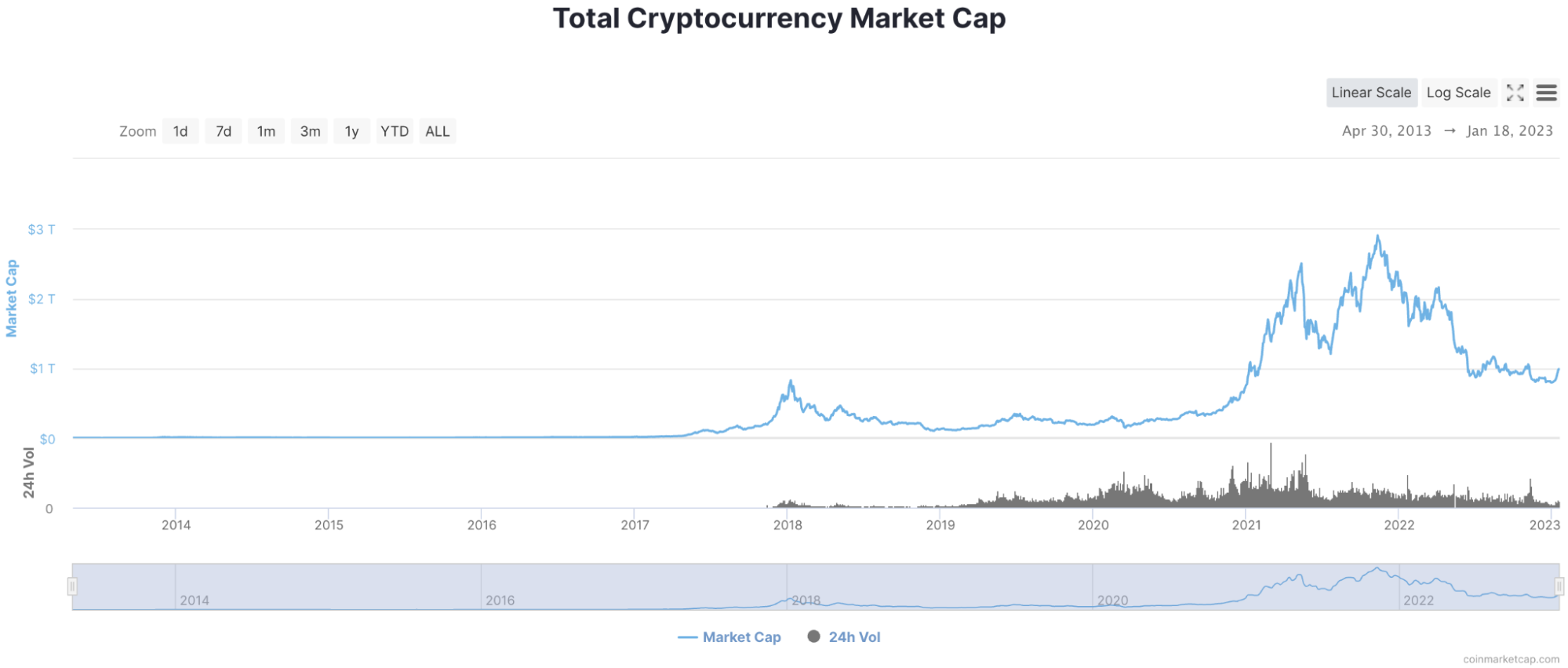

As you can see from the CoinMarketCap chart above, investor optimism in 2021 has pushed the cryptocurrency market cap to nearly $3 trillion. We have a long way to go before this level is emulated again, but it is imperative that more is done to ensure investors are not exposed to the mistakes of the last bull market.

Towards the end of the 2021 bull market, investors were increasingly looking for new assets to buy in hopes of exponential growth. It was this rush to buy new assets.

Buying non-functional assets isn’t a bad move, but investors are relying on memes to gain momentum as a source of income.

Aside from memecoins, we have also seen some small-cap Ponzi schemes and lag pulls taking place. For example, an owner creates a cryptocurrency while holding a large amount of assets, and fraudulently “pumps and dumps” its price before holding the worthless crypto when selling shares held by other investors. “can.

As we leave the crypto winter behind and usher in a new era of optimism, we need a more comprehensive vetting process for new assets entering major exchanges.

3. Improve the investor experience

Another major shortcoming of the industry has to do with investor experience when buying, converting and selling cryptocurrencies. Execution of withdrawals through market pairs and third parties is commonplace for die-hard enthusiasts, but these processes can put off new adopters.

The next bull market will build on a wave of mainstream adoption. Today, cryptocurrencies are everywhere, sponsoring major events and marketing directly to millions of individuals.

Data from Chainalysis suggests that adoption rates are declining in 2022, suggesting lingering barriers to adoption, even as cryptocurrency marketing remains prevalent. In order to make cryptocurrencies as accessible as possible, the investor experience across exchanges should be seamless and worry-free.

To accommodate more investors in 2023, exchanges must have new learning resources to help build new trust among adopters.

4. Continue to work towards carbon neutrality

Environmental issues are more important than ever. The problem of cryptocurrency mining has rarely gone away after Elon Musk sparked the Bitcoin crash in 2021, following tweets voicing concerns about the carbon footprint of cryptocurrencies.

Today, we can see that both BTC and ETH are making efforts to reduce their respective carbon footprints. These initiatives need to grow across the ecosystem.

2023 will put the carbon footprint of cryptocurrencies in the spotlight more than ever, as sustainability continues to be presented as a pressing concern in various industries. Moving away from proof of work cryptocurrency mining is important, but the project needs to show the environment. Commitment to earn investor trust.

5. Influencers need to take more responsibility

Some of the biggest losses within cryptocurrencies come from inexperienced investors blindly following ads posted by influencers. There are countless examples of celebrities and social media influencers promoting their assets in veiled advertisements, which only spread distrust among newcomers to the market.

Many cryptocurrency projects are using social media to build influencer advocacy in hopes that new investors will buy their assets. In some cases, influencers paid by these cryptocurrency projects know nothing about the protocol and blindly relay ads using thinly veiled #ad hashtags as a disclaimer. There is little difference between these thought-out “ads” and active cryptocurrency shillings.

However, the content an influencer’s followers see can be so misleading and sensational that the #ad hashtag isn’t enough. With this in mind, influencers should take a greater responsibility for their crypto advertising campaigns towards their followers. There is a risk of giving

Cryptocurrencies must learn lessons from the past

As we enter a new year for the cryptocurrency ecosystem, it is more important than ever for the industry to learn from the lessons of the past. While the asset’s price has been trending steadily upwards lately, its reputation among prospective adopters could hinder progress through 2023.

By learning from the shortcomings of the past, we can be reasonably optimistic about brighter years ahead for cryptocurrencies, but only if we see higher levels of responsibility, sustainability measures, and adequate regulation. increase.

[ad_2]

Source link