[ad_1]

After a turbulent 2022, 2023 has hit the industry hard, impacted by multiple negative developments culminating in the FTX debacle that sent the crypto space into yet another meltdown.

As ever, Bitcoin is up 38% since the turn of the year, an impressive rally. And as is customary, other tokens are also mimicking BTC’s behavior and surging. Of course, the rally has also spilled over into the stock market, with crypto-focused stocks benefiting from the shift in sentiment.

In fact, Cantor’s cryptocurrency specialist Josh Siegler expects the stock prices of several BTC miners to rise even further in the coming months, to more than 60%.

We ran these tickers against the TipRanks database to see how the rest of the streets judged Siegler’s pick. As it turns out, Siegler isn’t the only one taking a bullish view here. Both boast strong buy consensus ratings from the rest of the street. Let’s take a closer look.

Riot Platforms, Inc.Riot)

Cantor’s first cryptocurrency of choice was Riot Platform, one of the largest cryptocurrency mining companies in North America. The company is focused on expanding its operations by increasing its Bitcoin mining hash rate and increasing its infrastructure capacity.

The company’s self-mining capacity at the end of 2021 was only 3.1 EH/s, but has accelerated significantly in the past few months, with Riot achieving 9.7 EH/s in 2022. Deployed a fleet of 88,556 miners. Further expansion adds a new building to its Rockdale, Texas facility and installs more miners, so the company targets his 12.5 EH/s hashrate by the end of the first quarter. . Riot is also building a 200 MW liquid immersion cooling infrastructure. Additionally, the company hosts approximately 200 MW of institutional Bitcoin mining clients. Riot recently underwent a rebrand, renaming Riot Blockchain to Riot Platforms.

In addition to quarterly results, the company provides monthly operational updates. His latest December data showed Riot mining 659 BTC, a 55% increase compared to December 2021. The company sold his 600 BTC, making a profit of around $10.2 million.

Riot stocks fell outright last year, but are up 88% from their December lows.

By making RIOT a “crypto top pick,” Ziegler explains the bullish case. he wrote: “We are positive about RIOT’s ability to mine more bitcoins than other bitcoins and reinvest the proceeds to scale even further, as scale is paramount in this industry. , remains best-in-class at ~65%, largely due to having its own energy contracts…Unlike other miners, RIOT does not need to raise additional debt or equity to meet its guidance. is not.”

Siegler doesn’t just write an optimistic outlook. He said that with an overweight (i.e., buy) rating on RIOT stock and his $12 price target, which means he could be up 61% over the course of a year from current levels, it’s a is backed by (to see See Siegler’s achievements here)

Overall, it’s clear that Wall Street agrees with Siegler on RIOT’s future prospects. His eight recent analyst reviews of this stock included seven buys and his one hold, showing a strong buy consensus indicating a bullish outlook. The stock is $6.20 for him, and an average price target of $10.06 means a 62% gain over 12 months. (look RIOT stock price forecast)

Clean Spark Co., Ltd. (CLSK)

The next Cantor-approved cryptocurrency stock is CleanSpark, another Bitcoin miner. However, this was not always the case with this company. CleanSpark was once just a provider of microgrid solutions and just started mining operations at the end of 2020. Since then, however, mining activity has become a major concern, and the company is now a full-fledged Bitcoin miner.

The company operates its own Bitcoin mining facility in Atlanta, Georgia and co-located miners in Massena, New York. Bitcoin mining is known to be very energy intensive, but CleanSpark prides itself on being a sustainable mining company, primarily using renewable or low-carbon energy sources to mine. going. The company’s capital management policy includes selling a majority of the BTC mined, with the proceeds to fund further growth. This allowed CleanSpark to increase its hashrate from 2.1 EH/s in January 2022 to 6.2 EH/s in December.

According to the company’s recent update, 63,700 latest-generation Bitcoin miners mined 464 Bitcoins in December, with an annual production of 4,621, representing a growth of over 200%. The company sold 517 bitcoins at an average price of $17,000/BTC in December, reaching $8.7 million in sales.

At the same time, the company said it has lowered its CY23E hash rate outlook from 22.4 EH/s to 16.0 EH/s due to delays in infrastructure expansion at Lancium, where CleanSpark has signed a contract to deploy some of its mining gear. I was. .

As a result, the hash rate will drop by the end of the year, but Siegler sees the development as a “liquidation event” for the stock.

“The 16.0 EH/s target will cement CLSK as one of the largest vertically integrated self-miners in the industry,” analysts said. “However, we believe the company has greater foresight and control over developing its own mining site than colocation infrastructure. revealed that only 95,000 rigs and $70 million in CapEx spending are required, assuming the rigs can be acquired at $15/TH, which is the new cost to reach the target hash rate. is ~$212.5MM, which is in line with our current conservative assumption of approximately $350 million and may result in less equity dilution.”

CleanSpark’s stock could be up 48% from its December trough, but Siegler believes there’s still plenty of room to move. The analyst sets his price target at $5 and rates the stock as overweight (i.e. buy). This figure allows for his one-year earnings of 89%.

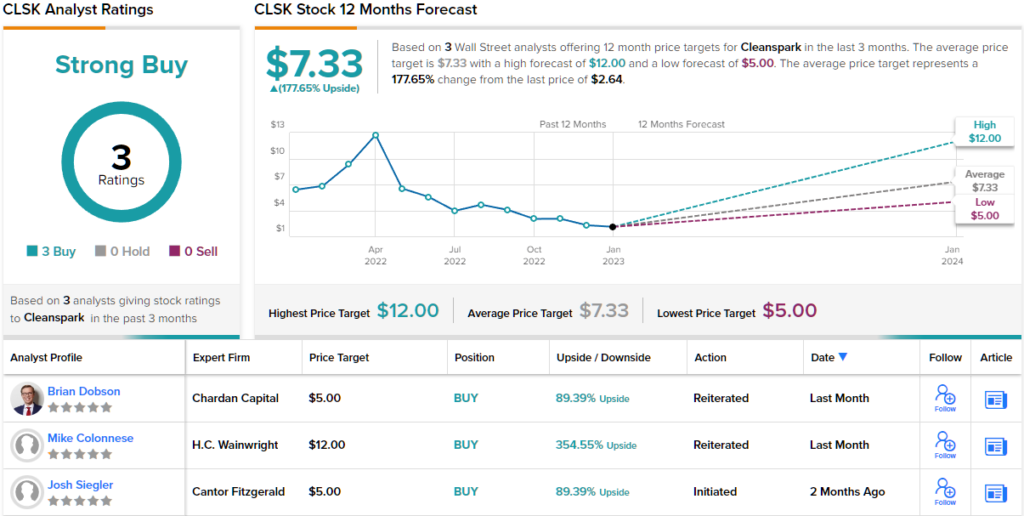

Two other analysts recently joined CLSK’s review and both were positive, making the consensus view here a strong buy. The average target is $7.33, which means the stock will rise by a whopping 178% over the next year. (look Clean Spark stock price forecast)

Subscribe to the Smart Investor newsletter now and never miss a top analyst pick again.

Disclaimer: The opinions expressed in this article are those of the featured analyst only. This content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]

Source link