[ad_1]

One of the most exciting moments of 2022 for Microsoft’s business application ecosystem is Viva Sales, the company’s new CRM-agnostic sales experience engine, developed by the same team that creates Dynamics 365 Customer Engagement applications and Power Platform services. It was the fact that Whether or not Viva Sales succeeds in the long term, its approach of blending productivity tools and business processes could serve as a useful lens for evaluating Microsoft’s broader business application plans for 2023 and beyond. there is. Dynamics applications remain important, but future generations of Microsoft’s business solutions could look very different in many ways. Let’s take a look at some recent developments at Microsoft that could impact the future of the Dynamics 365 and Power Platform products and ecosystem.

Microsoft’s world of business applications, but not always Dynamics

Microsoft may be working to release a new portfolio of point solutions built on the Power Platform aimed at meeting industry or role-specific needs. Mary Jo Foley reports that this so-called “Power House” approach provides Power Platform licensees with pre-built business applications for a variety of specific needs, such as financial approvals, contract management, and manufacturing requirements. increase. Microsoft has not confirmed this report, but the concept looks to be in line with what Microsoft has already demonstrated in her Viva Sales. It’s an app and process engine focused on the activities of one or a few job functions. Another example is the company’s work to build elements of its own invoice approval service, with mixed results so far.

From a traditional Dynamics 365 partner’s perspective, the idea that clients have access to dozens of pre-built point solutions for Power Platform can be both helpful and a new headache. In an optimist world, it can spark more productive conversations between partners and clients, thoughtful analysis of functional and process requirements, digital adoption journeys, and long-term technology investment strategies. For the pessimists, Microsoft’s approach, if true, slows decision-making, promotes inefficiencies in technology adoption, and encourages customers to push more restricted apps into their organisations. Technical Debt may occur and Dynamics may decline. 365 License.

2022 also saw some ominous signs of momentum for the Dynamics 365 product line. In particular, there was a risk that the product would lose out to Power Platform in terms of prominence. One of the company’s major global events, Microsoft Ignite 2022, is a particularly prominent example of this trend, with far fewer Dynamics-focused sessions than Power Platform sessions at the hybrid event. I’m here. For physical meetings, Power Platform easily surpassed Dynamics 365 in terms of visibility and perceived investment. Microsoft has fully endorsed the private Power Platform Conference and pledged to support its growth as the 2023 event moves to a larger venue, the MGM Grand in Las Vegas. On the other hand, we sent a relatively small number of executives and even product leaders to events focused on Dynamics products. An exception to this trend is the Dynamics 365 Business Central team, who brought key representatives to various events to demonstrate a consistently high level of engagement with the community.

Emerging Strategic Opportunities in SMBs

In December 2022, Cecilia Flombaum rejoined the Business Apps Group in a new SMB-focused strategic growth role within the R&D organization. As she told her MSDW, her new role is to identify ways to scale business application growth in SMBs, including reaching a larger percentage of Microsoft 365’s customer base. That mandate appears to align well with the idea of a “powerhouse,” at least to some extent.As Flombaum explained, technology investment decisions in the SMB space are often made by enterprise organizations. It’s not a decentralized process, it’s done by one or two executives.

But what really motivates partners with SMB expertise? It has been suggested that the motive may be simple.

Faced with other, more indirect ideas that Microsoft is pursuing, such as encouraging integrated solutions that blend Microsoft 365 with Power Platform apps and services, and encouraging partners to pursue ISV opportunities via AppSource. , a “pay me” approach could simplify partner planning. However, it may go against Microsoft’s goals.

For a hint of what the future of Business Central might look like, Microsoft MVP Erik Hougaard looked investigators to screenshots captured from a short video of a Microsoft internal hackathon presented in a late 2022 presentation. I turned it. It shows different ideas that may come up in some form in the future. A new onboarding experience that includes role-specific setup, use of bots or virtual agents, user collaboration capabilities, process analytics, and possibly new pre-built BI.

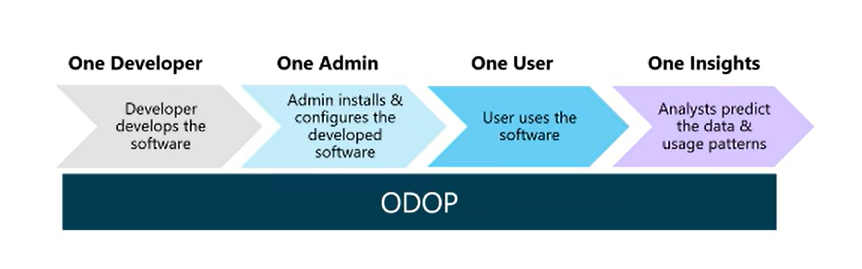

ODOP: One Dynamics One Platform sets roadmap for F&O cross-application capabilities

According to Microsoft’s Fredrik Saetre, Dynamics 365 F&O’s recent update on its “One Dynamics One Platform” plan is “the most important Dynamics 365 engineering roadmap story I’ve seen in a very long time.” The ODOP plan called for a “one admin, one user, one developer, one insight” vision to pursue an integrated Dynamics 365 Finance & Operations and Power Platform experience. increase. ODOP helps prioritize different R&D efforts, the presenter said, citing examples such as:

- Move the Lifecycle Services functionality to the Power Platform admin center to treat F&O as an application instead of an environment.

- Simpler and broader integration of F&O data into the Dataverse, including extensive use of virtual tables and Azure Synapse analytics use cases

- Other Power Apps embeds. Both model-driven and canvas apps can be embedded in F&O, but now you can embed his F&O pages in model-driven apps using the new embed look and feel.

- There is a growing list of “harmonized concepts for cross-app scenarios” in areas such as master data, quote-to-cash business process flows, inventory management, and field service.

- Incorporate Power Platform Tools for Visual Studio and Power Platform CLI into F&O development

Our presenters from Microsoft explained that from data to security to storage to management, layers converge at many points and require convergence across the technology stack. However, Microsoft also plans to maintain core principles such as avoiding rewriting existing technology, aligning new work with the Power Platform, and methodically using input from the community.

Leadership in 2023

2022 ended with several business application marketing leadership updates, capping off a year of significant change. Alysa Taylor has transitioned to her leadership role in marketing for “Azure + Industry” and CVP Jared Spataro now has overall marketing responsibility for both the Modern Work and Business Applications groups. Migrate from Oracle.

In early 2022, James Phillips announced he was leaving Microsoft and CVP Charles Lamanna succeeded him as the Dynamics 365 and Power Platform lead, reporting to EVP Scott Guthrie. Mike Morton also gained a new role, with his responsibilities broadening from his GP in D365 Business Central to now leading all his SMB offerings in the Business Applications Group. Channel strategy leadership then passed to Peter Jensen.

While it’s not uncommon for Microsoft employees to change roles, the number of new and updated roles last year suggests the group may be more stable in those positions in 2023. There is a nature. Partners and customers from all corners of the ecosystem.

[ad_2]

Source link